Share-based exchange-traded funds (ETFs) aren’t just a brilliant tool to help investors diversify. The multitude of stocks they hold can also provide spectacular capital gains and a decent dividend income, depending on the type of fund that one chooses.

Take the following growth-based ETFs, for instance. As the chart below shows, they’ve delivered eye-popping returns during the past five years.

| Fund | Average annual return |

|---|---|

| Invesco EQQQ Nasdaq 100 ETF (LSE:EQQQ) | 20.5% |

| iShares Edge MSCI World Quality Factor ETF (LSE:IWFQ) | 12.5% |

| iShares Core EURO STOXX 50 (LSE:EUE) | 8.3% |

And if these ETFs deliver the same performance over the next five years, an investor would turn a £21,000 lump sum invested equally across them into £41,704. They’d have more than doubled their money!

Remember that past performance isn’t a guarantee of future returns. But here’s why I think they’re worth serious consideration.

Tech titan

As its name indicates, the Invesco EQQQ Nasdaq 100 ETF provides robust exposure to the tech-focused Nasdaq exchange. Just over 51% of its entire weighting is dedicated to the information technology sector.

Furthermore, the so-called Magnificient Seven stocks — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla — are among its eight largest holdings, the other being Broadcom.

These businesses are heavyweights in their respective fields. And they have the scale and the knowhow to capitalise on emerging tech opportunities like artificial intelligence (AI), quantum computing, and robotics.

Historically, the Nasdaq index can be far more volatile than the S&P 500. But over the long term it can also provide better returns, as the numbers near the top show.

Global superstar

The iShares Edge MSCI World Quality Factor also holds US tech giants including Nvidia and Microsoft. However, it provides superior diversification to the other fund, helping investors spread risk more effectively.

As the name suggests, it holds stocks from across the world rather than just those in North America. Just over 77% of its capital is held in US shares, in fact.

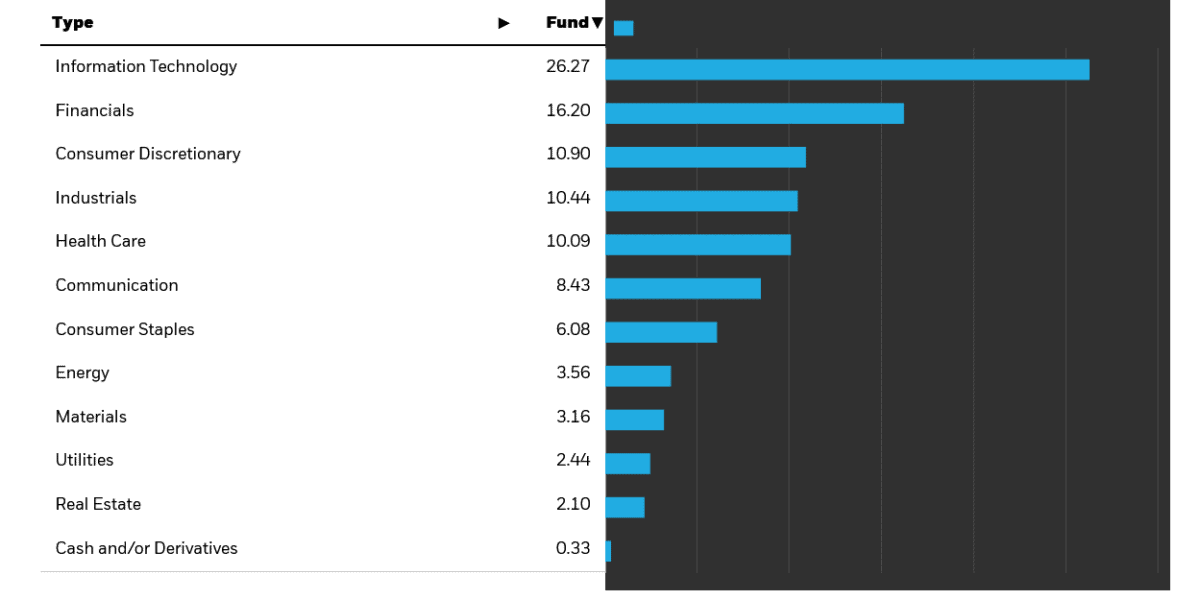

It also provides more even exposure to other sectors, illustrated above. Other major holdings here include Visa, Costco, and Novo Nordisk.

One drawback is that this has produced a lower return than tech funds like the one described above. But then that 12%-plus average return since 2019 is still a pretty decent return, in my opinion.

And the prospect of lower returns may be a price worth paying for better diversification to some investors.

Euro star

The iShares Core EURO STOXX 50 may have delivered a worse return than those other funds since 2019. But I don’t think an average 8%-plus shouldn’t be sniffed at! And I think it could provide much stronger returns over the next five years.

This is because of the underperformance of European shares in recent times relative to their US counterparts. It’s a lag that could, as we saw in 2024, could pave the way for exceptional capital gains from this point.

This fund also invests across a multitude of sectors. Major holdings here include semiconductor maker ASML, software provider SAP, and luxury goods specialist LVMH. In total, it holds 50 stocks, providing solid diversification.

Be aware, though, that political turbulence in much of Europe could dent future returns.