The forward dividend yield on FTSE 100 shares currently sits at 3.5%. That’s not bad, but I think I can do much better by hand-picking dividend stocks.

BP‘s (LSE:BP.) a blue-chip income hero with a long history of paying above-average dividends. What’s more, its dividend yields for the short term move through 6%. But do the risks of buying it outweigh the potential rewards?

Bright forecasts

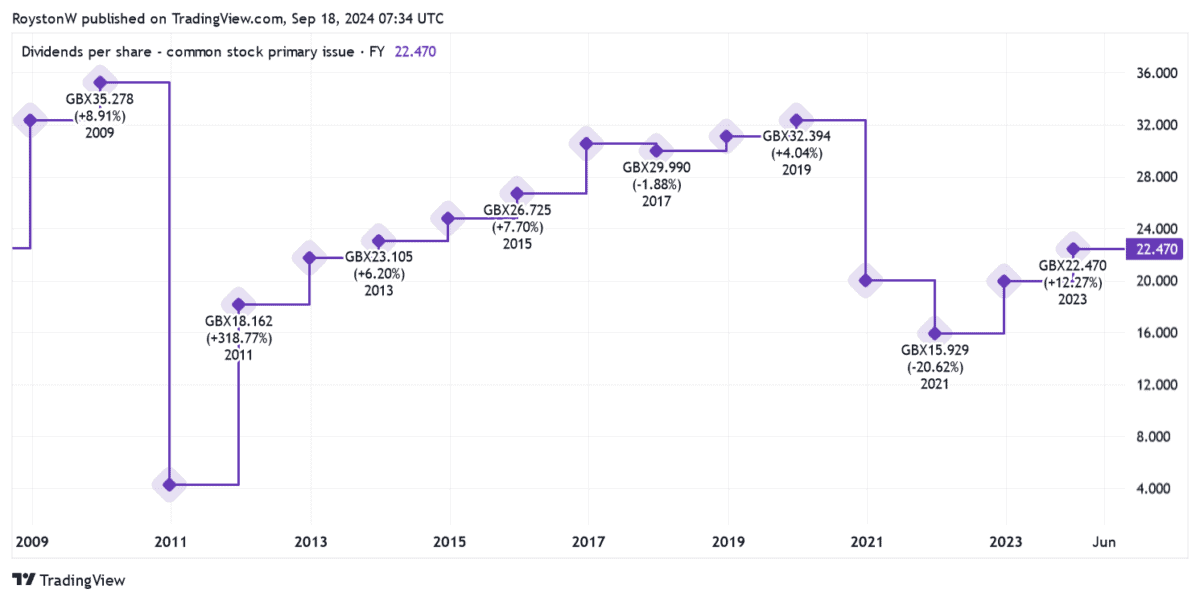

The formidable cash flows that oil majors have often make them great dividend shares. I say often, however, because dividends can be volatile according to the health of energy prices.

Should you invest £1,000 in Scottish Mortgage right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Scottish Mortgage made the list?

The good news is that City analysts think BP is going to keep raising dividends for the next few years at least. And so dividend yields for 2024 and 2025 stand at a market-beating 5.8% and 6.2%, respectively.

These forecasts are supported by strong dividend cover too. At between 2.2 times and 2.4 times for the next two years, predicted payouts are covered comfortably by earnings.

As an investor, I’m ideally seeking cover of 2 times and above.

Big questions

Having said all that, I don’t think BP is the ‘slam dunk’ passive income buy for me it may appear. During industry downturns, shareholder payouts can still slump, regardless of the level of dividend cover.

Profits can collapse when sales decline, in part due to the weight of oil major’s high fixed costs on margins and their huge debt costs.

Speaking of which, BP’s large $22.6bn net debt gives it little wiggle room on the balance sheet if oil prices keep declining. And especially when I consider the cash-hungry nature of its operations.

Tough times

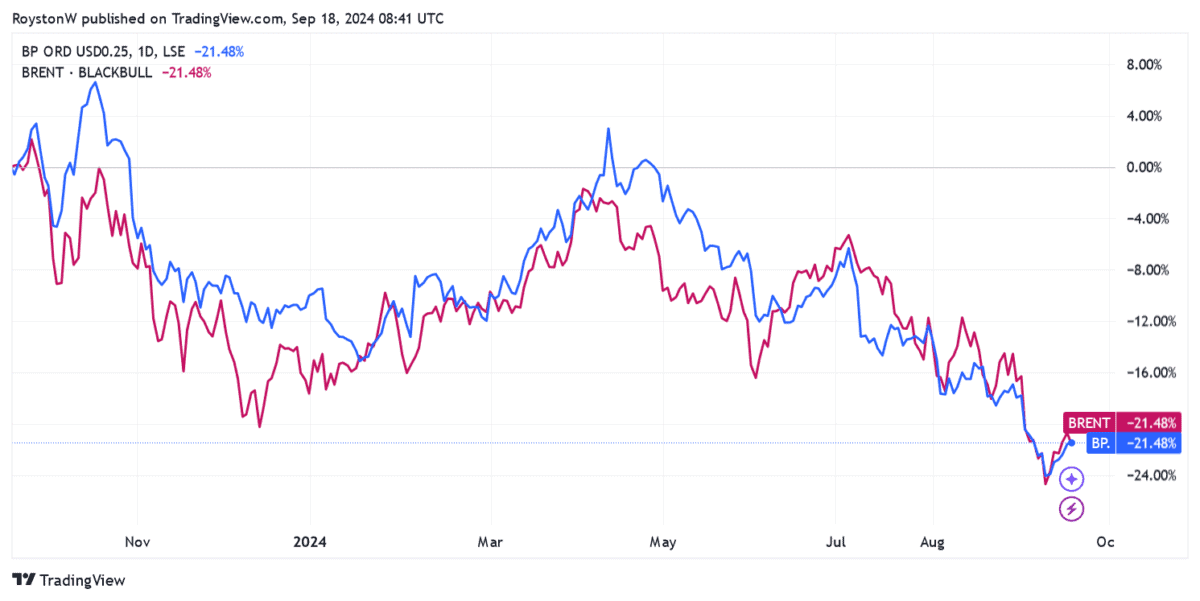

So why is this all relevant today? Well recent evidence suggests that oil prices could be in for a tough time in 2025 and potentially beyond.

Global oil demand is growing at its slowest pace since the Covid-19 crisis, according to the International Energy Agency (IEA). Oil consumption rose by just 800,000 barrels a day in the first half of the year, due in part to China’s weak economy. Demand could hit the wall next year if the US economy slumps into recession.

At the same time, production by non-OPEC countries is still on course to rise sharply, putting additional stress on energy values.

Growing threat

As a result, the outlook for BP’s dividends as well as its share price are pretty unnerving to me. And unfortunately, the supply and demand picture remains bleak beyond the short-to-medium term.

The IEA projects supply capacity to rise to nearly 114m barrels a day by 2030. That’s a “staggering” 8m barrels per day above anticipated global demand, the agency says, which would in turn “result in levels of spare capacity never seen before other than at the height of the Covid-19 lockdowns in 2020.”

Of course there’s no guarantee that oil prices will sink. Values could well tick up if, for example, the OPEC+ cartel cuts production, or other supply issues emerge.

But on balance, I think the risk to BP’s dividends (and its share price) are too great. I’d rather buy other FTSE 100 stocks for passive income.