I’ve been investing in tech stocks for some time now, and as the market suggests, my returns have been pretty strong. In fact, since withdrawing some money from my ISA a year ago, my portfolio of circa 25 stocks has almost doubled in value.

However, Monday (27 January) was almost certainly the worst day for my portfolio ever. The £15,000 drop in the value of my investments was not an insubstantial part of my total. However, as always, I should look to learn from these events. Here are my key takeaways.

A grey swan event

We can’t plan for every eventuality. And on Monday, artificial intelligence (AI)-related stocks tanked because a Chinese company’s language model, reportedly produced for just $5.6m, became the most downloaded chatbot on the App Store.

DeepSeek hadn’t been on investors’ bingo list for 2025. But just one month into the year, it’s got people questioning the dominance of US tech and asking how much money is really needed to develop AI. However, although DeepSeek ranked higher than many of its Western chatbot peers, some questions remain about the validity of the development claims.

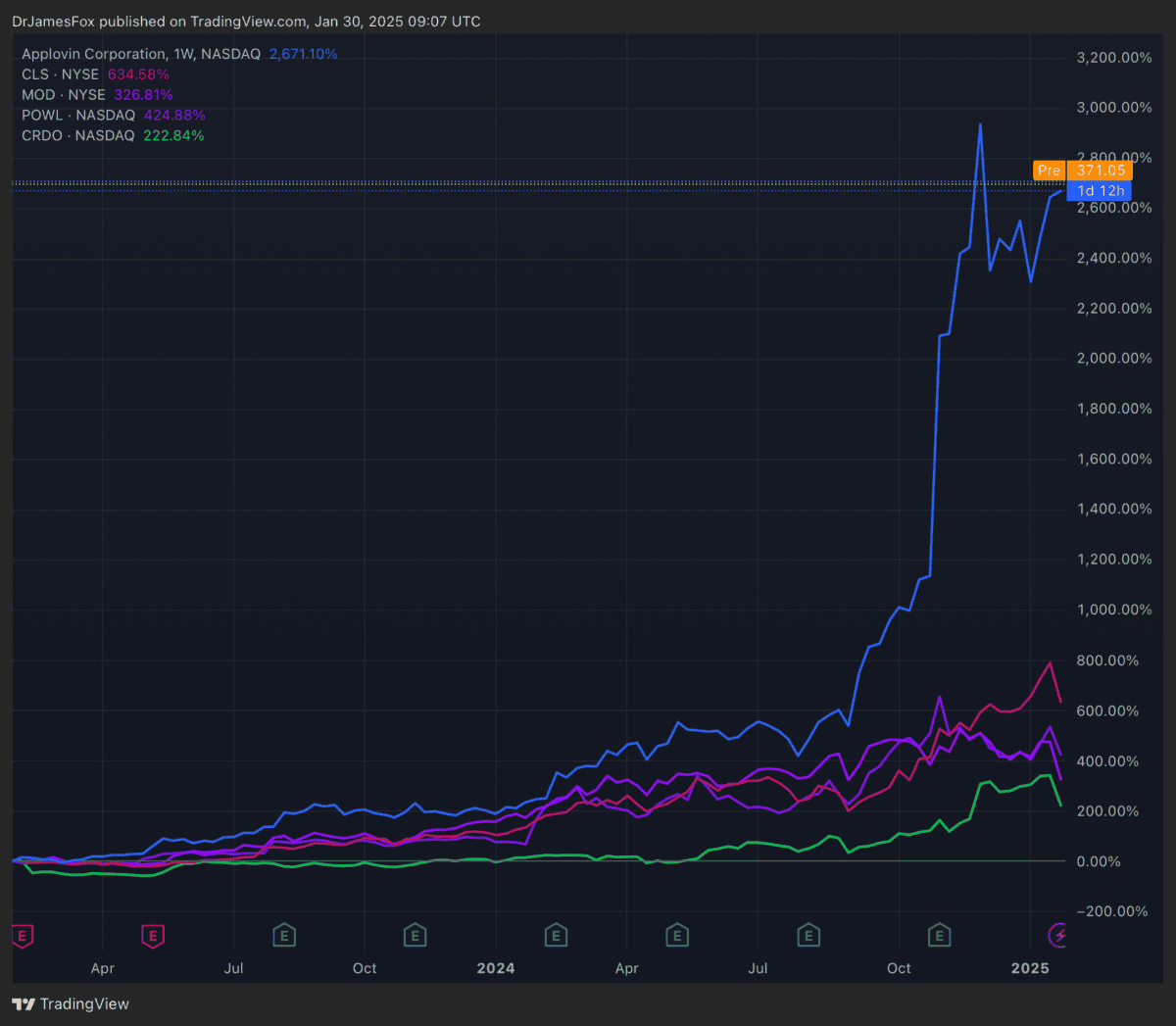

While the headlines focused in on Nvidia, which fell more than 10% in Monday’s trading, some of my AI infrastructure holdings fell further. Celestica and Credo both fell around 30%, while Modine Manufacturing and Powell Industries weren’t far behind.

A lapse in diversification

I have 25 stocks in my portfolio, but my error was that I allowed some to grow too large, creating concentration risk. I recently sold most of my AppLovin shares, which were up 800%, but I didn’t practice the same caution with Celestica, Modine, or Powell. All three were up over 200% in my portfolio, growing faster than most of my other stocks.

As a result, almost 20% of my portfolio focused on AI infrastructure. It’s an important reminder than diversification requires constant asset adjustment to avoid concentration risk.

Achieving diversification

Celestica stock has surged back from Monday though, and I partially expect the others to do the same. However, in the spirit of diversification, I could consider a stock for the ‘second layer’ of AI. UiPath (NYSE:PATH) is one such company, and it’s been on my watchlist for a while. It’s the second layer of AI because it’s one of the companies that is using technological developments to provide platforms to help business automate and optimise processes.

From a valuation perspective, it’s trading with a price-to-earnings-to-growth (PEG) ratio of 0.99, which represents a 46% discount to the information technology sector average. However, at 32 times forward earnings, there’s a certain degree of risk here and anything less than a stunning performance could be an issue. For now, it’s a stock I plan to keep a close eye on. Maybe I would have been wise to move a little earlier when the stock traded with lower multiples.

However, for even greater diversification, I may wish to consider an ETF or a fund-based approach. This can provide me with exposure to a host of companies typically with lower risk than investing in a singular stock.