Looking for the best FTSE 100 recovery shares to consider in the New Year? Here’s one I think has the potential to surge in value following recent troubles.

Grim business

The problems in Britain’s housing market have been well documented. Higher interest rates than we became accustomed to during the 2010s has ended the era of cheap borrowing and has dented demand for expensive assets like homes.

Housebuilder Barratt Redrow (LSE:BTRW) has been one of many casualties of the downturn. Its share price has slumped 23% in the past year as difficulties have endured. Over five years, the FTSE firm is down a whopping 48%.

To rub salt into the wounds, reduced build levels — combined with higher costs — have caused margins to fall sharply. Barratt’s own adjusted gross margin slumped 4.7% in the 12 months to June 2024, to 16.5%.

Potential drivers

There are still big risks here as the labour market weakens, potentially impacting new-build demand. Rising staff and materials costs could also weigh on profits. But I believe there’s good reason to expect the builder to bounce back.

Perhaps most crucially, the Bank of England (BoE) looks on course to cut interest rates several times in 2025 as inflationary pressures moderate. December’s surprise fall in CPI confirms things continue to (roughly) go in the right direction.

The impact of recent BoE rate-cutting has already been keenly felt in the market. Data from the Office for National Statistics (ONS) today (15 January) showed average residential property values rising at their fastest pace for two years in November.

Cause for cheer

Recent trading updates from the sector are also encouraging. FTSE 100 rival Persimmon said on Tuesday that forward sales are currently up 8% year on year. Its completion numbers also rose 7% to 10,664 units in 2024 as buyer affordability improved.

This followed Barratt’s own positive update on 23 October in which it praised “solid trading” in recent weeks. Then it said that “whilst customer demand continues to be sensitive to the wider economy, we are beginning to see more stable market conditions with increased mortgage availability and affordability.”

Signs of sustained momentum when Barratt reports interim results on 12 February could send its share price — along with those of other sector participants — sharply upwards.

A FTSE bargain?

The chances of Barratt’s share price rebounding in 2025 are improved by the company’s ultra-low valuation too.

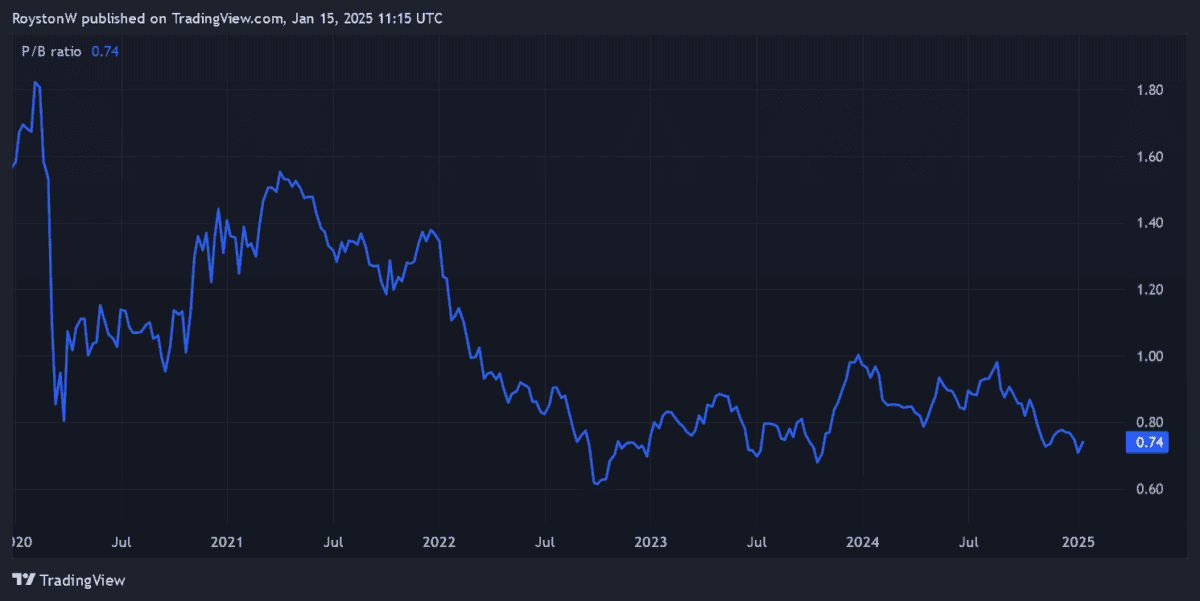

At 0.7, its price-to-book (P/B) ratio is well inside value territory of 1 and below. In layman’s terms, it means Barratt shares are undervalued compared to the worth of the firm’s assets.

The builder also looks attractive based on predicted profits. A forward price-to-earnings (P/E) ratio for this financial year ending June 2025 is an uninspiring 17.7 times.

However, this reading topples to 11.6 times for next year, reflecting broker expectations of a jump in annual earnings.

On balance, I think Barratt shares are worth serious consideration from investors seeking recovery stocks. Even if the builder doesn’t bounce back this year, I think it’s a matter of time before it does as the UK’s soaring population drives homes demand steadily higher.