Since the start of the year, the Barclays (LSE:BARC) share price has jumped from £1.55 to £2.42, making the stock one of the FTSE 100’s best performers of 2024. But what’s next?

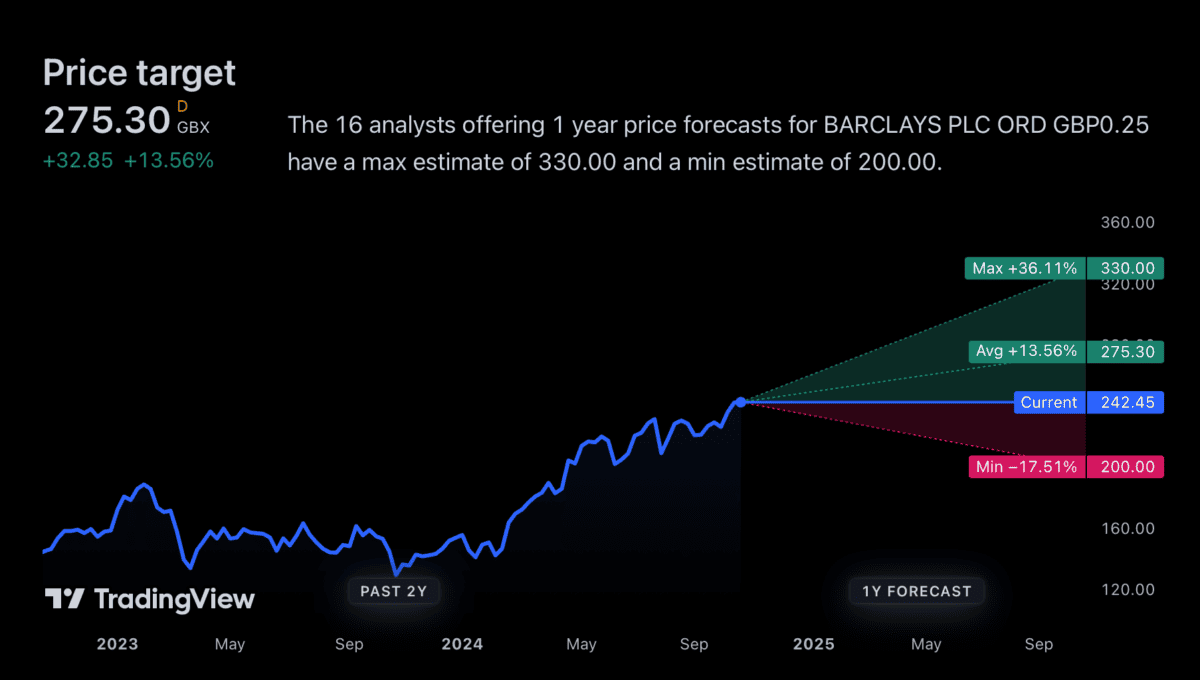

The average analyst price target’s around 13.5% higher than the current share price. And there are some clear signs things could be set to improve for the bank.

Analyst expectations

The average price target for Barclays shares is £2.75, implying optimism in the stock. But there’s quite a wide range of forecasts and not all are so positive.

The highest estimate I can find is £3.30, which is 36% above the current share price. But the lowest is £2, which implies a decline of around 17%.

Source: TradingView

This is a good illustration of why I wouldn’t be willing to buy Barclays shares simply based on what analysts say. There’s fairly substantial disagreement and it’s hard to know who to believe.

Predicting the next 12 months is clearly a challenge. But investors may be able to get some ideas from looking at what’s been going on elsewhere in the banking sector.

A diversified bank

Barclays operates a significant investment banking division as well as its retail lending arm. In this way, it’s more like Bank of America (BoA) and Citigroup than Lloyds or NatWest.

Both BoA and Citigroup reported earnings this month and there were similar themes. Interest rates starting to fall resulting in lower lending margins, but higher investment banking revenues.

The Bank of England has also been cutting interest rates. And while banks might make less money on their loans, Barclays could benefit from higher investment banking activity.

That’s a sign the company’s share price could do well over the next 12 months – especially relative to other UK banks. But there’s an important risk investors should consider as well.

Valuation

Right now, Barclays shares are trading at a level that reflects an optimistic outlook. The stock’s trading at around 62% of its book value – the difference between its assets and its liabilities.

Barclays P/B ratio 2015-24

Created at TradingView

That’s towards the higher end of where it has been trading over the last decade. And it’s a sign investors are positive on the company’s ability to earn a good return on equity going forward.

This is something investors should be cautious of in the current environment. To some extent, future investment banking growth might already be reflected in the current share price.

That means the prospect of lower lending margins is a clear risk for investors. If things don’t go as planned, the stock’s valuation multiple could contract, causing it to fall significantly.

A stock to consider buying?

Arguably, forecasting accurately what might happen with Barclays in the next 12 months is harder than it is with other UK banks. This is due to the company’s unique structure.

From a long-term perspective though, the combination of retail operations with an investment banking division is one I like. So I’d rather buy shares in Barclays than Lloyds or NatWest.

I don’t think the share price is that attractive at the moment. But the thing with bank stocks is that opportunities tend to present themselves sooner or later to patient investors like me.