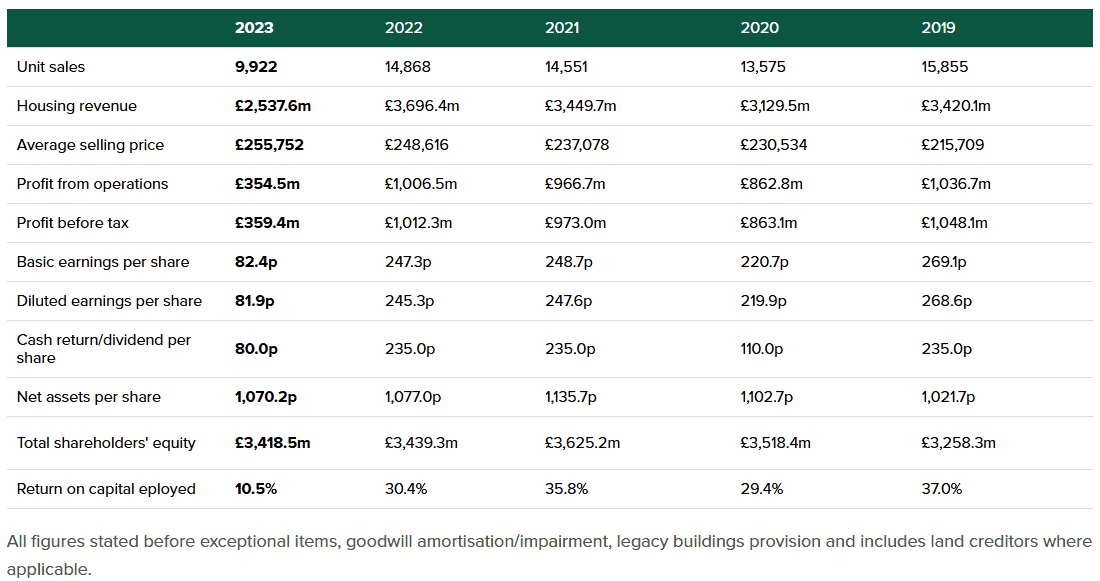

Not so long ago, of all the FTSE 100 stocks, Persimmon (LSE:PSN) would’ve been considered one of the best for dividend income. For example, in 2021 and 2022, the housebuilder paid 235p a share. At the end of February 2023, its share price was 1,452p, implying an astonishing yield of 16.9%.

But experienced investors know that yields like this are rarely sustainable. Indeed, on 1 March 2023, as a result of a loss of confidence in the housing market following a series of post-pandemic interest rate rises, the company announced a massive cut in its payout.

However, despite its recent woes, the company looks likely to pay 60p a share in respect of its 2024 financial year.

Should you invest £1,000 in Phoenix Group Holdings Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Phoenix Group Holdings Plc made the list?

Based on a current (27 December) share price of 1,184p, this means the stock’s still yielding 5.1%. This is comfortably above the average for the FTSE 100 as a whole (3.8%).

And it puts it in the top fifth of Footsie dividend payers.

Building blocks

In 2024, Persimmon expects to build 10,500 homes. This is 5.8% more than in 2023.

But it remains 4,212 (28.6%) lower than its 2019-2022 annual average of 14,712.

However, if the company could return to its recent average, it’ll have demonstrated impressive growth.

I’m sure the directors of any business that sells nearly 30% more of its principal product would be satisfied with its performance. And if the company can sell nearly 15,000 homes, I’m confident its annual turnover will be its highest ever.

For the first six months of 2024, its average selling price was £263,288. Multiply this by 14,712 completions and annual revenue would be £3.87bn. This would beat its previous best of £3.7bn, achieved in 2023.

A different landscape

However, it’s earnings that really matter.

And post-Covid inflation has fundamentally changed the cost base of Britain’s housebuilders. In 2023, Persimmon’s underlying operating profit margin was 14%, compared to 30.3%, in 2019. This is a massive difference and despite being able to pass on some of these additional costs to buyers, the average operating profit per house, in 2023, fell to £35,729 (2019: £66,105).

Although history suggests the housing market will recover, there’s no guarantee. However, if it does, the company’s well placed to capitalise.

At 30 June 2024, it owned 81,545 plots. Of these, 38,067 had detailed planning consent.

My view

Although I’m confident Persimmon will sell more houses in 2025, I think there are plenty of other stocks that’ll grow their earnings faster.

I think confidence will return but I suspect it’ll be a few years before the company’s approaching 15,000 completions again.

However, I still believe the housebuilder would make an excellent dividend stock, which is why I plan to hold on to my shares.

The company’s managed to come though the downturn with a strong balance sheet. This makes me believe that its dividend is reasonably secure. And it should increase further if the property market recovers as I anticipate.

Of course, there are no guarantees.

But its net assets per share is now higher than at the end of 2019. And the company has no debt. I believe this is a solid foundation on which Persimmon can seek to restore its status as one of the Footsie’s best dividend payers around.