With its dividend yield of 5.7%, BP (LSE: BP) might look like a tempting income share at first blush – especially with its price-to-earnings ratio of just 6. But performance in recent years has been mixed. For starters, a savage dividend cut in 2020 means that even recent strong growth has failed to bring the payout per share back to where it was five years ago. On top of that, the BP share price has fallen 21% in the past year.

Given the apparently low valuation, attractive yield and lower share price, could BP now be a bargain?

Missteps have hurt investor confidence

At its heart, I think BP is a solid company. Last year, for example, turnover fell – but still came in at $210bn. After recording a loss after tax from continuing operations in the prior year, BP last year reported a post-tax profit on the same basis of $15.8bn.

Should you invest £1,000 in BP right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BP made the list?

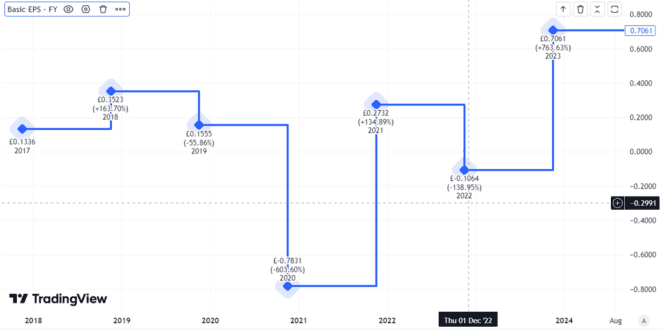

On one hand, that is a net profit margin of 7.5%. It looks fairly fragile given the ever present risk of energy prices moving around, sometimes dramatically and unexpectedly. After all, BP’s basic earnings per share have been volatile over the past few years.

Created using TradingView

On the other hand, it also underlines that BP has the potential to be a money machine. Based on last year’s performance, in the time it takes you to read this article, BP will have earned over $180,000 in post-tax profit.

So, why has the share price been falling to a point where its valuation looks so cheap?

Partly I think it reflects weakened investor confidence. The company seemed to be retreating from fossil fuels in recent years but is now more ambivalent. The dividend cut also did not help.

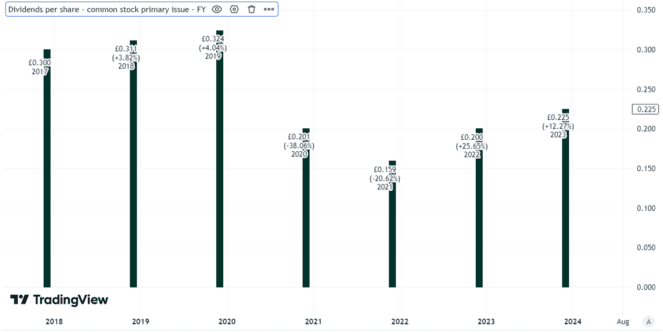

Created using TradingView

While BP cut its dividend in half in 2020, US rival Exxon kept raising its payout per share each year, as it has done for decades already.

A possible bargain?

But in the long term I think business fundamentals ought to outweigh investor sentiment.

BP is doing well. If energy prices stay close to current levels, or move higher, I expect that it can keep on producing the goods. On that basis, the current BP share price looks like a possible bargain to me.

I plan to hang on to my stake in the energy major and enjoy the passive income streams I hope it will keep on pumping out along with the oil.

Energy prices are volatile though. Perhaps the weakness seen over the past year signals a market expectation that oil companies’ profits could be set to fall. Rival Shell has also seen its share price fall in the past year, albeit by a more modest 6%.

That is always a risk of investing in energy companies, as I see it. For now at least, I feel the risk is more than reflected in the share price.