There’s no such thing as a guaranteed dividend income. As we saw during the pandemic, even the most reliable of dividend shares can reduce, postpone, or cancel shareholder payouts when crises come along.

However, there are steps we as investors can take to reduce the risk of dividend disappointments. Such tactics may be especially important today as fresh data shows British dividends falling again.

Here, I’ll show you how I can protect myself, and discuss a top dividend stock I’d buy if I had cash on hand to invest.

Q3 dividends lowest since 2020

Before I do, let’s have a look at that gloomy UK dividend data from the third quarter. According to Computershare, payouts from British companies slumped 8.1% on a headline basis to £25.6bn. Excluding special dividends, the total was down 3.5% at constant currencies.

As a consequence, the July-August period was the worst third quarter for dividends since 2020, when companies scrambled to save cash following the Covid-19 outbreak.

Computershare said: “The decline reflected steep cuts in the mining sector in particular” while “a stronger pound; unusually low, one-off special dividends; and large share buyback programmes” also hampered investor payout at headline level.

Taking precautions

Investors can’t totally protect themselves against falling dividends. Hardly anyone predicted that Shell — which hadn’t cut dividends since World War Two — would reduce payouts before the pandemic, to cite a famous example.

But we can boost our chances of receiving a strong (and hopefully growing) passive income by choosing companies that have:

- Market-leading positions in mature industries

- Diverse revenue streams, for instance through different geographies and product categories

- Competitive advantages (such as powerful brands and low cost bases)

- Robust balance sheets, with low debt and dependable cash flows

- Expertise in defensive, recession-proof industries (such as utilities and healthcare)

The good news is that UK investors can find many shares that meet all or most of these criteria. Defence contractor BAE Systems (LSE:BA.) is one I’d buy for my own portfolio.

A top FTSE stock

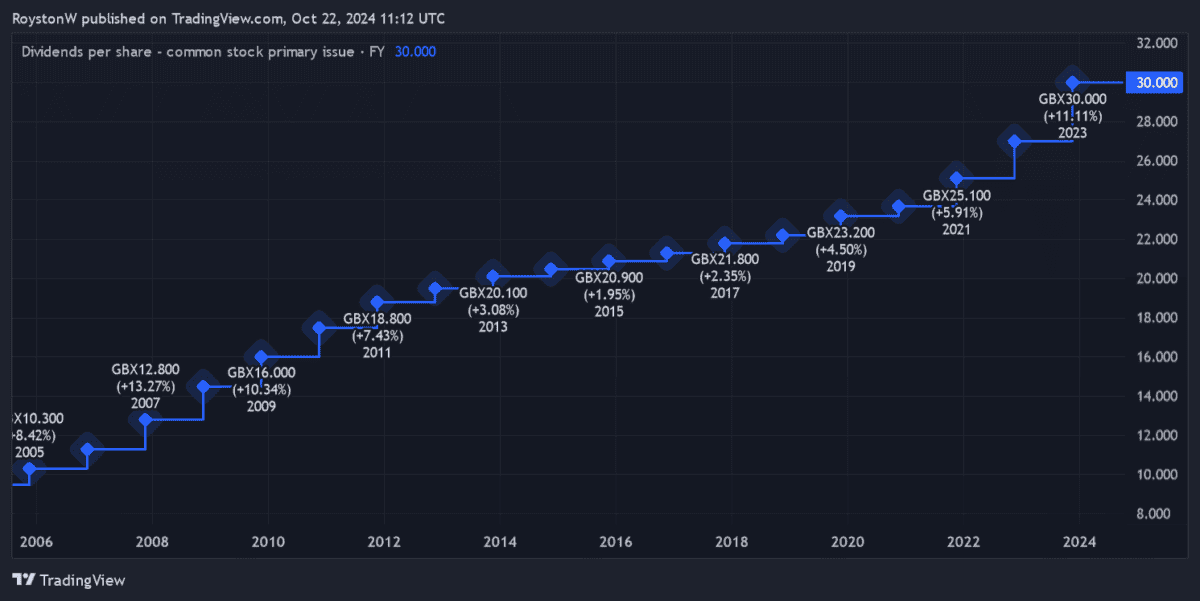

As you can see, the FTSE 100 company has a long history of dividend growth dating back decades. This is thanks to a variety of factors. Firstly, Western defence spending remains stable regardless of economic conditions. And as a critical supplier to the US and UK militaries, BAE Systems enjoys especially robust earnings visibility.

The business also manufactures a variety of technologies for land, air and sea. So long-term revenues continue to grow even as the nature of warfare evolves over time.

Finally, major defence contractors like this enjoy formidable barriers to entry, thanks to issues like security and expertise. This, in turn, reduces the competitive dangers they face.

BAE Systems isn’t without risk. Supply chain disruption, for instance, is affecting the entire aerospace industry.

Yet City analysts don’t think this will derail the firm’s progressive payout policy, as shown in the table below:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 32.3p | 8% | 2.4% |

| 2025 | 35.4p | 10% | 2.6% |

| 2026 | 38.8p | 10% | 2.9% |

As global defence spending spikes, BAE Systems may be one of the best dividend growth shares to consider today.