Warren Buffett says investors should look for businesses they’d be happy to own if the stock market closed for the next decade. Those aren’t always easy to find though.

A lot can happen in 10 years. But there are a couple of candidates from the FTSE 100 and the FTSE 250 that I’d like to own in my portfolio, even if I couldn’t sell them any time soon.

Is the stock market going to close?

It’s highly unlikely that the stock market is going to close for the next decade. But thinking about which shares I’d be willing to own if it did is key to investing properly.

As Buffett points out, investing isn’t about buying a stock at one price and selling it at a higher one. It’s about looking for the underlying business to provide a return from the cash it earns.

Companies can keep making money and distributing it to investors even if their shares aren’t being traded. So investing doesn’t require an active stock market to be successful.

Focusing on what I’d want to own if the stock market closed is a way of making sure I’m investing rather than buying something to try and sell it on. So which shares look attractive?

An enduring brand

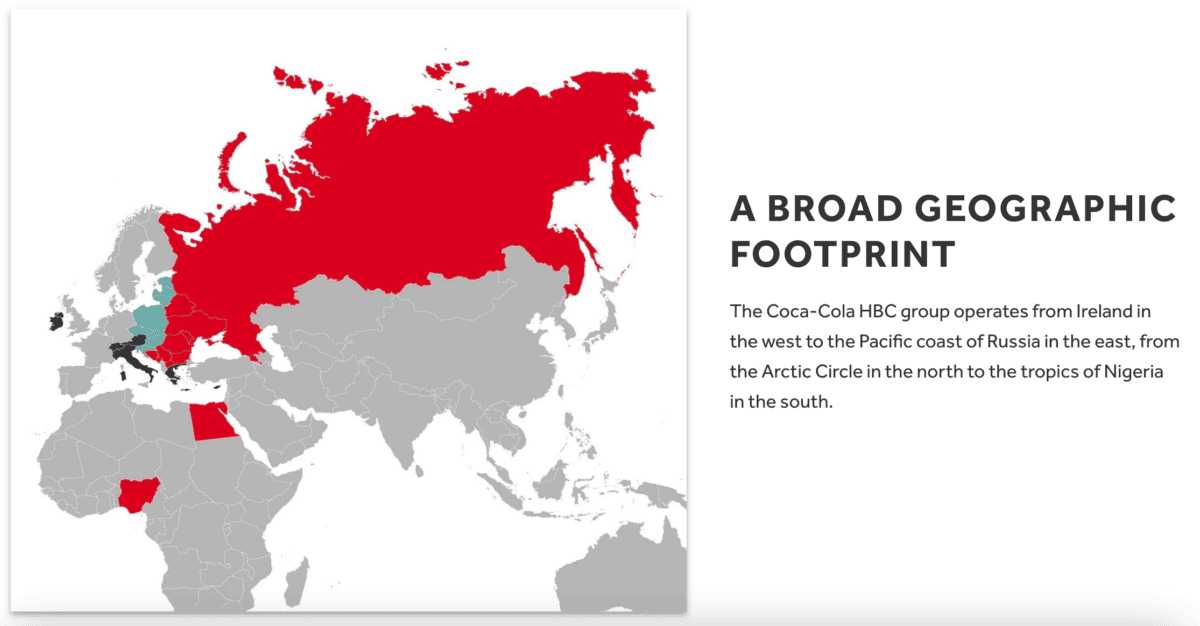

Coca-Cola HBC (LSE:CCH) bottles and distributes Coca-Cola products in countries including Greece, Nigeria, and Ireland. And it’s a stock I’d be happy to own for 10 years without selling.

Source: Company Website

The firm benefits from the durability of the Coke brand. But this comes with a key risk of the US business increasing prices to its distributors – as it did in the 1970s and 1980s.

To some extent, the potential for conflict still exists today. But things are a bit different – the Coca-Cola company is the largest shareholder in Coca-Cola HBC, with about 20% of the shares.

