Generating passive income from investments is a worthwhile financial goal, and an Individual Savings Account (ISA) is an excellent vehicle for achieving it. For UK investors seeking to earn £3,000 in monthly passive income determining the required ISA balance, and how to get there, involves some shrewd planning.

Hitting the target

A widely-used benchmark is the 4% rule. This suggests an investor can withdraw 4% of their portfolio annually without significantly depleting their capital long term — this could be achieved by investing in dividend-paying stocks with an average yield of 4%. Based on this, an investor would need £900,000 in their ISA to generate £3,000 a month.

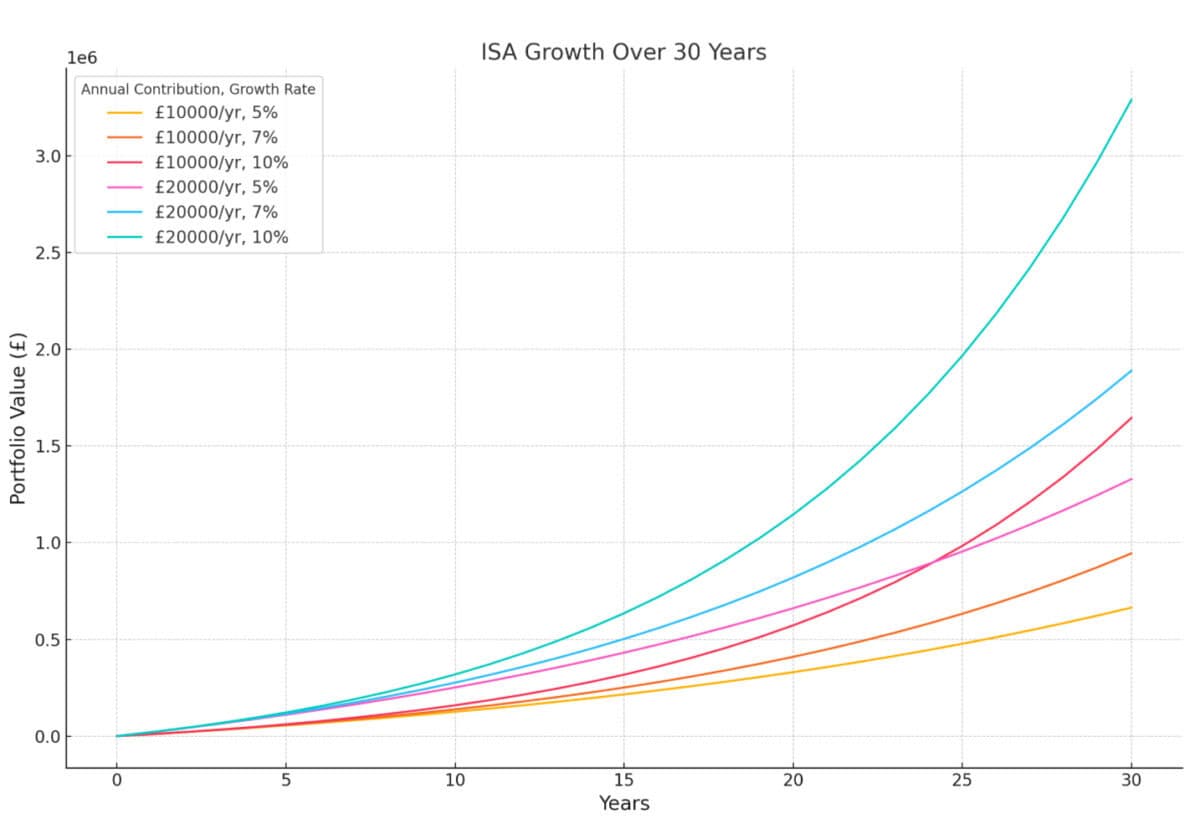

Achieving this balance depends on several factors, including initial contributions, the time horizon, and investment returns. ISA allowances permit up to £20,000 a tax year to be contributed. By doing this and investing in assets with an average annual return of 7% (a typical expectation for shares), an investor starting from £0 could potentially accumulate around £900,000 in 25 years. Of course, that’s not guaranteed and said investor could lose money as well as making it.

There are other ways to aim for the target. One could invest in higher dividend-paying stocks in an effort to generate a larger yield from a smaller balance. The required balance could also be achieved sooner or with less capital if the investor’s shrewd. This is highlighted in the below graph.

The art of the possible

Many novices will buy into index-tracking funds. These aim to track the performance of major indexes. For example, the FTSE 100 averaged 6.3% annually over 20 years, while FTSE 250 outperformed it. America’s S&P 500 returned about 10.5% annually since 1957, averaging 13.3% in the decade to 2024. The Nasdaq achieved 19.8% over the past decade.

But some people, those buying into individual shares and funds, achieve stronger growth. While I’ve averaged strong double-digit returns over the last five years, brain-boxes like analyst J Mintzmyer have averaged over 40%. However, as great as this sounds, investors need to remember that poor investment decisions can result in losing money.

Consider this for the growth phase

I typically invest in individual shares, but in my daughter’s Self-Invested Personal Pension (SIPP), which involves smaller investments, I prefer funds or trusts that offer me diversification while only paying one platform trading fee.

One trust she recently bought and I think is worth considering is Edinburgh Worldwide Investment Trust (LSE:EWI). It’s operated by Baillie Gifford, which also runs the popular Scottish Mortgage Investment Trust.

Like Scottish Mortgage, Edinburgh Worldwide invests in growth-oriented companies but focused on making an initial investment in companies when they are younger — originally companies with a market-cap smaller than $5bn, but this was recently upped to $25bn to broaden the field of play.

Its largest investment is SpaceX which represents a massive 12.3% of the portfolio. This is followed by PsiQuantum at 7.5% and Alnylam Pharmaceuticals. In short, it’s a very interesting portfolio, representing some of the most sought-after growth investments worldwide.

However, SpaceX and quantum computing go some way to highlighting the risky nature of the trust’s holdings. Not only are these early-stage companies — albeit one worth $350bn in the case of SpaceX — but there’s limited available data about their finances — only listed companies need to issue earnings reports.