The BP (LSE:BP.) share price peaked at 562p in October 2023. In fact, this was the highest level achieved since 2010, when the Deepwater Horizon disaster killed 11 people and resulted in 4.9m barrels of oil leaking into the Gulf of Mexico.

But it hasn’t done so well lately. It’s now around 415p.

Could it reach £5 again? Let’s take a look.

Analysing the figures

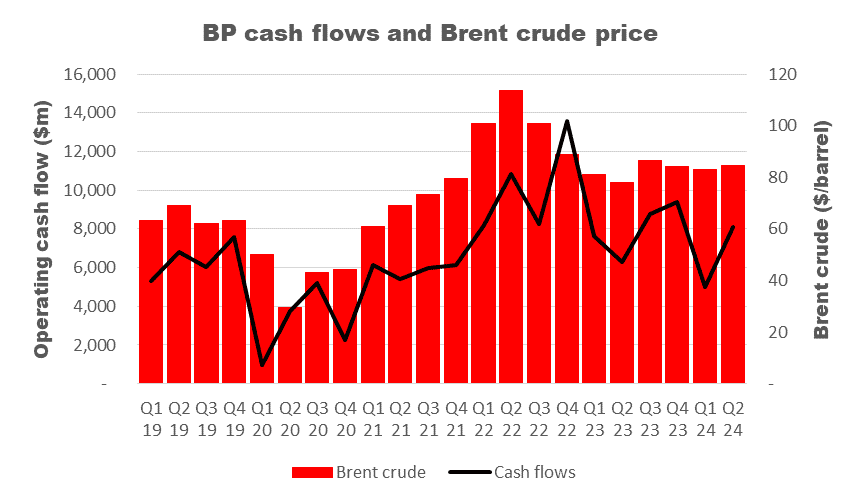

Given that the majority of BP’s income is generated from the sale of oil and oil-based products, it comes as no surprise to learn that its financial performance (and therefore its share price) is heavily influenced by the price of Brent crude.

As the chart below illustrates, there’s a strong correlation between the company’s operating cash flows and the cost of a barrel of oil. For the statistically minded, there’s been a 75% relationship between the two since the first quarter of 2019.

In 2022, when the price of the black stuff was regularly over $100 a barrel, the group generated $40.9bn of cash from its operations. No wonder its chief executive at the time, described it as “literally a cash machine”.

Although not very tactful given that many people were struggling to afford to heat their homes, it did help to highlight the potential of the business when conditions are in its favour.

Seeing into the future

So to answer the question about whether the oil giant’s share price will break the 500p-barrier again, we need to know how Brent crude will perform over the coming months and years.

And that’s impossible to predict — its price has ranged between $9 and $133 over the past five years.

If geopolitical events, the weather, currency movements, environmental legislation, and other commodity prices wasn’t enough, global economic growth will help determine demand and the decisions of OPEC+ will play a large part in affecting supply.

That’s why some academic studies have found that assuming tomorrow’s oil price will be the same as today’s is just as accurate as the results generated from many more sophisticated models.

My opinion

However, on balance, I think now could be a good time to consider investing in BP. Although I’ve no idea whether (or when) its share price will reach 500p.

But what I do know is that the drop in its share price has pushed its current yield to 5.9%. This compares favourably to the FTSE 100 average of 3.8%.

However, it’s important to note that dividends are never guaranteed. Remember, the company halved its payout in 2020 due to the pandemic and — in cash terms — it’s now 24% lower than pre-Covid.

And despite global warming, it doesn’t appear as though we’ve reached peak demand for oil. Although there are many different predictions, Goldman Sachs, for example, expects consumption to continue to rise through until 2034.

But I don’t want to take a stake in the business. I already have exposure to the sector through my shareholding in Harbour Energy. Having two potentially volatile energy stocks in my portfolio would be too risky for my liking.