The past six months haven’t been kind to retailer Pets at Home (LSE:PETS). The FTSE 250 share has tumbled on Wednesday (27 November) as disappointing sales to September prompted it to warn on profits.

At 242.3p per share, Pets at Home’s share price was last around 13% lower in midweek trade. This takes it to its cheapest since the Covid summer of 2020.

A tough economic backcloth could continue to challenge the petcare specialist. However, could its fresh price dive represent an attractive dip-buying opportunity for long-term investors? Here’s my verdict.

Market cools

Pets at Home is a leader in the UK petcare market. It’s a one-stop shop for everything your furry friend might need, selling food, toys, and even providing medical care through its network of veterinary surgeries.

Revenues boomed following the pandemic when pet adoption rates soared. But in spite of its strong market position, it’s fallen victim to weak consumer spending more recently.

Today it claimed that “we are operating in an unusually subdued pet retail market,” and says it expects pressures to continue into the second half of its financial year.

Guidance cut

Like-for-like sales at its retail operations failed to grow during the six months to September. And so Pets at Home subsequently cut its profits guidance for the 12 months to March 2025. It now expects only “modest” growth from last year’s underlying profit of £132m.

It had previously forecast profits of £144m.

But poor sales aren’t the only problem for Pets at Home. It also says it expects measures announced in the Budget to bite its bottom line in financial 2026.

Changes to the National Living Wage and employers’ National Insurance Contributions are expected to increase costs by £18m.

Structural progress

It’s prudent for the retailer to warn of tough conditions persisting through to March. Inflation is looking stickier than first expected, while the broader economy remains pretty weak.

Yet the longer-term outlook remains compelling, in my opinion.

Pets at Home certainly remains upbeat. It says that “we are confident this will be temporary, and growth will return to historical norms with the longer-term attractive outlook for the UK pet care market unchanged.”

There’s good reason for the retailer to remain bullish beyond the immediate future. Themes like pet humanisation, market premiumisation, and product innovation could drive market growth in the coming years.

Pets at Home is making strategic progress to exploit this opportunity as well. Investment in digital continues to yield impressive results, with app-based sales almost doubling in the first half. It also continues to grow its veterinary care division, adding two new joint venture (JV) practices and seven JV extensions between April and September.

Like-for-like sales at vetcare ballooned 18.7% in the first half.

To buy or not to buy

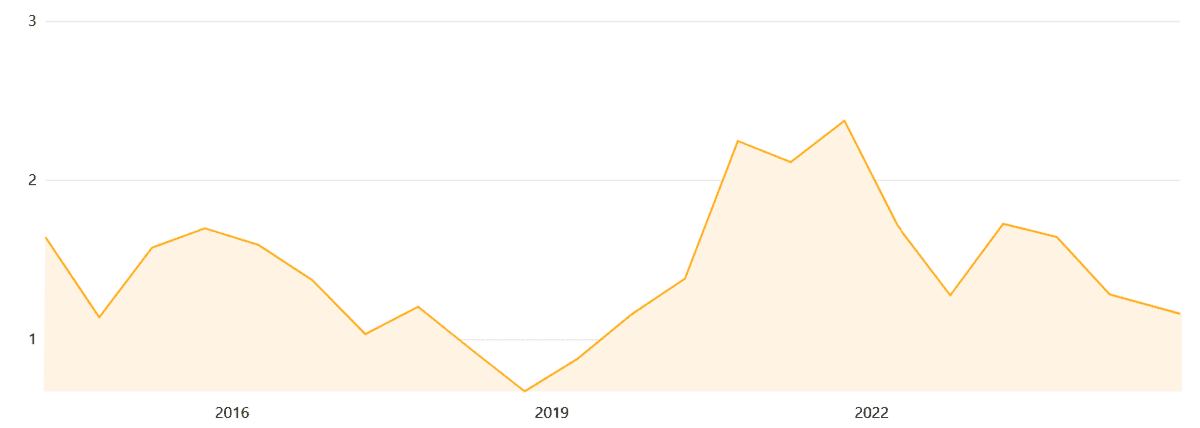

Today’s slump means the Pets at Home share price now looks cheap from an historical perspective. Its forward price-to-earnings (P/E) ratio is 10.9 times, well below the five-year average of 18.6 times.

Furthermore, the company’s price-to-book (P/B) ratio has fallen to 1.2 times.

At above 1, Pets at Home continues to trade at a premium to its book value. But the premium is the thinnest it’s been since late 2019.

Despite its current problems, I believe Pets at Home is an attractive dip buy for investors to consider.