Broadly speaking, investing in FTSE 100 shares has provided a tidy return over the long term. Since 2010, for instance, the UK’s leading index of shares has provided an average annual return of 7%.

It’s easy to see why the Footsie is a popular destination for investors. An index tracker fund provides exposure to:

- Blue-chip companies with market-leading positions and robust balance sheets.

- Attractive dividend stocks with large yields and strong records of payout growth.

- A multitude of different sectors (like banking, energy, and consumer goods).

- Many global regions, thanks to multinationals including BP, Legal & General, and Unilever.

Past performance isn’t always a reliable guide to future returns. But based on the last 14 years, how much could a 40-year-old investing £500 monthly in the FTSE 100 make by retirement?

Should you invest £1,000 in Associated British Foods right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Associated British Foods made the list?

Funds vs shares

The outcome depends on whether they purchased an index tracker, or built their portfolio themselves by buying individual shares.

There are advantages to both approaches. A FTSE-tracking exchange-traded fund (ETF) provides exposure to all 100 companies, and it can be cheaper and simpler than buying individual shares.

Purchasing specific stocks, on the other hand, can allow an investor to potentially make index-beating returns. Many businesses — including Ashtead and Games Workshop, which I personally own — have been delivering Footsie-beating, double-digit average annual returns for years.

But focusing on individual shares also creates higher risk and the potential for underwhelming returns. Prudential‘s been a pain in the neck for me personally, its share price sinking steadily since the mid-2010s.

This is why it’s a good idea to consider buying a selection of stocks to balance risk and opportunity.

Solid returns

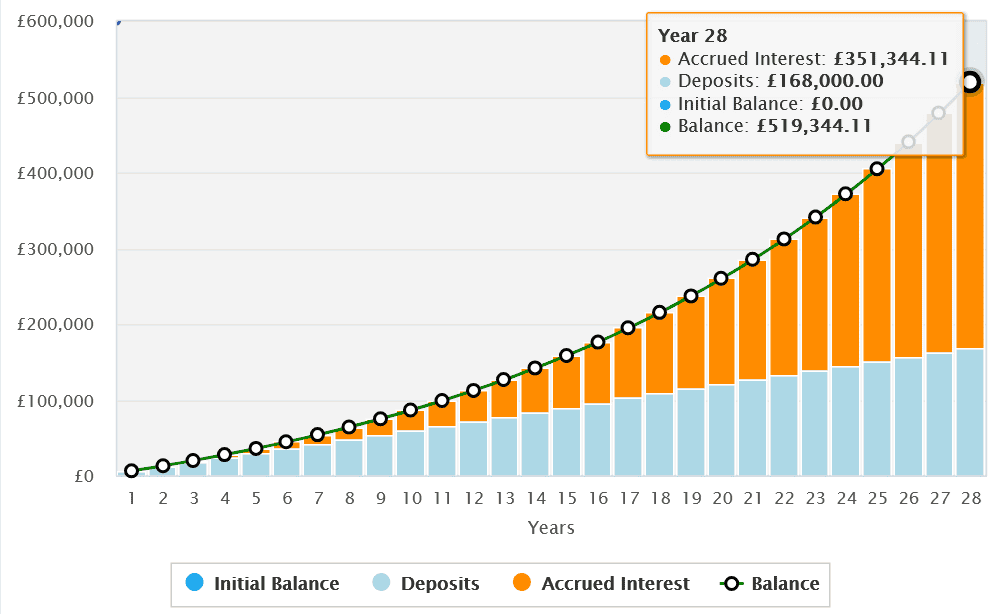

For the sake of this example, let’s say that our 40-year-old investor spends their £500 a month on a FTSE 100-tracking ETF.

Based on that 7% average annual return since 2010, they would — if they’re targeting retirement at the State Pension age of 68 — have a portfolio worth £519,344.

That’s excluding any trading fees, and any tax they may have to pay if not using a tax-efficient Individual Savings Account (ISA) or Self-Invested Personal Pension (SIPP).

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

A better fund?

That’s not a bad return. But it’s not enough to get me excited, given the range of investment opportunities elsewhere.

I’d rather purchase a fund with a better track record of growth. Indeed, it’s why I own an S&P 500-based ETF instead. With an average yearly return of 13.8% since 2010, this US index has provided an average annual return almost double that of the FTSE.

A £500 monthly investment here would turn into almost £2m instead (£1,983,318, to be exact).

The one I chose is the HSBC S&P 500 ETF (LSE:HSPX). With a 0.09% ongoing charge, it’s one of the cheapest in the business.

Its high weighting of tech stocks means the fund could disappoint during economic downturns. But over the long term, I’m expecting further blistering returns thanks to the adoption of new technologies like artificial intelligence (AI).

There is no ‘right’ way to invest in the FTSE 100. But for me, I think investing in individual UK shares and non-Footsie funds is the best approach.