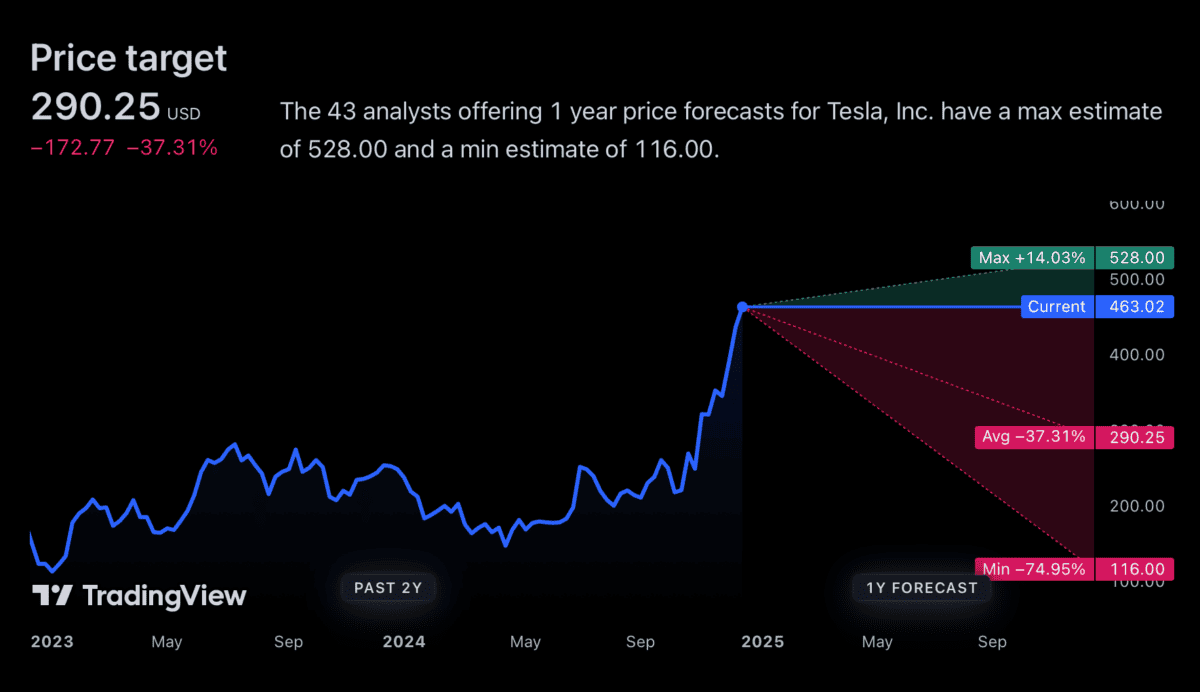

Since the US election, the Tesla (NASDAQ:TSLA) share price has been hitting new all-time highs. But analysts don’t seem too optimistic about the outlook for the stock.

As I write, the average price target’s $290 – 37% lower than the current level. So should investors stay well away from the shares heading into 2025?

Tesla analyst price targets

Should you invest £1,000 in National Grid right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if National Grid made the list?

Source: TradingView

Great expectations

There are two big reasons for optimism for Tesla investors. One is the prospect of the firm producing cars it can sell for lower prices and the other is the advent of its autonomous vehicle network.

I think the first of these is very important. The company’s announced that affordable vehicles are expected in early 2025 and I think this is an important part of the investment thesis.

Using its manufacturing scale to produce cars at a lower cost than competitors is a key part of Tesla’s long-term competitive advantage. So the news it’s going to start using this strength’s very positive.

The robotaxi network’s more of a multi-year project. And there are still some key obstacles to navigate, both in terms of the technology and the regulatory approval.

Investors seem to think Elon Musk’s position in the new US administration could help with the latter issue. But while this might push the stock higher, it’s unlikely to make a difference to sales in 2025.

The recent news has sent the stock soaring above analyst forecasts – at least, most of them. But this doesn’t automatically mean it’s likely to come back down to earth next year.

What could bring the stock down?

There are a few risks with the Tesla share price right now. But their scope for bringing down the stock in 2025 looks limited to me.

The first is valuation. The stock climbing only on the basis of the news – rather than earnings – has caused its price-to-sales (P/S) multiple to roughly double since November.

Tesla price-to-sales ratio 2020-24

Created at TradingView

Despite this, the valuation multiple’s only around the average of where it has been over the last five years. So I don’t see this as something that’s likely to bring the stock down imminently.

The second is the economic environment in the US. Tesla’s total sales have slowed in the last couple of years, but the reason for this has been weaker consumer spending.

Tesla total sales 2020-24

Created at TradingView

This however, looks set to improve. Wages across the Atlantic are growing faster than inflation. And this means the outlook for consumer spending’s actually reasonably positive.

As a result, I don’t think the macroeconomic situation in the US is set to sink the Tesla share price in 2025. That only leaves one real issue.

News

The biggest threat to the Tesla share price – in my view – is the news. Any kind of delays to its affordable car production, or threats to its robotaxi network, could cause the stock to fall sharply.

In that situation, it’s hard to see that the firm’s earnings and cash flows give investors much to fall back on. And that makes it too risky, from my perspective.