The Barclays (LSE:BARC) share price has been one of the outstanding FTSE 100 performers of this year. The stock’s up 84% since the start of January.

Despite the sharp climb, the combination of dividends and share buybacks means the stock still looks attractive heading into 2025. I think investors should think seriously about buying it at today’s prices.

Dividends and share buybacks

Barclays is in the early stages of a plan to return significant amount of cash to its shareholders. Earlier this year, it said it aims to distribute £10bn through a combination of dividends and share buybacks.

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

So far, the bank’s completed £1bn in share buybacks and started on another £750m, as well as sending out £1.2bn in dividends. That’s a big chunk, but it still leaves quite a bit over the next couple of years.

By my calculations, that leaves roughly £7bn left to be distributed to shareholders. And with a market-cap of nearly £39bn, that could be around 9% a year for the next couple of years.

I’m not expecting the FTSE 100 to manage this kind of return, so I think Barclays shares look like good value. But investors thinking of buying the stock should look at the bigger picture.

Outlook

Beyond capital returns, I think there are reasons for investors to be positive about the underlying business. Unlike other UK banks, Barclays has a significant investment banking operation.

Across the Atlantic, both Citigroup and JP Morgan are expecting investment banking revenues to grow strongly in the near future. If they’re right, I’d expect this to be positive for the UK bank as well.

Speculatively, I wonder about the long-term future of this part of the business. Barclays reorganised itself into five divisions earlier this year, with investment banking one of them.

Management said the intention was to give investors better insight into how the different parts of the organisation are performing. But I wouldn’t be surprised if this isn’t the whole story.

A potential spin-off?

When companies reorganise like this, it’s sometimes a sign they’re looking to divest a unit. While I’ve no proof Barclays is planning this, the investment banking business has achieved lower returns recently.

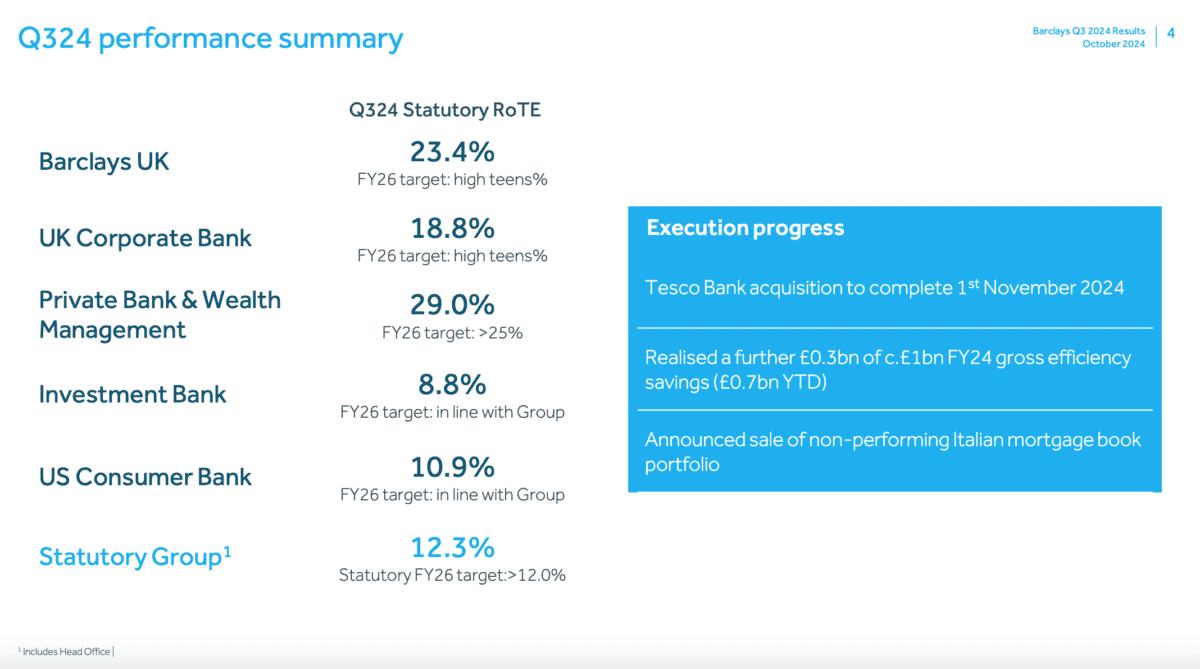

Source: Barclays Q3 2024 Results Presentation

Part of this is due to the industry being in a cyclical downturn after the surge brought on by negative real interest rates. But it’s worth keeping an eye on this division to see if things improve.

Another thing investors should pay attention to is the ongoing car loan investigation. While Lloyds appears to be the major bank with the most exposure, Barclays isn’t thought to be entirely immune.

It would be a pity for investors to see some attractive-looking capital returns offset by some significant liabilities. But the risk’s one that should be taken seriously.

Still undervalued?

It seems strange that a stock might be undervalued when it’s climbed 85% in just under a year. But I think there’s a good argument to be made that this is the case with Barclays shares.

If the ongoing car loan issue doesn’t create too much trouble, the stock could offer a better return than the FTSE 100 over the near term. I think investors should consider buying at the start of 2025.