I think it’s important as a stock market investor to be willing to change one’s mind. As John Maynard Keynes is credited with saying: “When the facts change, I change my mind.”

Here are two shares I’ve changed my opinion on this year.

More bearish

The first stock is one I’d previously owned for a few years and that’s ASML (NASDAQ: ASML).

Should you invest £1,000 in Legal & General right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General made the list?

As the sole supplier of extreme ultraviolet (EUV) lithography machines, the Dutch firm plays a unique role in the global semiconductor industry. Its systems enable chipmakers to etch intricate designs onto silicon wafers, driving innovation in artificial intelligence (AI), smartphones, and other technologies.

As such, ASML is arguably the most important company in the world (or at least one of them). And its incredible 27% net profit margin befits such status. It’s a wonderful business.

So why on earth have I sold the stock? It’s down to reducing political risk exposure in my portfolio.

You see, ASML is caught in the centre of the geopolitical tussle between the US and China. Basically, more restrictions are being placed on the company’s ability to export its older products and services to China.

In Q3, the company’s net bookings came in at €2.6bn, well below the forecast €5.6bn analysts were expecting. This was mainly due to delays in the production of fabrication facilities by Intel and Samsung. So nothing overly alarming.

However, management now expects China sales to fall sharply in 2025, due to US-led export restrictions. With Donald Trump back in the White House, I only see this pressure increasing.

China is expected to account for around 20% of revenue in 2025, down from 26% in 2023. Could ASML eventually lose most of its China business? We can’t say for sure, but I’d say it’s a big risk.

Currently, the stock trades on a premium price-to-earnings (P/E) ratio of 34. So these risks don’t appear priced into the valuation.

My portfolio already has quite a bit of China exposure, with stocks like HSBC, AstraZeneca, Rolls-Royce, and Taiwan Semiconductor Manufacturing. I sold ASML to bring this down a bit.

More bullish

Changing one’s mind can go both ways, and one company I’ve become much more bullish on recently is Duolingo (NASDAQ: DUOL).

This is the world’s leading language learning platform, with over 113m monthly active users at the end of September.

Initially, I was a bit sceptical about online education stocks, as we’ve seen the likes of Coursera (down 62% this year) and Chegg (down 83%) struggle badly after first growing strongly.

However, Duolingo continues to advance rapidly. In Q3, revenue jumped 40% year on year to $192.6m, with subscription bookings surging 45%. Free cash flow rose 57% to $52.6m.

One risk here is an unexpected slowdown in growth or the sudden rise of a competing app. These risks are magnified by a very high valuation.

As a paying subscriber though, I think the firm is onto something big. It’s introduced powerful generative AI-powered features that transform the learning experience on the app.

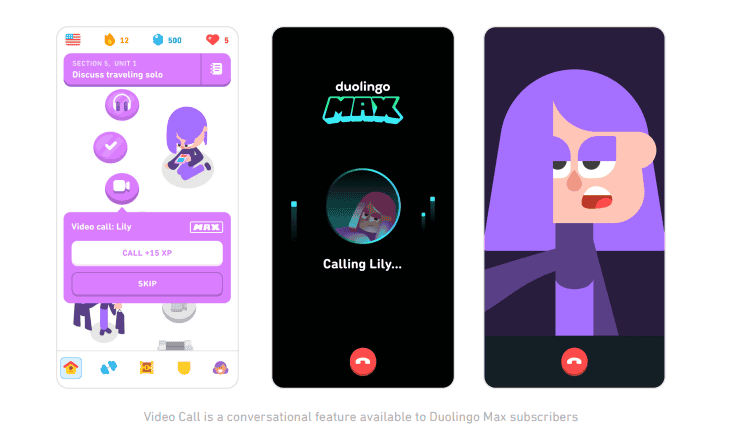

Paying subscribers can ring AI-powered characters, for example, to have real-time conversations. This is a big step towards eventually replacing human tutors. The market opportunity is enormous.

I’ll buy the stock as soon as it experiences a significant dip.