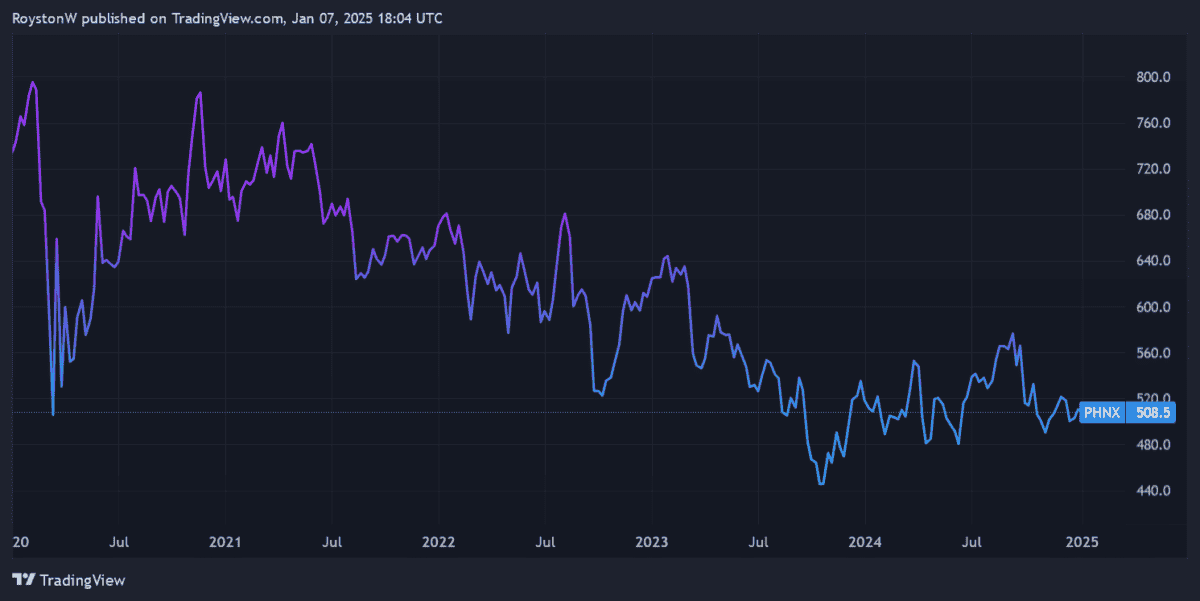

Phoenix Group (LSE:PHNX) has been one of the FTSE 100‘s most impressive dividend shares in recent years.

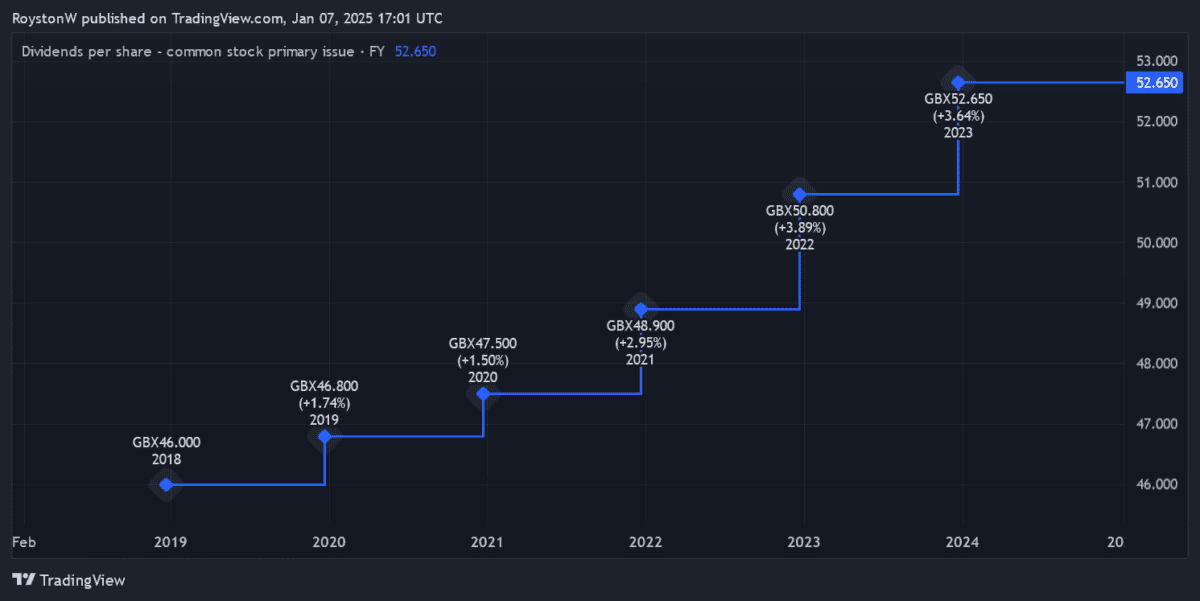

Annual dividends have risen for six straight years, including during the pandemic when other blue-chips were slashing, delaying or cancelling shareholder payouts.

And what’s more, dividend yields have also comfortably beaten the FTSE average of 3% to 4% during that time.

Should you invest £1,000 in Schroders Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Schroders Plc made the list?

While dividends are never guaranteed, analysts are expecting Phoenix shares to continue delivering large and growing cash rewards over the next couple of years at least.

With a £10,000 lump sum investment today, how much passive income could an investor like me generate?

11.2% dividend yield

As a financial services provider, Phoenix’s profits are very sensitive to broader economic conditions. In periods of high interest rates and weak growth, demand for pensions, savings and retirement products can waver. That is a risk investors should not ignore.

Indeed, the business has seen earnings drop in three of the past five years. Yet despite this, a strong balance sheet has allowed it to continue paying a hetfy and increasing yearly dividend.

As the table below shows, City brokers are expecting Phoenix’s proud payout record to continue:

| Year | Dividend per share | Dividend growth | Forward dividend yield |

|---|---|---|---|

| 2025 | 55.6p | 3% | 10.9% |

| 2026 | 57.2p | 3% | 11.2% |

For 2024, the business is expected to have raised the annual payout 3% year on year, to 54.1p per share.

A strong earnings outlook and robust capital base means I personally expect dividends to keep growing beyond 2026 too. But even if they don’t, a £10k lump sum invested here today could eventually provide an investor with a regular monthly passive income above £800.

£800+ a month

Let’s say dividends at Phoenix Group match forecasts up to next year then remain unchanged for a decade. In this scenario, an investor would make £1,120 in 2026, and £11,200 over 10 years. Over three decades, they would make a stunning £33,600 in dividends.

This would be the worst-case scenario too. If they were to reinvest their dividends, this investor would own more shares and therefore receive even more dividends.

In this situation, they’d have made £28,719 in passive income after 10 years. And after 30 years, they’d have received total dividends of £235,494.

That’s around seven times the £33,600 made without reinvesting the dividends.

After adding their £10,000 initial investment, this investor’s portfolio would be worth £245,494 (assuming zero share price growth). If they then withdrew 4% of this amount each year, they’d have an annual passive income of roughly £9,820 — and a monthly one of £818 — for around 30 years.

Of course, we mustn’t forget that payouts can go down as well as up, as can share prices.

A top stock

But over the long term, I think Phoenix Group’s share price can recover strongly, driven by demographic changes that raise demand for its financial products. More specifically, sales of its pensions and other retirement products could balloon as the world’s elderly population increases.

At the same time, investors can expect more gigantic dividends if the firm can maintain its strong balance sheet. The Solvency II capital ratio here was 168% as of June.

Although profits could disappoint during economic downturns, I believe Phoenix is a top dividend share to consider today.