I think it’s understood these days that both parties rely on each other. And the US giant’s unparalleled marketing budget means if I owned shares in the bottling franchise, I’d be happy to keep them.

Durable demand

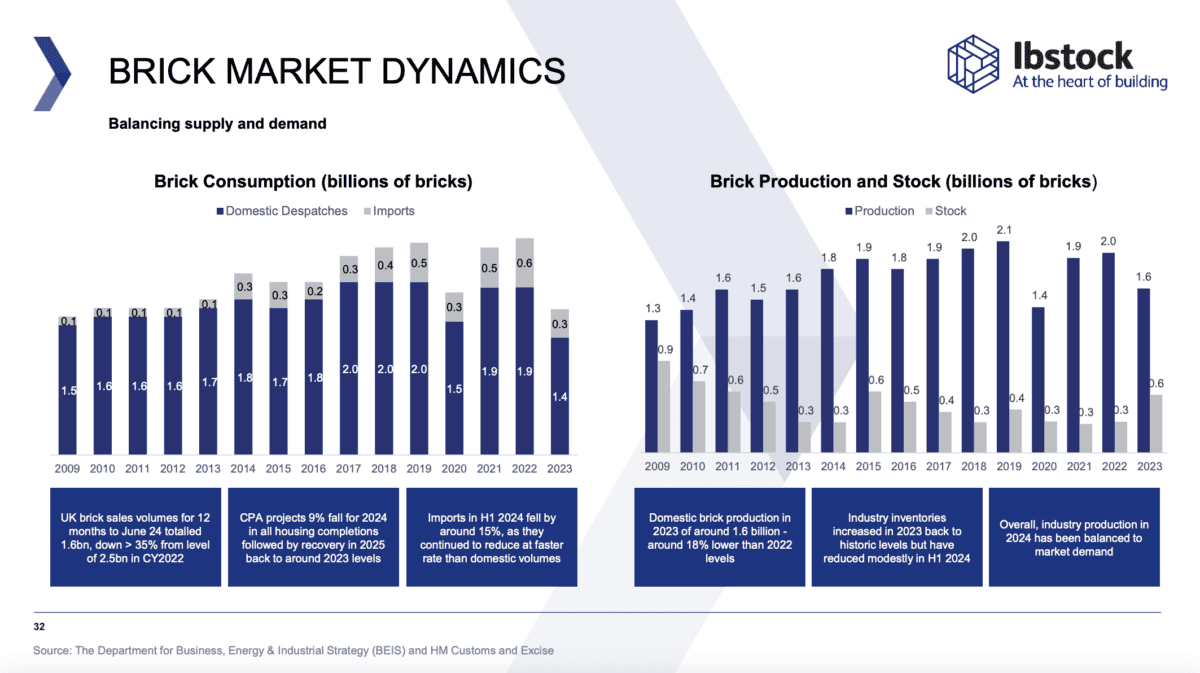

There’s a lot I don’t know about how things will be a decade from now. But I’m confident the UK will still be building houses and that demand for bricks will be strong as a result.

That’s why I’d be comfortable owning Ibstock (LSE:IBST) even if the stock market was going to close for the next 10 years. Put simply, it’s the UK’s largest brick manufacturer.

The biggest risk for the company is probably inflation. Higher energy, labour and materials prices can all have a big effect on margins for a business like Ibstock.

Source: Ibstock Interim Trading Update 2024

Nonetheless, the UK brick market’s structurally undersupplied. And while I don’t know what sales will look like in any given year, I’d expect them to be strong over the course of a decade.

Long-term investing

In my view, the most important thing when investing for the long term is whether the company will still be around. And Coca-Cola HBC and Ibstock look very durable businesses to me.

I don’t own either stock yet, but I’m looking seriously at adding one of them to my portfolio. Right now, I’m still working out which one looks most attractive at today’s prices.