There’s no ‘right’ or ‘wrong’ way to go about building a Stocks and Shares ISA. But owning a diversified portfolio of shares from the FTSE 100, FTSE 250 and elsewhere can help investors generate a strong and stable return over time.

One effective way to diversify is by purchasing a selection of value, growth and dividend shares that provide a smooth return during all stages of the economic cycle.

With this in mind, here are three great Footsie shares for new and existing Stocks and Shares ISA investors to consider today.

Value

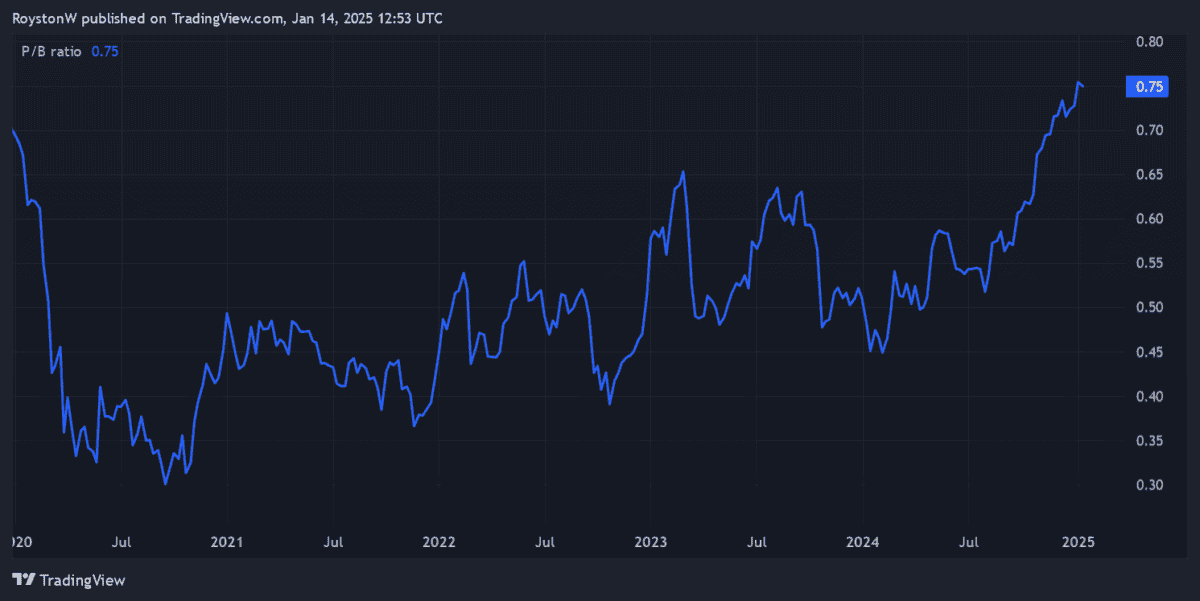

Emerging markets bank Standard Chartered looks cheap across a variety of metrics. In terms of profits, it trades on a forward price-to-earnings (P/E) ratio of just 8.3 times. Meanwhile, its price-to-earnings growth (PEG) value — at 0.6 — sits comfortably inside value territory of 1 and below.

Standard Chartered shares also look cheap relative to the value of the bank’s assets. At around 0.8, this is also below the value threshold of 1.

It’s true that Asia-focused StanChart faces uncertainty as China’s economy splutters. However, it also has considerable long-term growth potential as rising regional wealth and population growth drive banking services growth.

The firm also has considerable exposure to Africa to help offset temporary trouble in China.

Growth

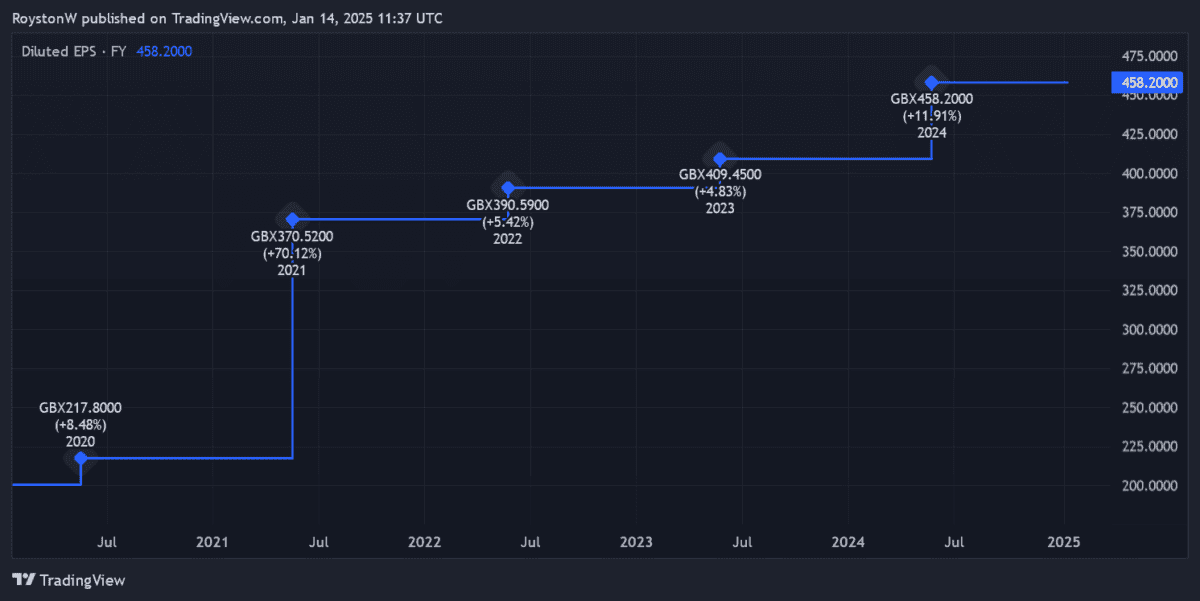

Tabletop gaming’s becoming increasingly mainstream, driven by market leader Games Workshop (LSE:GAW). Its miniatures and games systems are considered the gold standard of the industry. As the chart below shows, it continues to enjoy rapid earnings growth.

Games Workshop — which only entered the FTSE 100 last month — is best known for its Warhammer line of products. Hobbyists build, paint, and then do battle with their miniatures within a community of fellow enthusiasts.

It’s a niche yet highly lucrative business. Revenues totalled £299.5m in the six months to 1 December, up 14% year on year. With Games Workshop also enjoying sky-high margins, operating profit increased 33% to £126.1m.

While weak consumer spending remains a threat, City analysts think earnings here will rise 7% in this financial year (to May), and another 4% the following year. Over the long term, I think profits could rise significantly as the firm ramps up licencing of its IP to TV, film and video game producers.

Income

I think Legal & General‘s one of the Footsie’s hottest dividend stocks today. It’s why — along with Games Workshop — I hold its shares in my own portfolio.

It’s raised dividends every year for more than a decade, and has pledged to keep raising them until 2027 at least.

What’s more, the dividend yield on Legal & General shares is an enormous 9.9% for 2025 and 10% for 2026. To put this in context, the index average is way back at 3.6%.

Dividends are never, ever guaranteed. And shareholder payouts here could come under pressure if consumer spending weakens and/or competitive pressures rise.

But in my view, the firm’s rock-solid balance sheet leaves it in good shape to keep delivering large and growing dividends. As of last June, its Solvency II capital ratio was more than twice the regulatory minimum, at 223%.