Christmas is a tough time for the wallet. So I think anyone looking for the best cheap shares to buy this month should check out this FTSE 250 bargain share. I believe it’s worth serious consideration.

A top trust

Investing in mining stocks carries a whole range of risks for investors and my pick isn’t immune to them. Problems at the exploration, mine development and production stages can be common, and they can leave sales projections in tatters.

Many mining companies also operate in volatile regions where political upheaval and civil unrest are rife, affecting their operations. Additionally, fluctuating commodity prices can severely impact profitability, a problem that metal producers tend to have very little control over.

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

However, the potential rewards can also be significant. And they could remain lucrative in the coming decades thanks to phenomena like global urbanisation, rapid digitalisation, increasing defence spending, and the growing green economy.

It’s why I myself own shares in Rio Tinto despite those aforementioned dangers. For risk-averse investors, a better option to consider could be to consider a trust like the BlackRock World Mining Trust (LSE:BRWM).

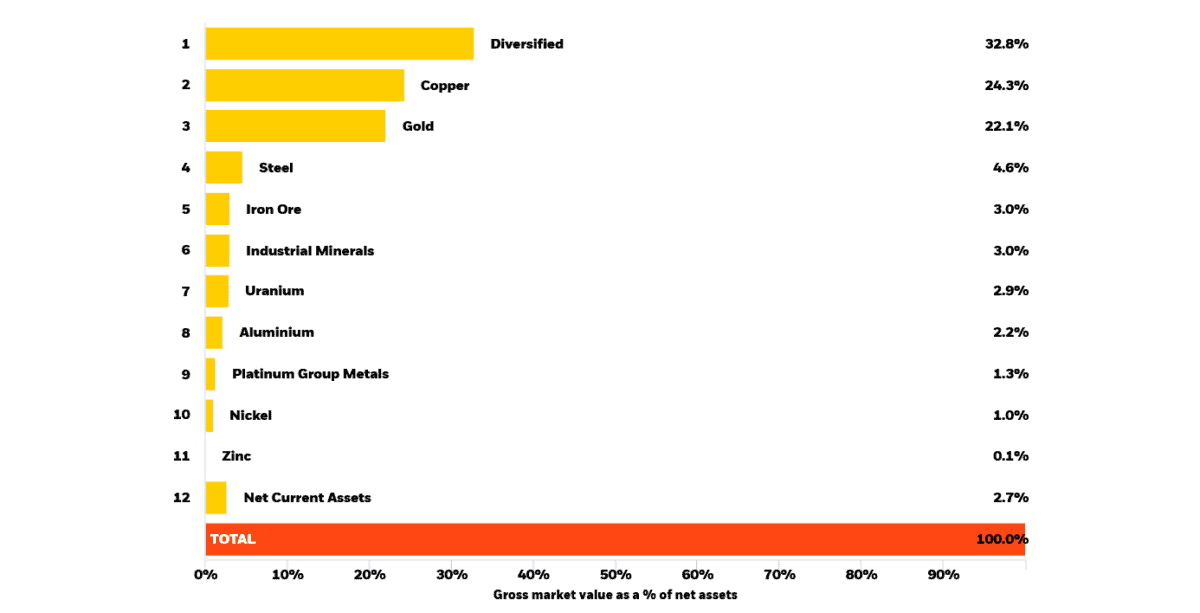

The trust doesn’t completely eliminate these problems. But its investment across more than 60 different companies helps to spread this risk. In total, the trust has more than £1.2bn invested in large- and mid-cap stocks from across the globe.

Some of its largest holdings include diversified miners BHP Group, Rio Tinto, Glencore and Anglo American.

Strength in depth

As well as spreading risk, this broad approach provides the trust with a wealth of opportunities.

For instance, the fund’s high weighting of copper stocks (and diversfied miners with copper interests) gives it good exposure to growth sectors like electric cars (EVs), consumer electronics, construction and artificial intelligence (AI).

At the same time, its uranium holdings give it a chance to capitalise on rising demand for nuclear energy. And by owning shares in iron ore producers, it can profit from themes like rising infrastructure upgrades in the West and increasing renewable energy capacity.

Strong returns

Just like the individual shares it holds, the BlackRock World Mining Trust can deliver poor returns during economic downturns. This reflects weaker commodities demand at times like these and a subsequent fall in prices.

Having said that, the trust’s large exposure to gold stocks can limit overall weakness in the portfolio, as gold often performs well during economic slowdowns.

Besides, during the last 20 years it’s delivered a healthy 6.8% average annual return. Past performance isn’t always a reliable guide to the future. But I’m confident the trust will remain a lucrative long-term investment for the growth phenomena described above.

A brilliant bargain

And I think now could be a great time to consider opening a position. This is because of the exceptional all-round value it currently provides.

At 491p per share, this FTSE 250 trust trades at a 9.4% discount to its estimated net asset value (NAV) per share.

In addition to this, its trailing 12-month dividend yield is a whopping 6.8%. That’s almost double the FTSE 100 corresponding average of 3.5%.