Four takeover approaches from a News Corp subsidiary has helped push the share price of Rightmove (LSE:RMV), the FTSE 100 stock, nearly 14% higher.

REA Group, a subsidiary of the Australian media conglomerate of which Rupert Murdoch is Chairman Emeritus, owns and operates real estate websites throughout the world. It sees the activities of its UK-based peer as complementary to its business and is keen to acquire all of its issued share capital.

However, after its fourth and final offer worth 780p a share was rejected, it now says it’s no longer interested in buying.

Should you invest £1,000 in Aston Martin right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aston Martin made the list?

It remains to be seen whether this is a negotiating tactic.

Staying independent

REA Group’s initial bid was 698p a share. Its last offer was 11.7% higher than this. And 40.7% more than Rightmove’s share price just before the first approach was disclosed.

The takeover was rebuffed as the UK company’s directors believe it to “materially undervalue” the group. Personally, I think this is a mistake.

A look at the company’s balance sheet at 30 June 2024 reveals that other than cash and amounts owed by customers, its biggest asset is goodwill, which is difficult to value. On the same date, its book value was £66m. At £4.87bn, its market cap is now an eye-watering 74 times higher.

Impressively, there’s no debt on its books.

With little on its balance sheet, an earnings-based approach is necessary to value the company.

For the year ending 31 December 2024 (FY24), analysts are forecasting earnings per share (EPS) of 25.98p. With a current (1 October) share price of 626p, its forward price-to-earnings (P/E) ratio is 24.1.

Although well above the FTSE 100 average, it’s not excessive for a high-margin internet-based business.

For example, Autotrader is expected to report earnings per share of 32.69p in its current (31 March 2025) financial year. If achieved, its forward earnings multiple is presently 26.5.

And REA Group trades on a forward (2024) P/E ratio of 57. No wonder it was prepared to pay up to 30 times earnings for the group, which I think is more than generous.

Looking to the future

In some respects, Rightmove’s principal strength is also its major weakness.

With an 86% share of “top property portals”, 2bn visits to its website each year and 93% consumer awareness there appears little scope to grow further.

Although the housing market’s showing signs of recovering, the group’s directors acknowledge that it’s not going to be enough to sustain the company’s medium-term ambition of achieving double-digit percentage growth in both revenue and earnings.

To achieve this, the company’s seeking to replicate its residential success in the commercial property market. It also wants to partner with mortgage brokers. And use artificial intelligence to generate more revenue from the data that it collects.

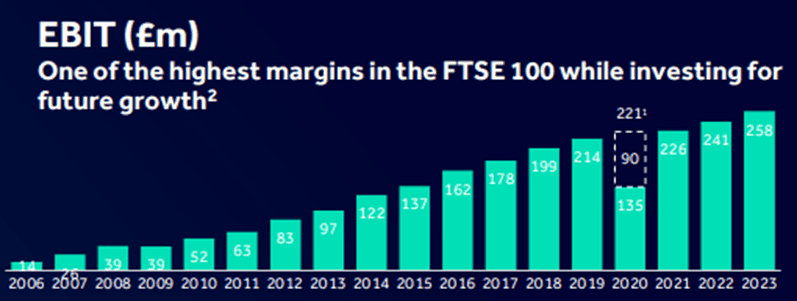

This all sounds very plausible to me. As the chart below shows, the company has a good track record of delivering growth in its earnings. But I still don’t want to invest.

Its dividend yield of 1.5% isn’t very attractive and the takeover approach has pushed the share price to a level where the company’s now on the cusp of being expensive.

It’s not that I’m anti-Rightmove, I simply think there are better opportunities elsewhere.