The FTSE 250 is filled with exciting opportunities for investors; however, it also contains numerous value traps. Thankfully, I see Bank of Georgia (LSE:BGEO) as an opportunity, but it’s not simple.

Unbeatable metrics

Valuation metrics should always be the first port of call for investors. And Bank of Georgia — Georgia’s (the country) second largest bank — doesn’t disappoint.

Despite the stock surging in recent years, the company is currently trading at 4.43 times earnings from 2023 and 3.1 times forecasted earnings for 2024. That’s a significant discount to British banks.

What’s more, Bank of Georgia is on a strong growth trajectory, with the forward price-to-earnings (P/E) ratio set to fall to 2.7 times, and Georgia’s economy currently flourishing. Not only is this cheap compared with other banks, it’s below the Bank of Georgia’s five-year average P/E of 5.1.

Moreover, dividend payments are set to rise to £2.85 per share in 2024, representing a forward yield of 7.6%. This continues to rise to 8.1% in 2025 and 8.4% in 2026.

What’s the catch?

The first catch is that investors typically assign more value to companies operating in mature and secure economies. While Georgia has been one of Europe’s fastest-growing economies in recent years, it’s an lesser-known economy. Simply, we like to invest in what we know.

It’s also the case that Georgia is experiencing some political upheaval. And as UK investors will know from the last few years, political upheaval can have a profound impact on the economy, and on the attractiveness of domestic stocks.

Keeping an eye on Georgia

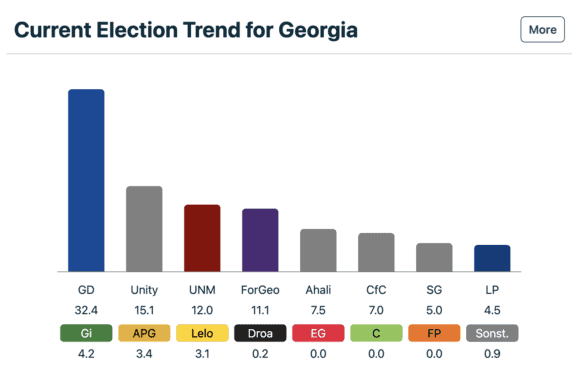

This political turbulence is set to come to a head on October 26 when Georgians take to the ballot box. The Georgian Dream are the incumbents, but they’ve come under pressure domestically and internationally for being too lenient on Moscow.

The party has put the economy first, but Tbilisi has seen an influx of Russian migrants, which — judging by the graffiti around the capital — are incredibly unpopular. It’s also the case that party founder Bidzina Ivanishvili made his fortune in Russia… it’s a link that’s hard to break.

The latest polls show the Georgian Dream to be the largest single party, but its share of the vote could fall by 16%, leaving the way for a myriad of other parties to potentially rally against them.

The issue is, politics has been very polarising in recent years. And while some in the West have called for the return of Mikheil Saakashvili-affiliated parties, the man himself was responsible for a war and forced several prominent business owners to nationalise their companies in order to fund his agenda.

In short, we may see more unrest in the coming months, and I’m not entirely convinced as to what would be the best outcome for the country.

And what about Bank of Georgia? Well, I sold my stock prematurely — a year ago — in anticipation of future unrest.

For now, it’s a stock we should all know about because it’s incredibly cheap. But we need to keep a close eye on it, as political unrest could pull this stock further down.