Since its inception in 1984, the FTSE 100 has delivered average annual return of around 7%. The S&P 500 meanwhile, has provided an 11% average return since it began in the late 1950s.

Those figures aren’t too shabby, I’m sure you’d agree. In fact, someone who invested just £1,000 when the S&P 500 started should be a millionaire.

Could there be a better way to build wealth today however? I have exposure to the Footsie and the S&P 500 through individual shares and funds. But I’m looking for ways to make an even better return.

If I had cash to invest, here are two exchange-traded funds (ETFs) I’d add to my portfolio.

Talking tech

Soaring tech profits have propelled the S&P 500 higher in more recent decades. US companies have effectively exploited (and indeed, pioneered) a range of phenomena-like advances such as e-commerce, smartphones, cloud computing, social media and the Internet of Things (IoT).

With the digital revolution continuing, some of these segments have further room for growth. There are also other new exciting tech frontiers opening up like artificial intelligence (AI), 6G and space travel.

The trouble is that less than a third (31%) of the S&P is made up of tech stocks. For the FTSE 100, the proportion is much weaker. It’s less than 1%, in fact.

Investors can get around this however, by purchasing a pure technology-focused ETF. The iShares S&P 500 Information Technology Sector ETF (LSE:IUIT) is one such financial instrument.

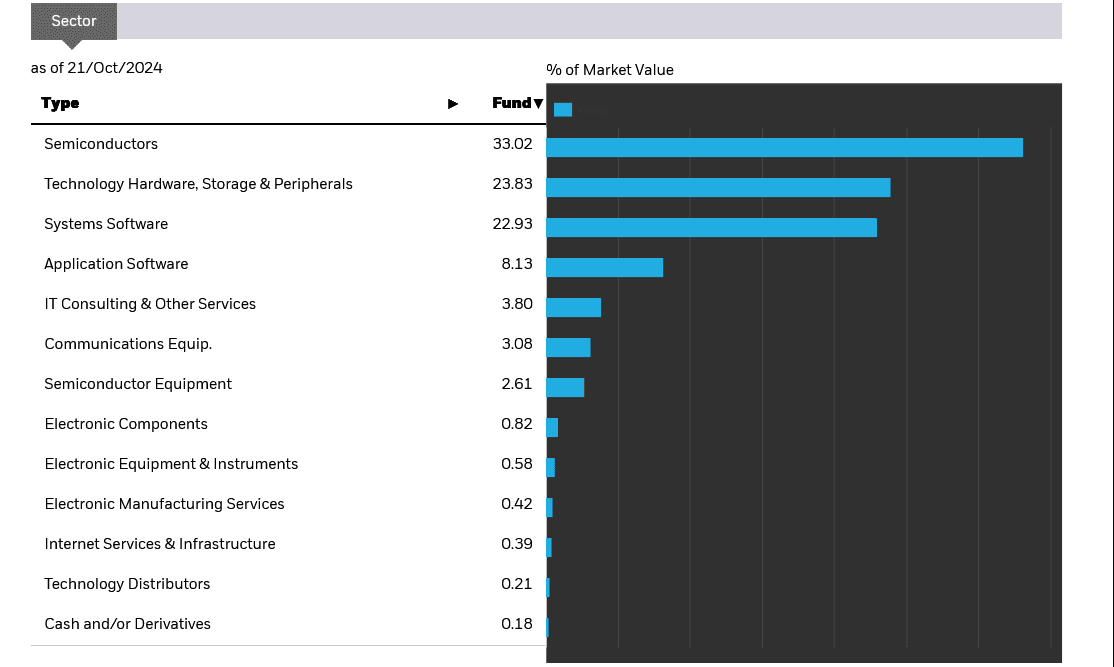

Since it started in 2015, the fund has delivered a whopping average annual return of around 23%. It provides exposure to big tech hitters like Nvidia, Microsoft and Apple, and across multiple sub-sectors like semiconductors, consultancy and comms equipment.

Okay, here’s the thing. I already own this tech-geared ETF, along with one that tracks the broader S&P 500. When I next have spare money, I’ll invest more in the first one to target a better return.

Having said that, I am aware that its focus on the cyclical tech sector could result in more disappointing returns during economic downturns.

Looking east

Targeting superior profits may also involve more than just choosing certain types of UK or US shares. It might see me diverting some of my attention to other faster-growing economies.

The Franklin FTSE India UCITS ETF (LSE:FLXI) could deliver mighty returns as Asia’s third-largest economy grows. It’s already enjoyed an average yearly return above 13% since it began five years ago.

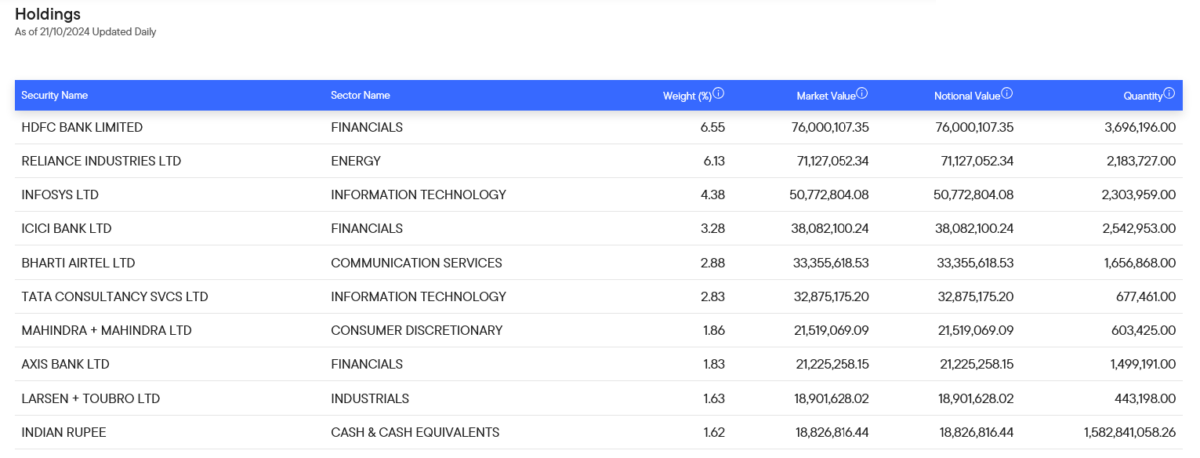

The fund invests in 244 mid- and large-sized Indian companies across multiple sectors, which in turn provides solid diversification.

India’s economy is booming for several reasons. It has a young and growing population, rising middle class, improving technological landscape, and is benefitting from rising foreign investment and economic reforms.

Encouragingly for investors in this ETF, economists are expecting GDP there to continue rocketing. The IMF’s tipping growth of 5.5% in 2025, which could have positive implications for the country’s stock market.

For the US and UK, growth’s predicted at a far more modest 1.7% and 1.1% respectively.

While India offers huge opportunities, it also faces big challenges that could hamper growth. High unemployment and climate risks are a couple of such dangers.

Still, on balance, I think this ETF could prove a top buy for me.