As I write, Warren Buffett’s net worth is thought to be just in excess of $140bn. So it may come as no surprise to hear that he’s known as the ‘Oracle of Omaha’, with investors around the world eager to hear and interpret his every word. And despite his unimaginable wealth, his teachings are incredibly valuable for novice investors.

No savings? No worries

Many Britons have no savings at 30. But while it may be common, it doesn’t mean it’s happy situation to be in. Conventional wisdom tells us we should have enough savings for at least six months. Beyond building a small reserve, many of us want to build wealth, and investing regularly and over a sustained period of time, is one of the best and most popular ways of doing it.

Thankfully, Britons start can investing with very little money at all. Investors could look to put aside as little as £50 a month from our salaries in order to get started. Or if an investing were willing to make cutbacks in other parts of our lives — such as a daily coffee out — that £50 figure could be expanded upon.

Should you invest £1,000 in Unilever right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Unilever made the list?

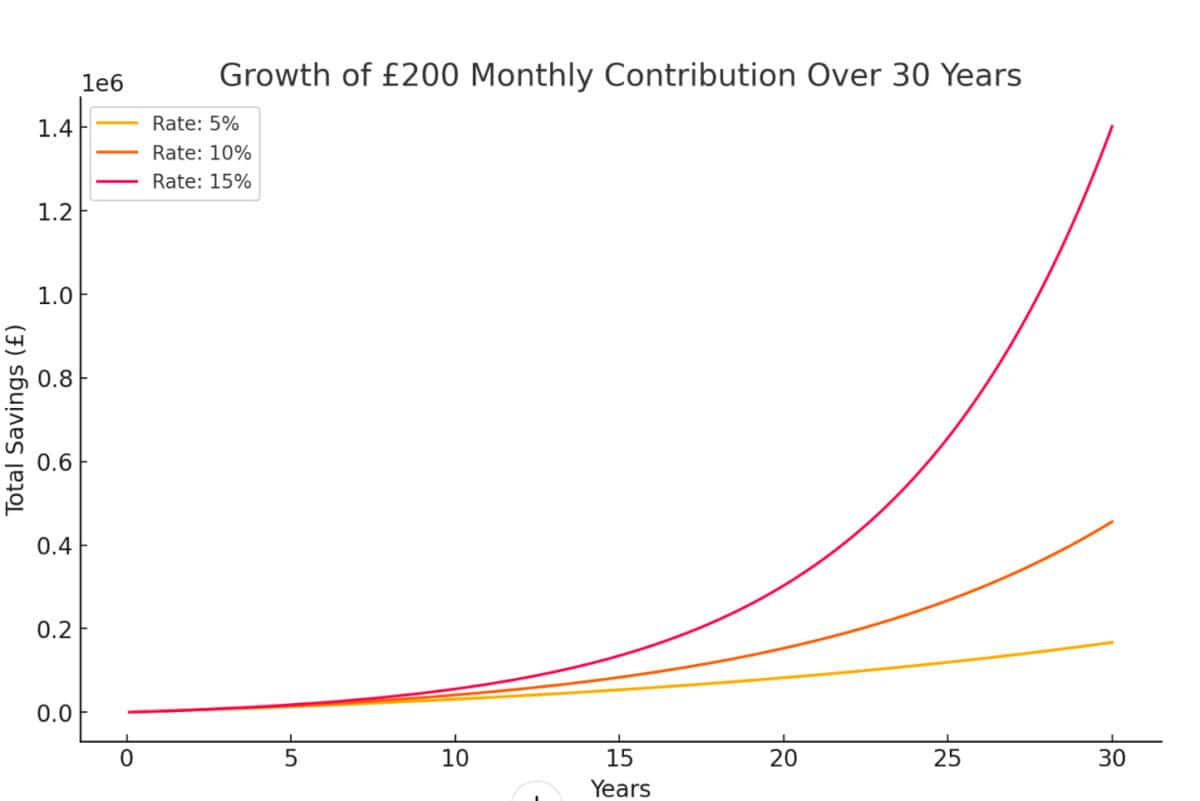

Here’s a graph showing how £200 monthly contributions compound over 30 years at annual rates of 5%, 10%, and 15%. The differences in growth become more pronounced over time due to the power of compounding, with the higher rate reaching £1.4m.

Buffett’s golden rule

So, what does this have to do with Warren Buffett? Well, it’s simply about how we invest. Many novice investors lose money chasing big returns. And that’s why Buffett’s first rule of investing is “don’t lose money”. The thing is, if an investors makes a poor investment decision and the value of that asset — stock — goes down 50%, the investment has to go 100% up to get back to where it started.

It’s certainly easier said than done — don’t lose money. However, it underscores the need to make researched investment decisions and not simply follow our gut or even the crowd. This could mean using quantitative models to build a rationale for our investments.

A strong investment to consider?

One stock potentially worthy of consideration is Blue Bird Corporation (NASDAQ:BLBD). The American company is a leading designer and manufacturer of school buses in North America. And it has benefitted from the electrification agenda, supported by federal subsidies.

Some recent pullback in the share price may be associated with President-elect Donald Trump’s likely repeal of the clean energy/ EV provisions in the Inflation Reduction Act. This does create some risks for shareholders.

However, the company boasts a strong backlog of orders, a robust balance sheet, and impressive profitability grades. Moreover, the valuation data is highly attractive. The stock is trading at 9.7 times forward earnings and has a price-to-earnings-to-growth (PEG) ratio of 0.77. It’s also a brand that customers know, having been founded in 1927. That counts for a lot sometimes.

Those considering it should bear in mind that buying US stocks will mean that their investments are also subject to exchange rate fluctuations. Moreover, they’ll need to apply for a W8-BEN which will allow them to buy and trade US-listed stocks. This needs updating periodically but it’s still simple and I don’t think it should put anyone off US investing.