The S&P 500 has increased by more than 23% in three out of the last four years. While great for investors’ portfolios, it’s also sobering to think that the last time returns were as strong as this was in the lead up to the dot.com market crash.

Consequently, a growing number of commentators are turning bearish on the S&P 500’s prospects in 2025.

This might lead some investors to consider selling in case their stocks take a tumble. I think that would be a mistake though. Here’s why.

Should you invest £1,000 in Coca-cola right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Coca-cola made the list?

Avoiding market timing

A market crash is often defined as a rapid drop of more than 20%. The problem is that nobody really knows for certain when one will happen.

So, if I sell my stocks in anticipation of one, what do I do if stocks continue to go up in 2025? Then again in 2026? I might see the gains I’m missing out on and dive back in, at a premium, just before it actually does crash or starts sliding towards a bear market.

Moreover, I’d have to be right twice for this move to be successful. There would be the exit, getting out just in time to save my portfolio from a painful drop. Then I would have to re-enter the market at the right time before it recovered and started to chug upwards again. But all research on market timing shows that this is almost impossible to get right.

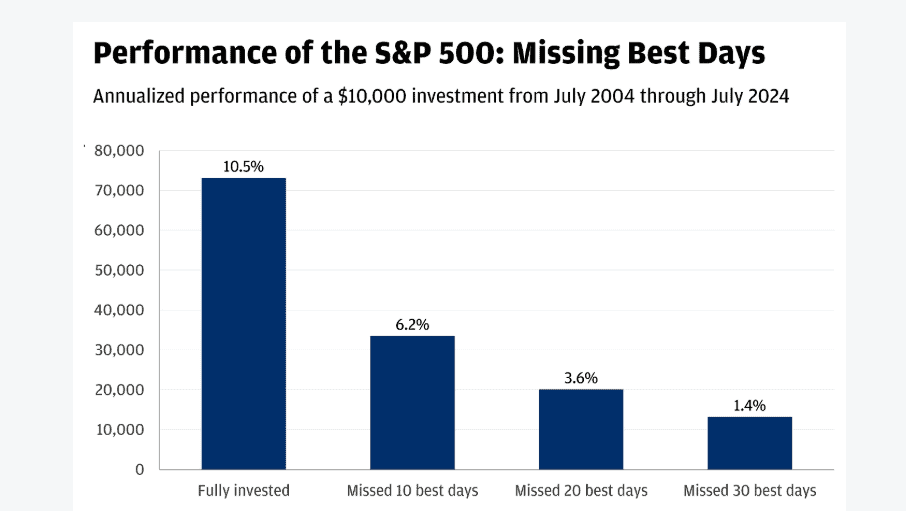

So, what if the market does quickly crash and I’m left with a badly bruised portfolio? Again, the worst thing to do here would be to sell my shares. The reason being that over the past 20 years, 7 of the 10 best market days occurred just a couple of weeks after the worst 10 days, according to JP Morgan.

Staying fully invested, a $10,000 investment in the S&P 500 in 2004 would have grown to over $70,000 by last year. But missing the 10 best days through wrongly timing the market would have cut that to under $35,000!

The key then is for me to avoid panic selling and stay invested.

Seeking a better price

Earlier this week, AI chip stocks plunged after a Chinese start-up unveiled a seemingly cheaper-built version of ChatGPT. This cast doubt on the massive costs related to the ongoing AI buildout.

Were these concerns to snowball and trigger a crash, I’ll be keen to buy more shares of CrowdStrike (NASDAQ: CRWD). This is the AI-powered cybersecurity company whose name came to the public’s attention for all the wrong reasons back in July when a faulty software upgrade caused a global IT outage.

The share price crashed 38% after this incident, but has since bounced back strongly, rising 82%.

While I’m relieved about this, it’s also left the stock looking very pricey at 27 times sales. This lofty valuation leaves little room for error, particularly if another software incident or, worse, cybersecurity breach of its platform takes place.

However, as of the last quarter, 66% of customers were using five or more of its cybersecurity modules, while an impressive 20% were using eight or more. So the software debacle seems to have caused little lasting damage.

Looking ahead, analysts still expect CrowdStrike’s revenue and profits to grow above 20% until at least 2028.