We at The Motley Fool are huge fans of the Stocks and Shares ISA. It can save investors a fortune in taxes on dividends alone.

In the UK, dividend taxes are not insignificant. And they escalate considerably, according to an individual’s income tax band:

| Tax band | Tax rate on dividends |

| Basic rate | 8.75% |

| Higher rate | 33.75% |

| Additional rate | 39.35% |

A yearly dividend tax allowance of £500 is applied before taxes are taken. But this has fallen considerably in recent years and could continue to do so.

I’m also likely to see a big bite taken out of my eventual return, regardless of this allowance. Let me show you why investing in an ISA can be so important for building wealth.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Big tax savings

The following high-yield dividend shares are near the top of my shopping list for when I next have cash to invest:

- Greencoat Renewables (LSE:GRP), which has a forward dividend yield of 7.2%

- Phoenix Group, whose forward dividend yield’s 9.5%

- HSBC, which has a prospective dividend yield of 8.9%

If broker forecasts prove correct, a £20,000 lump sum investment spread across these UK shares would provide me with a £1,700 passive income.

If held within an ISA, I’d pay £0 in dividend tax to HM Revenue and Customs. However, if I were a basic rate taxpayer I’d have to pay £105.

As a higher-rate or additional-rate taxpayer, I’d be liable for a much higher £405 and £472.20 respectively.

It’s important to remember too, that these payments are due each and every year. If these companies maintain or grow their dividends, I could end up paying tens of thousands of pounds in dividend tax over a few decades.

3 top dividend shares

So if I had a spare £20k floating about, I’d max out my annual ISA allowance and add them to my portfolio that way. But why would I buy these specific stocks, you ask?

In the case of HSBC, I think it has considerable long-term investment potential due to its focus on fast-growing Asia. Economic problems in China may dent earnings growth in the immediate future. But I feel the future here’s bright as population sizes and wealth levels boom in its emerging markets.

I also like Phoenix Group as a way to capitalise on the UK’s growing elderly population. While it faces considerable competitive pressures, it has a chance to supercharge profits as pension sales rise.

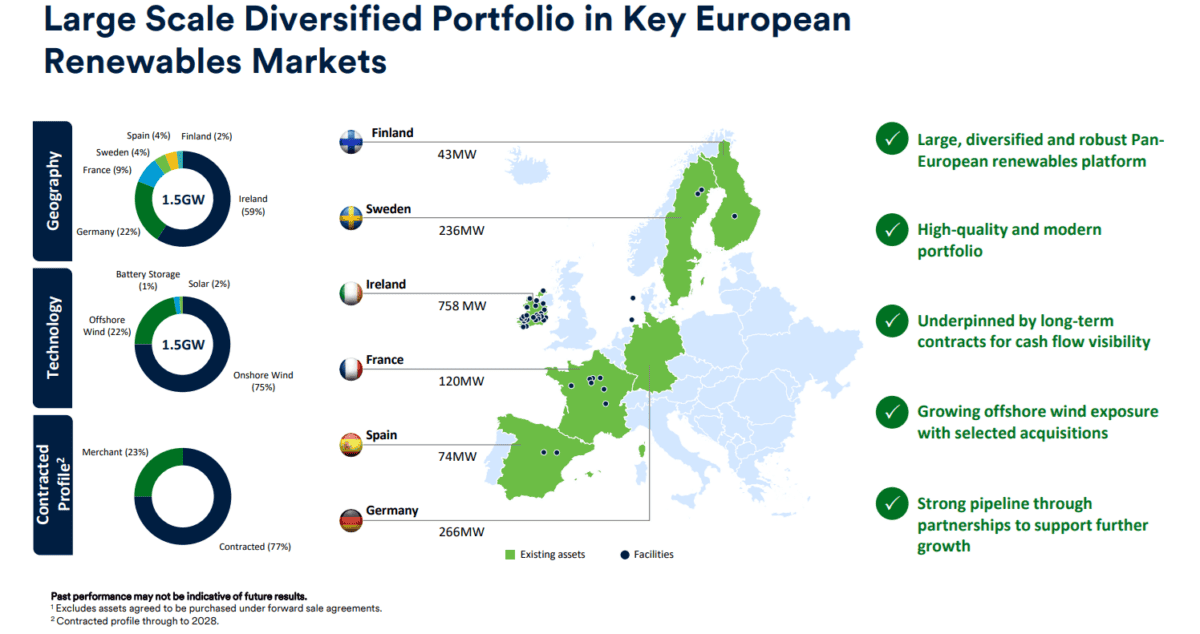

I’m especially interested in buying Greencoat Renewables shares this October, which operates clean energy assets across Ireland and in parts of Continental Europe.

With inflation toppling across the eurozone, it could receive a big boost to earnings if the European Central Bank (as expected) ramps up interest rate cuts.

Furthermore, Greencoat has considerable long-term investment potential too, as demand for solar energy rockets in response to the escalating climate crisis.

Having said that, the profits it makes could suffer at times when unfavourable weather conditions emerge.

But on the whole, I think it could be a reliable dividend payer over time, as its history of paying above-average dividends since 2017 shows. This is thanks in large part to the defensive nature of its operations.

I think it’s a top dividend share for ISA investors to consider.