The ISA is an excellent vehicle for building wealth and then generating a tax-free passive income. And this is something I plan to use to the fullest extent.

But using an ISA to generate £10,000 per month or £120,000 a year sounds hard, right? In the current market — given that an average 5% dividend yield is very achievable — this passive income target could be reached with £2.4m invested in stocks and shares.

That’s a lot of money. But it may surprise many investors to know that it’s also achievable. In fact, with 4,850 ISA millionaires in the UK in 2023, thousands of Britons could already be generating the type of passive income we’re talking about.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Stock markets beat savings accounts time after time

Stock markets have consistently outperformed savings accounts over the long term, with several major indexes demonstrating this trend. The S&P 500, a benchmark for the US stock market, has delivered an average annual return of 10.13% since 1957. Even when adjusted for inflation, the real return remains impressive at 6.37%. This significant difference in returns can lead to substantial wealth accumulation over time.

Even though the FTSE 100 hasn’t performed that well over the past decade, long-term total returns are rather encouraging. In the 20 years from 2003 to 2023, FTSE 100 total shareholder returns came in at 241%, while the FTSE 250 has outperformed that — almost 600%.

In short, even when investing in relatively unexciting index-tracking funds, stocks and shares vastly outperform savings over the long run (although savings accounts are safer). And while past performance is no guarantee of future success, the track record of stock markets in developed economies — especially the US and UK — is very strong.

How the maths adds up

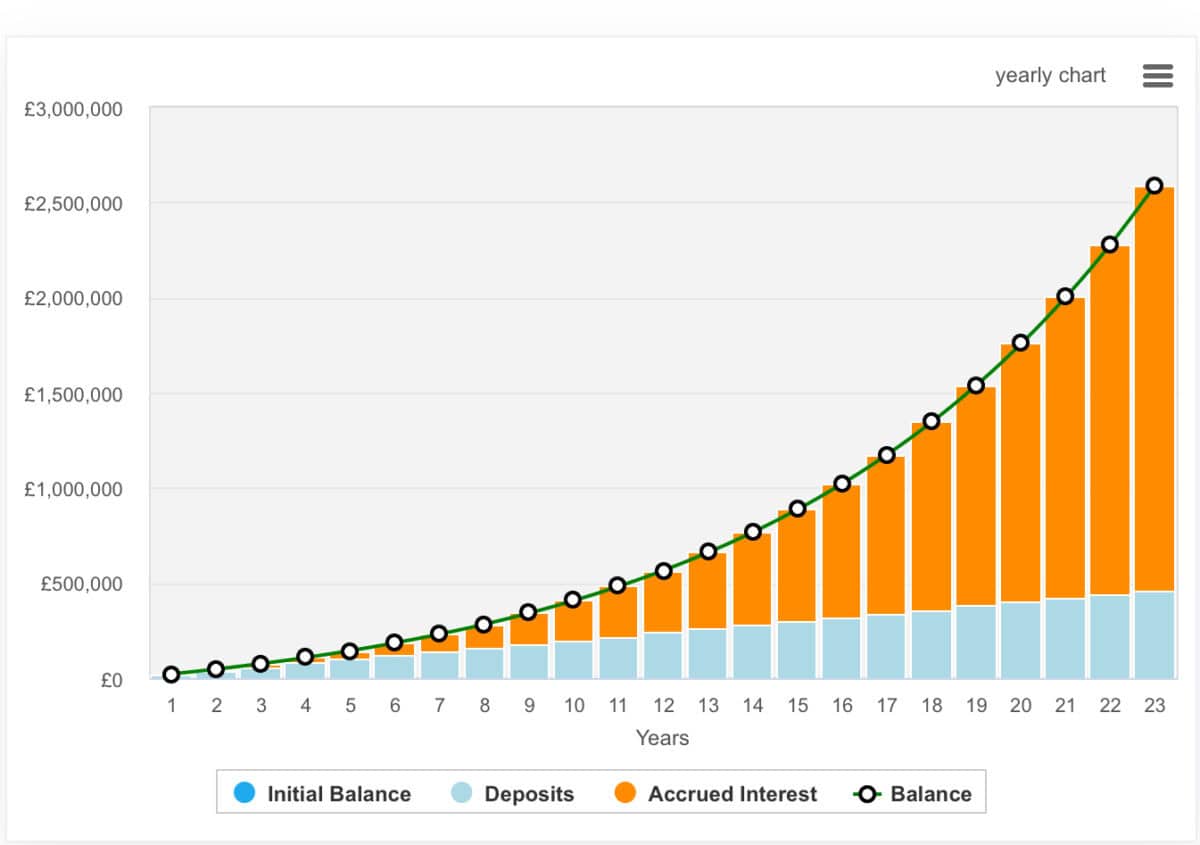

There are various ways to make the maths work and hit £2.4m. One way, as shown below, would be to max out the ISA contribution — £20,000 per year — for 23 years, and average 12% annualised returns. Some people may say 12% is ambitious and they’re right. But it’s still far below the Nasdaq’s total returns for the last decade — around 20%.

One stock for the growth phase

Investors may want to look at some of my favourite stocks, including Celestica, Credo, and DXP Enterprise. However, novice investors may prefer to consider funds or trusts like Scottish Mortgage Investment Trust (LSE:SMT) for easy diversification.

The FTSE 100-listed investment trust typically invests in growth-oriented companies with Elon Musk’s SpaceX now representing the largest holding at 7.5%. This is followed by Amazon and MercadoLibre, among other big tech companies.

What’s more, the Baillie Gifford-managed fund has a reputation for picking these tech winners before they become household names. It’s a great track record and it’s one that has seen them deliver approximately 333% share price growth over the past decade.

Things to worry about? Well, some of its biggest holdings are Magnificent Seven stocks, which may underperform the market this year and beyond following terrific growth in previous years. That could, however, be mitigated by stronger performing mid-caps lower down in the portfolio. It’s a stock I hold, and I recently bought more for my daughter’s SIPP.