Keeping an eye on Wall Street’s best hedge funds is always worthwhile. These elite money managers have built fortunes through a keen ability to identify top value stocks in the market.

One buying trend among some hedge funds recently has been China stocks. For example, billionaire David Tepper, founder of Appaloosa Management, has built up massive stakes in cheap stocks like Alibaba, JD.com, and Baidu (NASDAQ: BIDU) in recent quarters.

Meanwhile, Michael Burry, the investor famously portrayed by Christian Bale in the film The Big Short, had almost 46% of his fund in those three Chinese stocks in the second quarter.

Surging share prices

Now, the latest data available is from the second quarter. So we don’t know exactly what these hedge funds are holding right now (we’ll find out in November when they disclose their third-quarter trades).

However, Chinese stocks notched their best five-day period in yonks last week. So it looks like these big bets are starting to pay off.

Here’s how those three tech shares have performed so far in September:

- Alibaba +24.3%

- Baidu +24.3%

- JD.com +47.8%

Speaking in a CNBC interview on 26 September, Tepper confirmed he’s increasing his exposure to Chinese stocks. He said he’d do “ETFs, I would do futures. Everything.”

Why the sudden surge?

Tepper’s one of the world’s greatest hedge fund managers. Over the last three decades, he’s earned incredible returns of around 28% annually.

Why’s this elite money manager become so bullish on China? Well, the big rally last week came after Beijing’s authorities announced measures to stimulate the world’s second-largest economy.

These include lowering interest rates, easing mortgage repayments, supporting the property market, and increasing government spending. Interestingly, the central bank is also making it easier for companies to buy shares and engage in buybacks. Indeed, they’re actively lending them money to do so!

Tepper said these measures would have “implications in bonds, currencies, and stocks.” But he noted that Chinese shares are still dirt cheap today even after the recent surge. So he’s been buying more.

Should I invest?

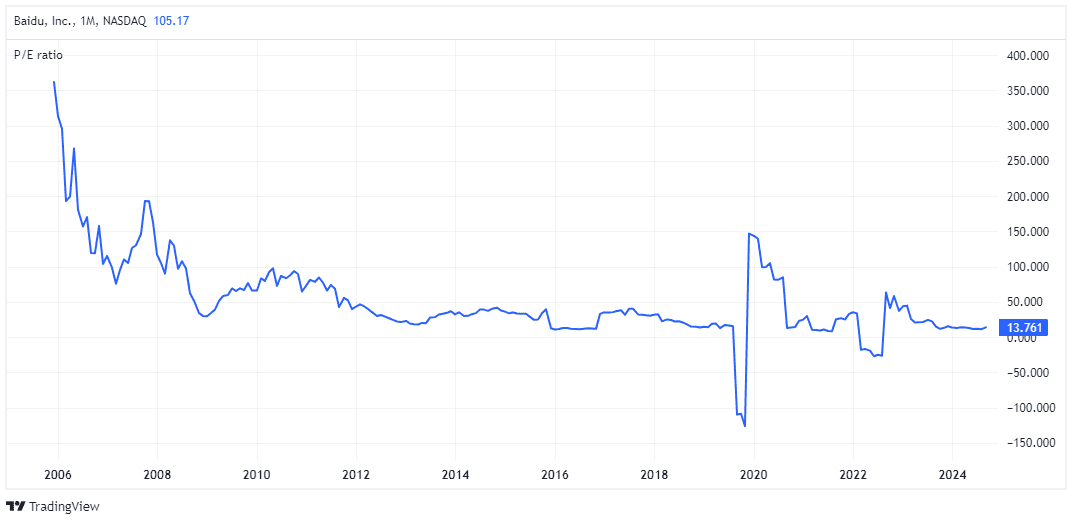

Looking at Baidu (whose shares are listed in New York), he has a point. The search engine giant, often called ‘China’s Google’, is trading at just 13 times earnings. On a forward-looking basis, it’s just 9.7 times earnings!

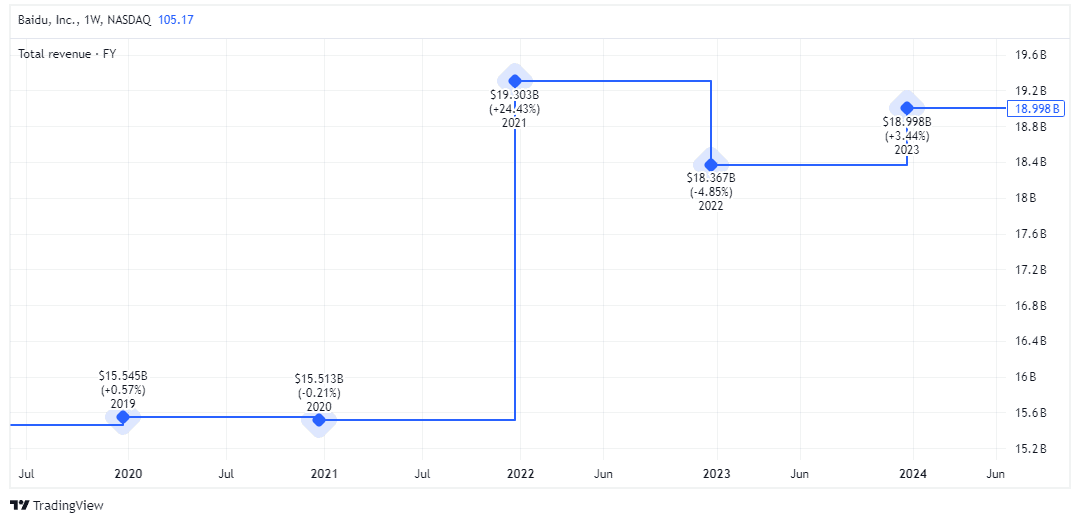

Baidu isn’t the high-growth machine it was once. Any revenue growth tends to be in the single digits these days.

But it still has attractive opportunities in cloud computing, where revenue grew 14% in the second quarter, and robotaxis. And while its search ad business has been under pressure from competition, an improving Chinese economy and consumer confidence would surely be positive for this division.

It’s also a leader in artificial intelligence (AI) and has been integrating generative AI into its search business. But this has been leading to less ad impressions, so that’s a clear risk to earnings growth.

Stepping back, the rally in Chinese stocks could have a lot further to go, especially with moves to encourage share buybacks. However, unpredictable government regulation still worries me too much to invest.

All things considered, I’ve decided to maintain my exposure to China through stocks such as Asia-focused HSBC and insurer Prudential. Hopefully they’ll benefit too.