Despite a strong performance, Games Workshop‘s (LSE: GAW) share price slipped almost 4% today (14 January) after the company published its first-half 2024/2025 results.

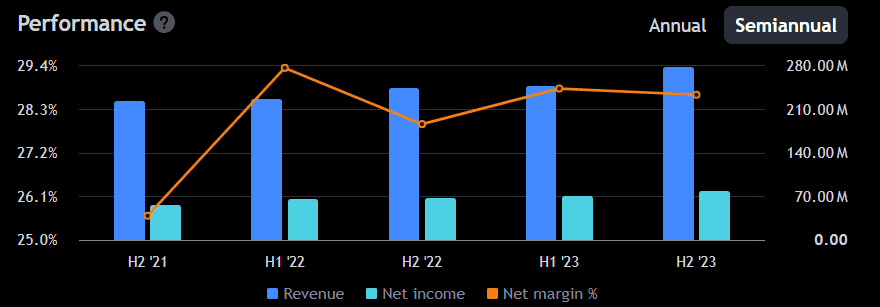

These revealed a pre-tax profit of £126.8m, marking a 25% rise compared to £95.2m in the prior year. Core revenue reached £269.4m, a 10% increase from £235.6m in the same period last year.

Income from licensing surged to £30.1m, more than doubling from £12.1m previously. However, its net increase in cash was lower, at £79.1m, compared to £85.3m in the second half of 2023.

Should you invest £1,000 in Games Workshop right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Games Workshop made the list?

A dividend of £1.55 per share was also announced, bringing the full amount up to £4.20 for the financial year. The ex-dividend date is 23 January.

The company isn’t planning any share buybacks or acquisitions.

Growth drivers

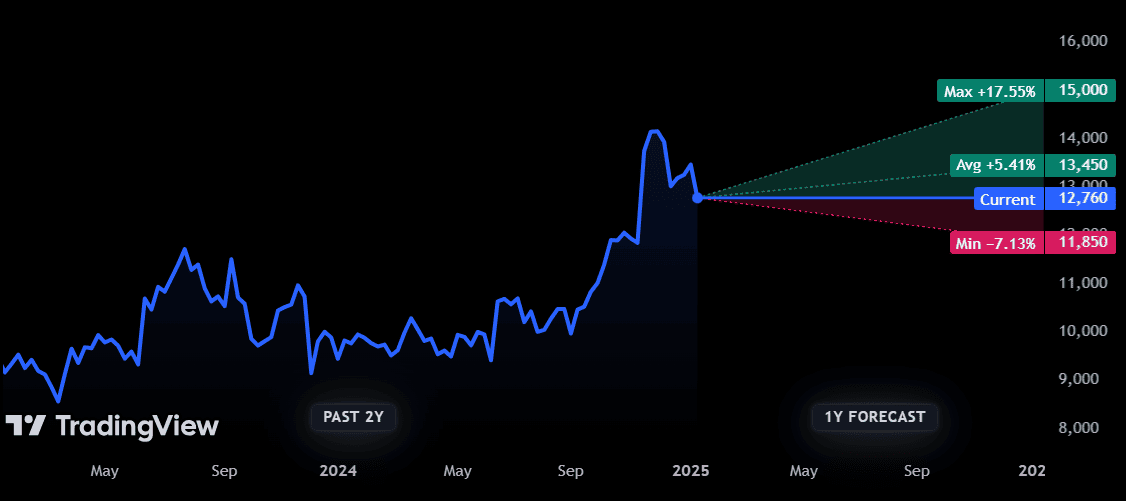

Renowned for its Warhammer series, Games Workshop’s gone from strength to strength. The share price rose 15% in 2023 and a further 34% in 2024, following consistent revenue growth in the past five years.

With a view to continue expanding, the company’s initiated several key developments. Most notably, a planned partnership with Amazon to adapt Warhammer 40,000 into a television series could be a huge boost for the brand.

With a dedicated global fanbase and website that attracts 2.8m monthly visitors, the deal stands in good stead to benefit both parties.

On the video gaming side, the release of Warhammer 40k: Space Marine 2 in September helped boost its digital footprint. Although there were some critical reviews from online gaming sites, the overall reception was generally favourable.

Fundamentals and forecasts

The soaring share price means Games Workshop looks slightly overvalued. It has a trailing price-to-earnings (P/E) of 28.9, well above the industry average. However, with earnings forecast to grow, this is expected to come down.

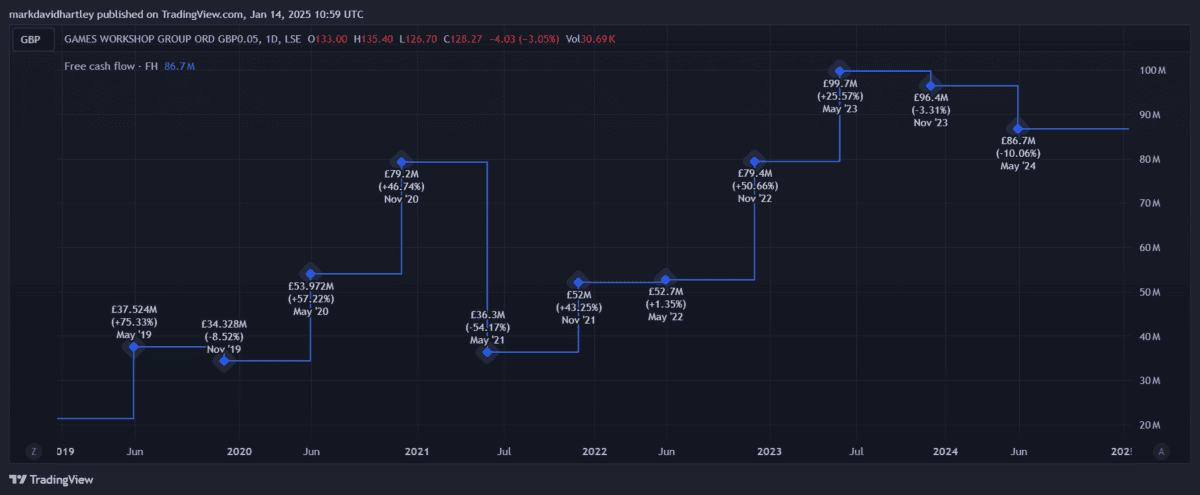

Despite a slight dip in 2024, free cash flow has been steadily increasing overall. And with no debt, the risk of further interest rate hikes shouldn’t be a cause for concern.

Still, it may be difficult for the share price to see further gains from here. Analysts watching the stock don’t expect much above 5.4% growth in the coming 12 months.

Risk to consider

Whether the company can continue to find new customers is the question. As a non-essential retailer, rising inflation could lead to a drop in sales as consumers prioritise their spending. Although it recently joined the FTSE 100, it remains a comparatively small outfit.

With the economy looking uncertain in 2025, investors may opt for the safety of larger and more well-established companies.

In today’s results, it also warned of potential third-party cost inflation related to US trade tariffs. This may be one reason the share price dipped after the news came out. High tariffs could limit profits from the US, its largest market by revenue.

Final thoughts

Overall, Games Workshop appears to be in a good position, both regarding finances and business developments. The partnership with Amazon represents a particularly compelling value proposition.

I’ve been considering the stock for some time as I think it shows great promise. However, considering the current economic climate, I’ll wait for more info about US tariffs before deciding to buy.