When it comes to finding shares to buy, understanding the underlying business is essential. But there are limits to what investors need to know.

Technology companies arguably don’t come much more complicated than Palantir (NASDAQ:PLTR). However, evaluating the stock as an investment doesn’t necessarily involve understanding its tech.

Warren Buffett

Believe it or not, this is the view Warren Buffett has. One of the Berkshire Hathaway CEO’s most successful investments is in Apple but this isn’t based on understanding how its products work.

Should you invest £1,000 in Coca-cola right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Coca-cola made the list?

Here’s what Buffett said at the 2024 Berkshire shareholder meeting:

I have no idea how the iPhone works, there may be some little guy inside or something. But I know what it means to people, and I know how they use it. And I know enough about consumer behaviour to know that it’s one of the great products, maybe the greatest product of all time. The value it offers is incredible.

Knowing how an iPhone works isn’t important for investing in Apple because that isn’t what makes it a great business – it’s the value it provides for customers. And the same might be true for Palantir.

Palantir’s growth

Understanding how Palantir’s products work is complicated. But what seems to be very clear is that they’re providing terrific value for their customers.

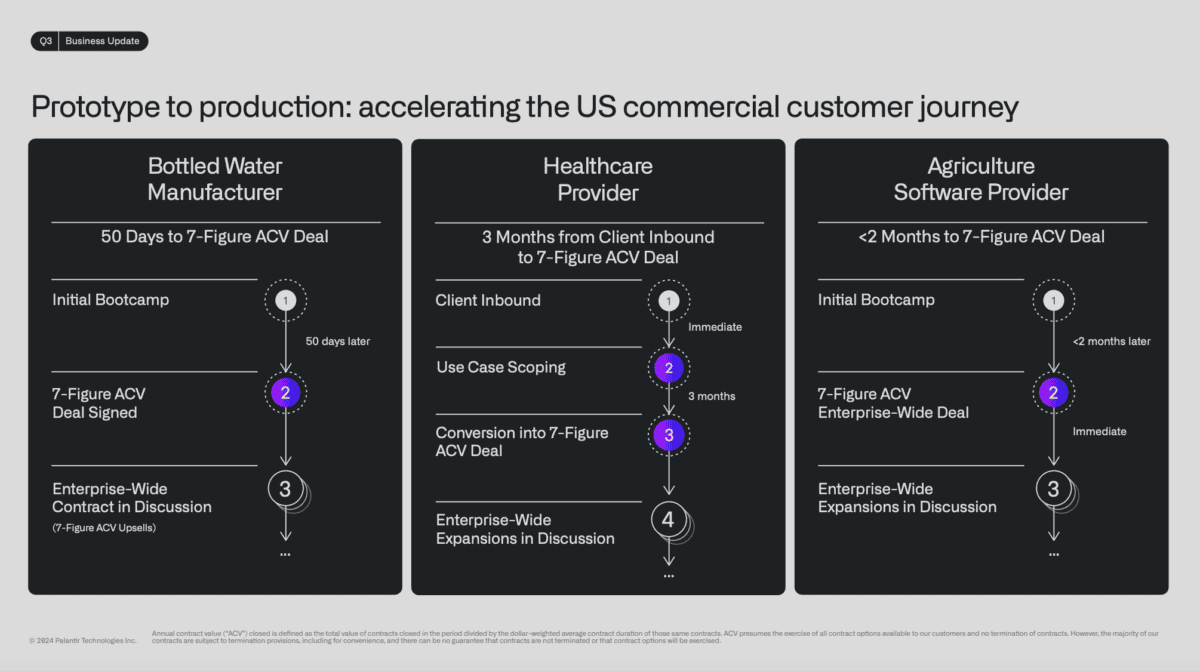

A good illustration of this comes from the so-called bootcamps the company’s been running. These are five-day workshops where it shows potential clients what its products can do for their businesses.

The firm highlighted three of these in its most recent earnings report. One was a bottled water manufacturer, another was a healthcare provider, and a third was an agricultural software company.

Source: PalantirQ3 2024 Business Update

Importantly, all three signed seven-figure deals within three months. This means first that the value Palantir adds is obvious, and second that its products can add value across a lot of different industries.

The next Apple?

I think investors can see how important Palantir is to its customers and how much they value it. In this way, it resembles what Buffett claims to know about Apple.

There is, however, a glaring difference between buying Palantir shares now and Buffett investing in Apple stock for Berkshire Hathaway in 2016. The difference is valuation.

At a price-to-sales ratio of 68, there’s no way around the fact that Palantir’s priced for a lot of growth. While it clearly has an extremely effective product, the big question is around competition.

Right now, it doesn’t look like there’s a meaningful competitor in sight. But the current share price implies this is going to be the case for a long time and investors need to be clear about the risk here.

Circle of competence

To sum up, a lot of investors buying Palantir shares may not fully understand the tech. But Buffett’s investment in Apple shows that maybe they don’t need to.

Staying within someone’s circle of competence involves understanding the business and how it works, not every detail of how its products operate. In the case of Apple, this is also a matter of how its customers see it.

With Palantir, there are clear reasons for thinking it’s making a big impression on companies with its bootcamps. And for investors who can weigh up the risks, this might be enough to consider buying it.