The MicroStrategy (NASDAQ: MSTR) share price is up a further 143% since I last wrote about it in early April. As far as I can tell, it’s now the best-performing US growth stock this year.

But that doesn’t necessarily mean it’s a highly successful company.

Far from its early days as a small software firm, it has recently reimagined itself as an AI-integrated cloud analytics company. However, its growth seems to have materialised more as a result of its focus on digital currency.

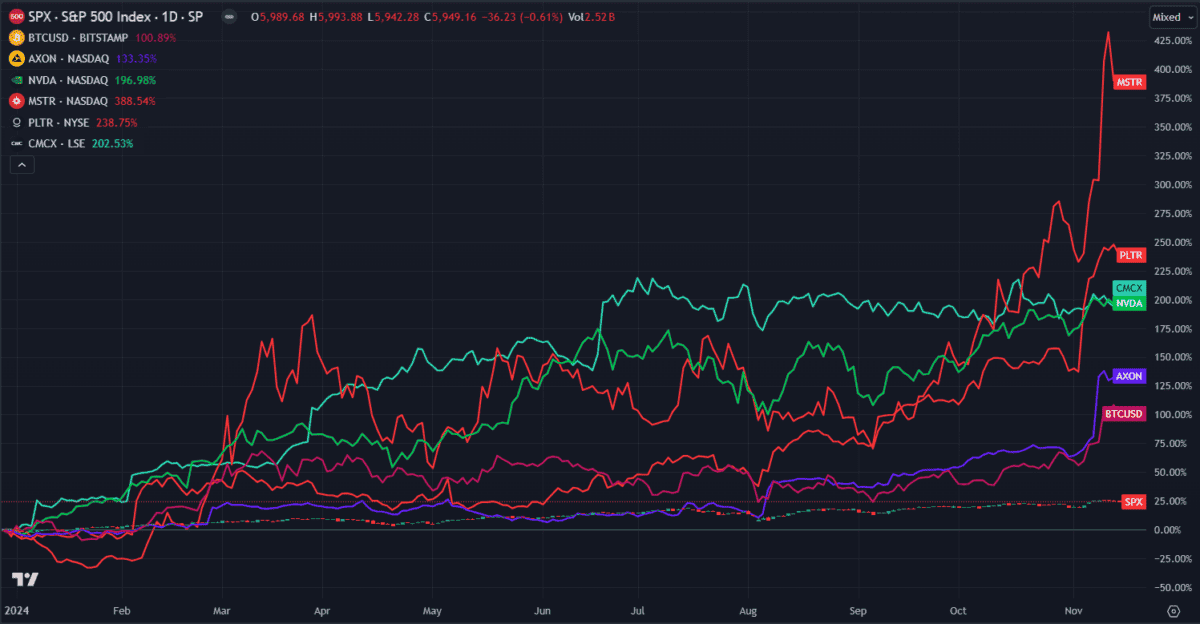

Since 2020, founder Michael Saylor has been accumulating massive reserves of the cryptocurrency Bitcoin, exhibiting strong faith in its innovative powers. With Bitcoin surging again this year, MicroStrategy’s share price has followed suit, albeit to a much greater extent. It’s up 461% this year, while Bitcoin has managed only a meagre 116%. Be mindful, past performance is not an indicator of future results.

In fact, MicroStrategy has outshone all other major stocks this year, including big winners like Palantir, Nvidia, and Axon. On a side note, the top-performing FTSE 350 stock this year, CMC Markets, is actually ahead of Nvidia!

But after climbing so rapidly in such a short space of time, is MicroStrategy stock destined to come crashing back down again just like Bitcoin often does?

The answer lies in MicroStrategy’s macro strategy.

Growth, but at what cost

On paper (or at least, on its website), MicroStrategy is a provider of business intelligence and analytics software. It also has some AI integration and cloud services thrown in for good measure.

It’s not a small or upcoming firm by any means, with customer stories from the likes of Pfizer, Visa, eBay, Sainsbury’s and even TSA (yes, the airport guys who take away your cologne).

But it’s difficult to gauge just how much success the firm would have achieved without Bitcoin. A quick web search seems to suggest the stock is treated as a way to invest in the digital currency without actually getting one’s hands dirty, so to speak.

But with Bitcoin ETFs now easily available via a multitude of brokers, how long can that selling point last?

If (when) the crypto bubble inevitably bursts, I can’t help but worry that MicroStrategy stock will go down with it. In fact, this already happened once in 2022 — and that wasn’t the first time. The company is no stranger to booms and busts. It found its original fortune during the dot com bubble of 2000, right before losing 99.9% of its value.

Will this time be different?

With net income down 137% in the last earnings call, it doesn’t look promising. The $66.5bn company is currently unprofitable, with a price-to-sales (P/S) ratio of 142. It has more debt than equity but holds around $9bn in assets.

However, its latest earnings figures came out before the recent boom. If the company can use this opportunity to redirect some profits back into the core business, it could position itself to maintain long-term growth.

If it doesn’t do that though, I fear history will simply repeat itself. I like to think it has a more concrete plan this time around – but only time will tell.