Looking for the best growth shares to buy in the New Year? Here are two of my favourites.

I’ve put my money where my mouth is and bought them for my own portfolio.

Games Workshop

Last year was a landmark one for tabletop gaming giant Games Workshop (LSE:GAW) as it entered the FTSE 100 for the first time.

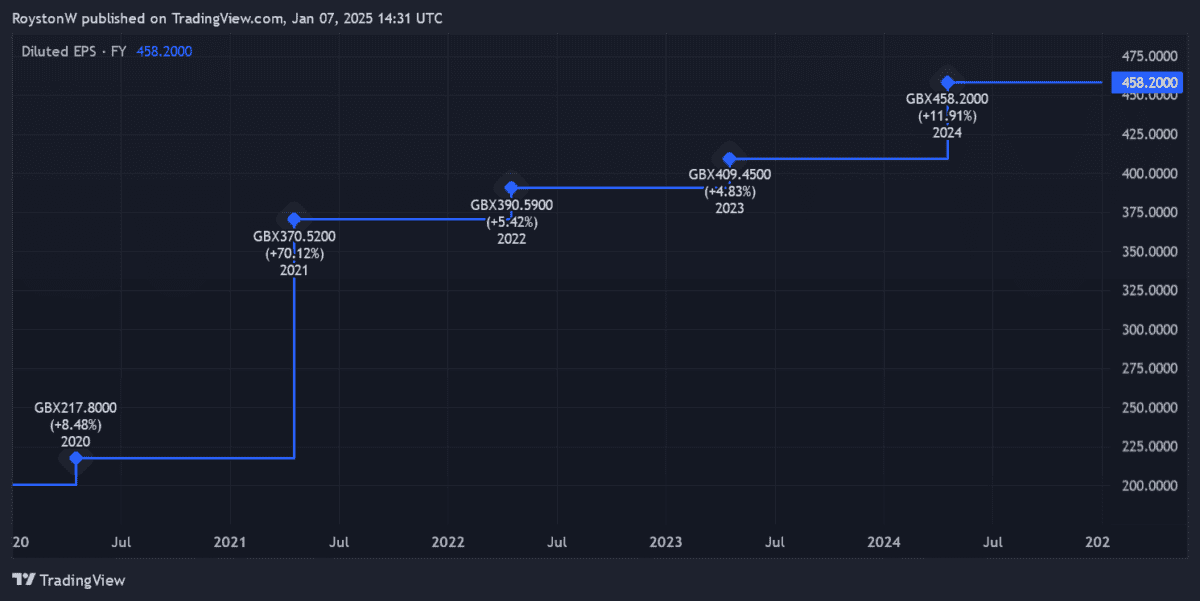

Earnings here have grown consistently and at rapid pace in recent years, as the chart below shows. Tabletop wargaming isn’t everyone’s cup of tea. But it’s growing rapidly as global interest in the fantasy soars, and board gaming in general enjoys a renaissance.

Through its Warhammer line of products, Games Workshop is at the forefront of this booming industry. And it’s aiming to enter the mainstream by launching film and TV content with Amazon in the next few years.

It’s a move that could supercharge sales of its traditional games systems and create huge royalty revenues in its own right.

Profits look set to continue rising strongly in the meantime, as new products fly off the shelves and the company grows its worldwide store estate. Late November’s trading update underlined its continued trajectory, predicting pre-tax profits of at least £120m in the six months to 1 December, up 25% year on year.

This supports City predictions that annual earnings will grow 7% this financial year (to May 2025). Earnings are tipped to increase another 5% in next year as well.

Games Workshop’s strong outlook is reflected by its elevated price-to-earnings (P/E) ratio of 27.2 times. While I think the company is worthy of this premium valuation, it means its shares could potentially slump if any hiccups occur.

Greggs

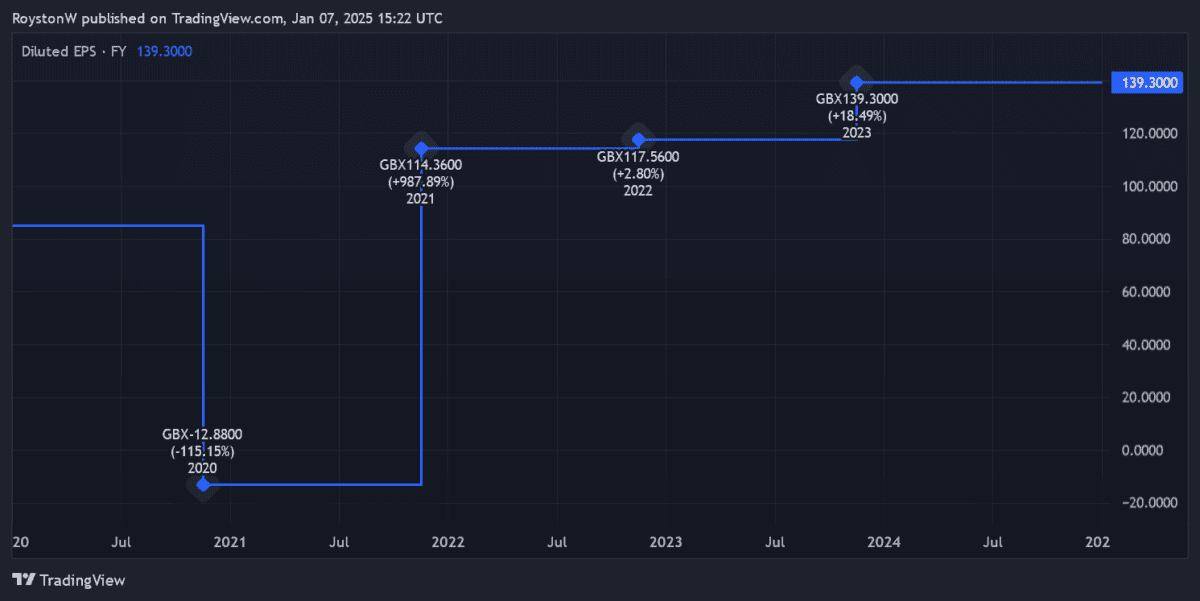

Pandemic aside, Greggs (LSE:GRG) has also enjoyed impressive earnings growth in recent years. This is thanks largely to an expansion strategy that’s pushed sales around three-quarters higher since 2019.

For 2024, City analysts think the FTSE 250 company’s earnings rose 8% year on year. They’re forecasting further meaty growth — of 7% and 8% — in 2025 and 2026.

This is perhaps unsurprising given Greggs’ commitment to keep growing its store estate from current levels of around 2,560. It planned for between 140 and 160 new outlets in 2024 alone, and plans to have 3,500 company-managed and franchise outlets up and running in the next few years.

Competition in the food-on-the-go market is intense and remains a threat. But Greggs’ recipe of offering generational favourites (like sausage rolls and doughnuts) at attractive prices is helping it successfully navigate this danger. Latest financials showed sales up 12.7% between 1 January and 28 September.

The baker’s also effectively tailoring its services to meet the needs of the modern consumer. Recent measures include introducing a click and collect service, building drive-thru outlets, and extending opening hours into the evening.

Today Greggs trades on a forward P/E ratio of 20.8 times. While the stock isn’t cheap, I don’t this will affect its chances of printing further impressive gains following last year’s healthy rise.