Looking for ways to create life-changing wealth? Here’s three tactics I’d use to try and maximise my returns with UK shares.

Slash tax costs

The first step I’d take it to set up a tax-efficient investment vehicle. There are currently two on the market that protect individuals from both capital gains tax (CGT) and dividend tax.

The first is the Individual Savings Account (ISA). Under this category, investors can buy shares, trusts, and funds in a Lifetime ISA and/or a Stocks and Shares ISA.

The other option I have is to open a Self-Invested Personal Pension (SIPP).

Over several decades, these products can save individuals literally tens of thousands of pounds in tax. It’s one reason why the number of Stocks and Shares ISA investors has soared 27% in the past 10 years, to 3.8m today.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Diversify my holdings

With this set up, I’ll be looking to create a diversified portfolio that provides a strong and stable return year over year.

This will involve buying a mix of value, growth, and dividend stocks spanning multiple sectors and geographies. Such a strategy would help me to manage risk as well as capture a variety of growth opportunities.

I don’t necessarily have to buy a large number of shares to achieve diversification, however. I can also choose to buy a fund or a trust that invests in a multitude of different assets.

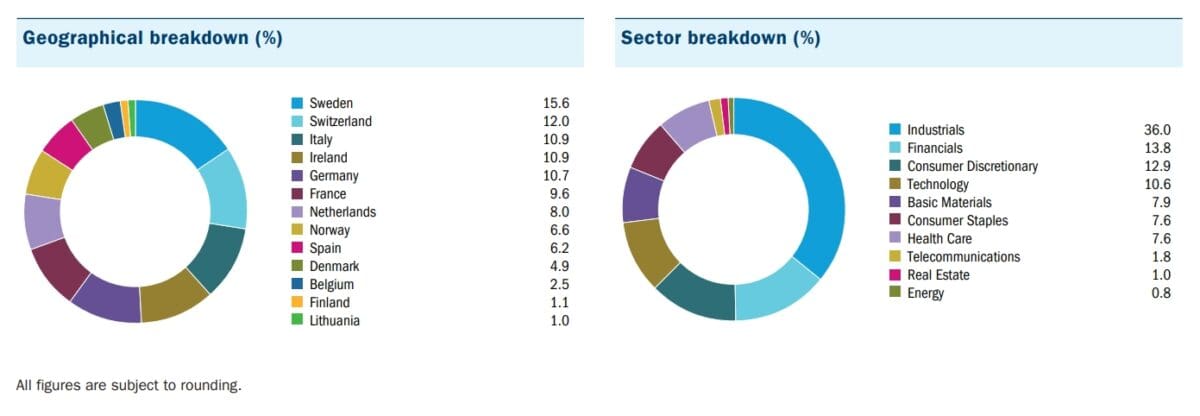

The European Assets Trust (LSE:EAT) is one such financial instrument. It’s been going since 1972, and invests in small and mid-sized companies across many different countries and industries.

On the downside, the trust’s focus on smaller companies may result in disappointing returns during economic downturns. This has been the case more recently as major European economies have stalled.

But with inflation fading, now could be a good time to open a position. As the trust comments: “Europe’s hugely dynamic smaller companies have generated some of the strongest returns among global stock markets over the past 15 years.”

I also think the trust offers excellent value at current prices. At 83.4p per share, it trades at a 13% discount to its net asset value (NAV) per share.

Investors can also grab a healthy 6.7% dividend yield at today’s prices.

Reinvest any dividends

The final step on my quest to create long-term wealth would be to reinvest any dividends I receive. This way, I can take advantage of compounding, where reinvested dividends generate additional income over time.

Essentially, this means I earn money on the interest (or dividends) I receive as well as on my initial investment. The more shares I buy, the more dividends I receive. Over time, this snowball effect can cause my portfolio to swell considerably.

Let’s say I invest £10,000 in a 5%-yielding dividend stock. In year one, I make £500 in dividends, which I use to buy more shares. This gives me a portfolio worth £10,500, which at the end of the second year will give me an improved £525 in dividends (based on that 5% yield).

After 10 years of growing my portfolio like this, I’d be receiving around £814 in annual dividends, assuming the stock price and dividend yield remain stable. And my total investments will be worth £16,289 as opposed to just £10k.