The latest FTSE 100 share I’ve bought for my portfolio is JD Sports Fashion (LSE: JD.). It’s slumped 37% year to date and is now 55% lower than it was in November 2021.

Here are three reasons I snapped up some shares.

Still growing worldwide

JD Sports has struggled due to weak consumer demand across the retail sector. In Q3, the company’s organic sales growth was 5.4%, but like-for-like sales were basically flat.

Should you invest £1,000 in JD Sports right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if JD Sports made the list?

Consequently, management now expects full-year pre-tax profits to be at the lower end of its previous guidance (£955m-£1.03bn). That’s not great, but equally not disastrous, in my opinion.

That said, we don’t know when the recovery will kick in. A return of inflation is a risk, while the current holiday season is key for the group. If Christmas trading is poor, the stock could suffer another setback.

Taking a longer term view, however, I think there’s a lot to like. The firm has leveraged its strong brand to form close relationships with both adidas and Nike. Collaborations with these major brands for exclusive releases strengthens JD’s market position and loyalty among consumers seeking the latest trends.

Meanwhile, it opened 79 new JD stores in Q3, taking the total number of openings so far in FY25 to 181. So the company’s expansion continues, while many smaller competitors are unlikely to survive this tough period.

After the recent acquisition of Hibbett in the US, JD’s total worldwide store count now stands at 4,541.

Attractive valuation

The second reason I’ve added the stock to my portfolio is that it looks undervalued to me.

Going on forecasts for FY26 (which starts in February), the forward price-to-earnings (P/E) ratio is just 7.2.

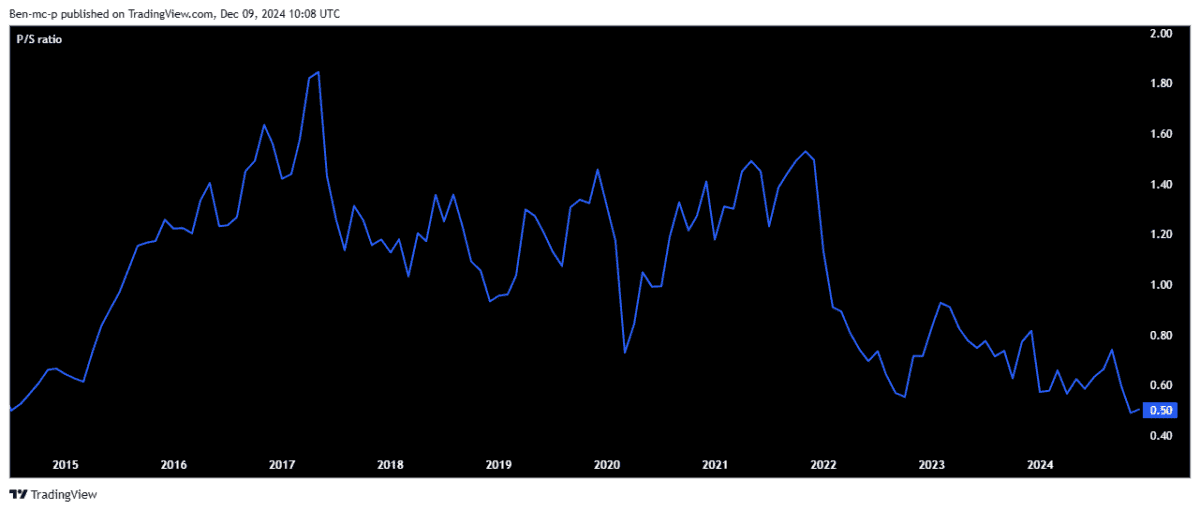

The price-to-sales (P/S) multiple is 0.5, which means investors are currently paying 50p for every £1 of JD’s sales. It’s the lowest the P/S ratio has been in over a decade!

At this sort of rock-bottom valuation, I have to imagine most of the bad news is already factored in for the sports fashion retailer. The share price could get a nice rebound if and when things start to pick up.

Most City brokers seem to agree. For example, analysts at Shore Capital recently wrote: “The shares look cheap to us…we see this current weakness as a great entry price with significant mid-term upside if the company can deliver on its ex-UK growth potential.”

Much higher average price target

Finally, the average share price target from brokers is encouraging here. It stands at 157p, which is 50% higher than the current level of 104p.

Indeed, one of the 15 analysts covering the stock has a maximum estimate of 250p — some 137% higher!

Of course, this doesn’t mean it’ll ever reach these prices. But it does highlight how wide the disparity is.

Foolish holding period

Looking past the current weakness, I reckon JD is operating in an attractively large growth market.

According to Hargreaves Lansdown, the global sportswear market is set to grow to $544bn by 2028, up from $396bn in 2023. It should grow even higher beyond 2028 as the shift towards more casual and active lifestyles continues.

As always, I’ve bought the stock with the intention of holding it for a minimum of five years.