The last time I could pick up Glencore (LSE: GLEN) shares for 360p was back in December 2021. From its Covid-lows in March 2020, its share price surged over 400%, topping out at 575p in January 2023. Since then, it has been on something of a roller-coaster ride, but the trend has most definitely been downward.

As an investor who has been steadily increasing my position in the company over the last four years, I have certainly lived the highs and the lows of such volatility. But I have found that when investing in mining businesses, the key is to stay firmly rooted in a long-term thesis, which is the very reason that attracted me to the stock in the beginning.

AI and data centres

Demand for electricity is set to explode over the next decade. One of the largest drivers of this growth will be from data centres.

Should you invest £1,000 in Greggs Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Greggs Plc made the list?

We are already seeing the likes of Google and Microsoft signing agreements to source their electricity from nuclear power. But building nuclear power plants takes time. If you couple that with the fact that electricity grid systems are ageing and will need huge investments, then demand for copper is going to surge.

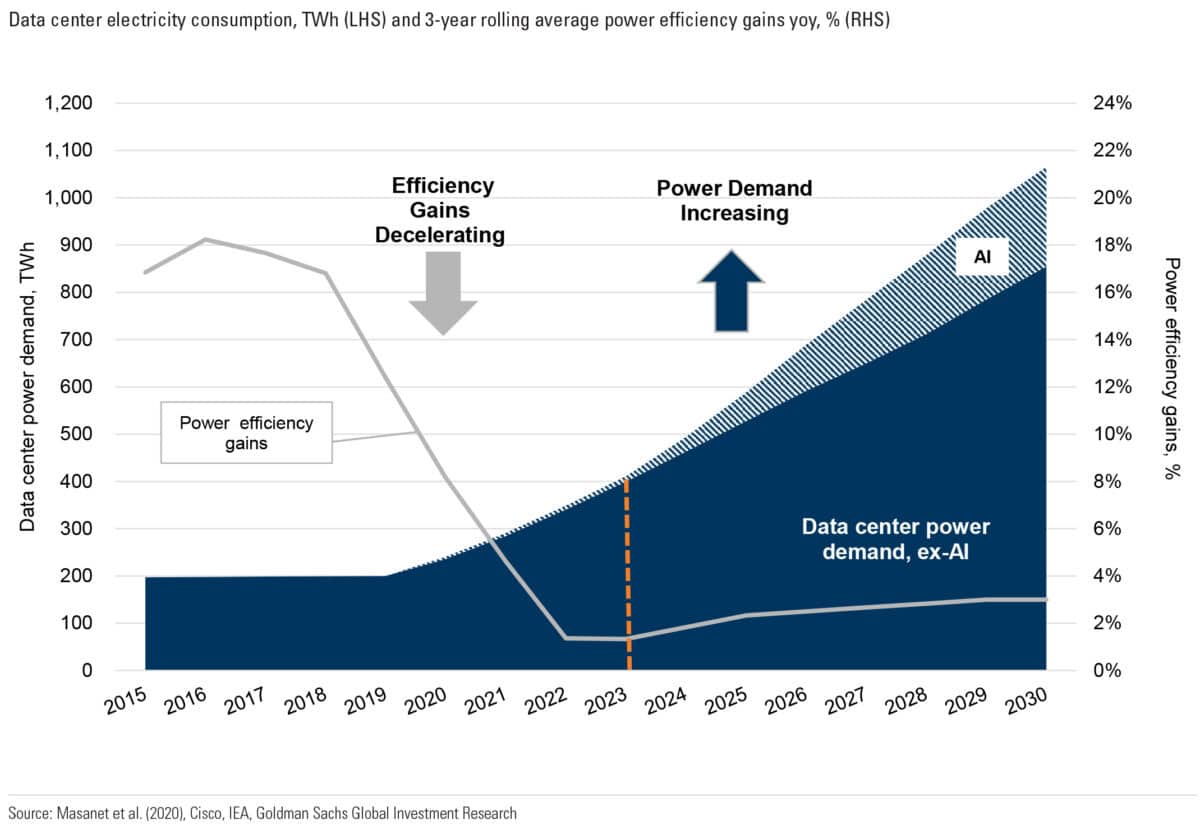

Analysts at Goldman Sachs estimate that power demand from data centres will more than triple by 2030, relative to 2020. I believe even that figure could be a conservative estimate, given the arms race that hyperscalers (which include Alphabet, Meta, and Microsoft) are engaged in as they develop generative AI capabilities.

The following chart highlights this expected surge in electricity demand. It also highlights how power efficiency gains could potentially be lost in the coming years, as a result of the exponential growth in next generation AI servers’ computational speeds.

Source: Goldman Sachs 2024

Copper supply

If demand for copper is on the rise, what about supply dynamics? This is where it gets really interesting. Investments in bringing new supply online is at record low levels.

Commodity producers have become increasingly risk averse. The low hanging fruit of high-grade ores have long been mined, which means mining operations are becoming increasingly complex.

Today, miners have to contend with a whole host of issues. These include ESG mandates, permitting challenges, land acquisition, shortages of water, soaring costs, labour strikes, and geopolitical risks.

Consider permitting, as just one example. It takes, on average, 15 years from prospecting for metals through to developing a fully operational mine. Clearly, bringing new copper online at short notice isn’t going to happen.

Chinese demand

The fly in the ointment that is weighing down on Glencore’s share price is a sluggish Chinese economy. As the manufacturing plant of the global economy, when China isn’t buoyant, then demand for commodities will inevitably flounder.

But at the same time, I think most investors place too much of an emphasis on China in driving demand. Since Covid, the US has been steadily increasing its manufacturing operations. I only see this trend accelerating under President-elect Trump. We have likely seen peak globalisation, which can only be healthy for Glencore.

Ultimately, there are many ways investors can get into the AI revolution. My personal preference is in cheap commodities businesses, and that is why I recently bought more of its shares for my Stocks and Shares portfolio.