I’m drawing up a list of the best FTSE 250 income shares to buy in the coming days and weeks. Here are two I’ll consider adding to my portfolio when I next have spare cash to invest.

8.5% dividend yield

Despite falling interest rates, the outlook for the UK and world economies remain highly uncertain. So I think investing in some classic defensive shares could be a good idea to target a solid and growing passive income.

Supermarket Income REIT (LSE:SUPR) is one such stock I’m considering today. You’ll notice straight away that it’s designed to generate a steady income from the stable food retail sector.

The company lets out supermarkets to industry heavyweights like Tesco, Sainsbury, and Aldi. And more recently, it expanded into France by acquiring a portfolio of Carrefour properties, providing extra strength through diversification.

As a real estate investment trust (REIT), Supermarket Income has to pay 90% of annual rental profits out in the form of dividends. This is in exchange for certain tax perks, and can make the business an excellent buy for income investors.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

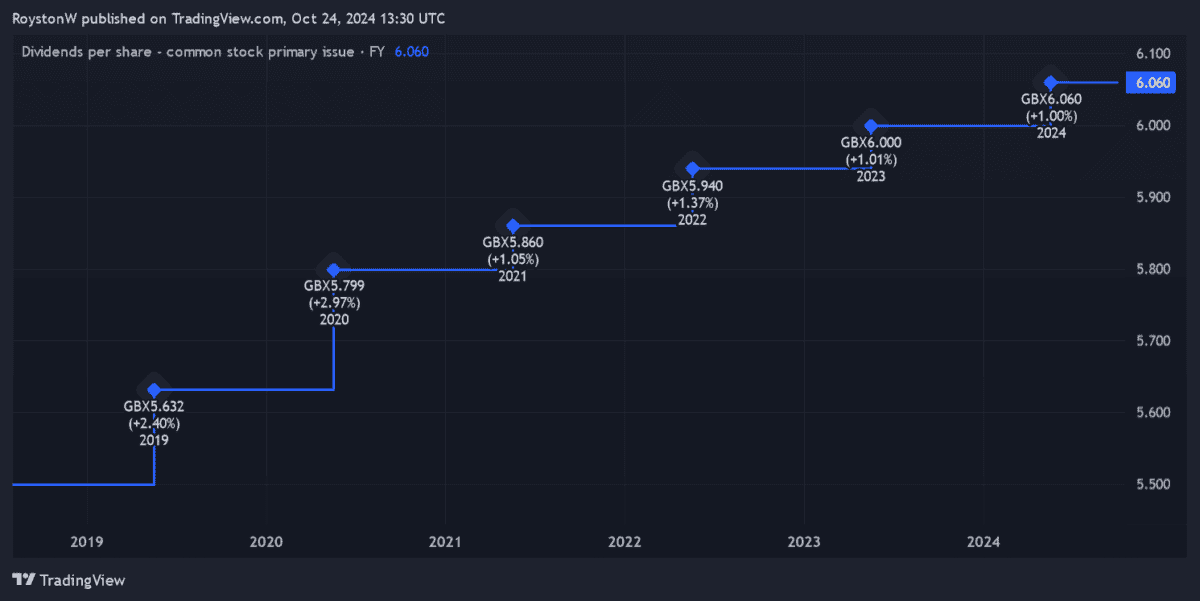

Indeed, it’s raised the annual dividend each year since its IPO in the late 2010s, as the chart shows.

And City analysts are expecting further growth this financial year, to 6.12p per share. This leaves the business with a huge 8.5% dividend yield.

On the downside, Supermarket Income’s share price has dropped sharply from 2022 levels. This reflects poor investor sentiment towards the commercial property sector.

But by looking to buy and hold the trust for the long term, I can smooth out the risk of further weakness. I might also potentially set myself up for a sector upturn.

In the meantime, I can look forward to some juicy dividends flowing in.

10.8% dividend yield

SDCL Energy Efficiency Income Trust (LSE:SEIT) is one of just three FTSE 250 shares with double-digit dividend yields. This merits serious attention, naturally.

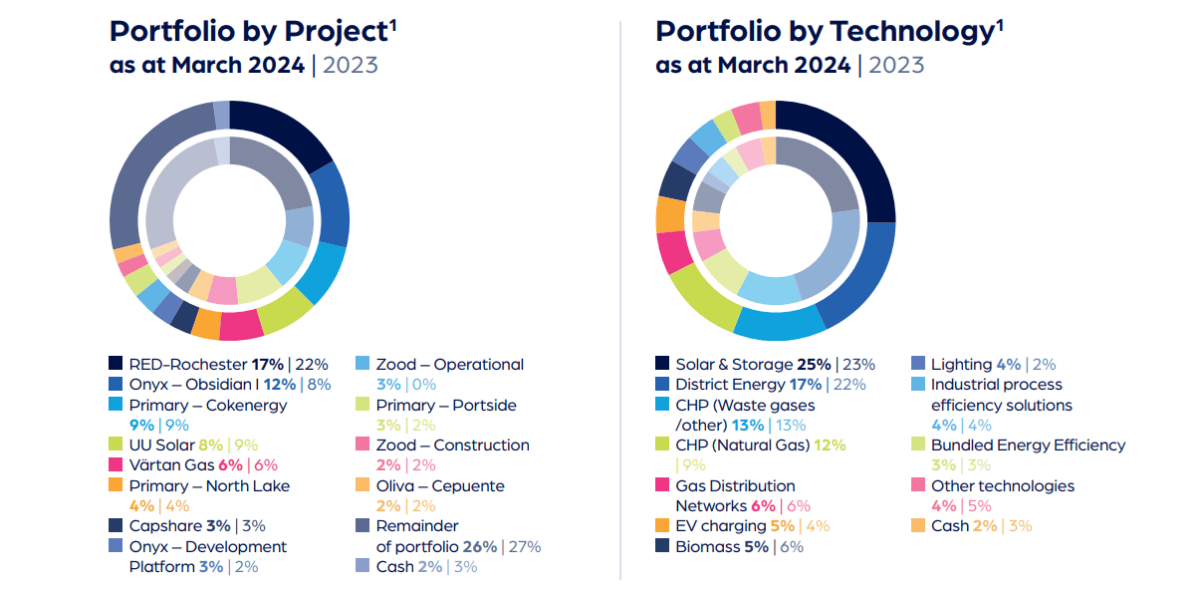

This business, as its name implies, focuses on property that enhances power efficiency. In its own words, it invests in projects that “either provide decentralised on-site generation of power and heat, or projects which reduce energy demand“.

SDCL operates in a growing market as the fight against climate change intensifies. And it is well diversified by geography and technology, which helps to reduce investment risk. Assets range from solar projects in Vietnam and energy storage in New York, to biomass boilers in the Midlands.

The business also has a solid record of dividend growth. And it hopes to raise the full-year payout to 6.32p per share from 6.24p last year, resulting in a gigantic 10.5% dividend yield.

With interest rates falling, now could be a good time to buy the trust. But remember that an inflationary spike could limit any further rate cuts, impacting asset values and the company’s earnings.

Today SDCL trades at a 33.7% discount to its estimated net asset value (NAV) per share. Combined with that huge dividend yield, I think it’s a brilliant bargain to consider today.