Tesco (LSE: TSCO) shares haven’t often outperformed the FTSE 100 in recent years. The UK’s leading supermarket has largely abandoned its international growth plans, causing its share price to meander.

Yet that trend has reversed dramatically more recently. Over the past year, the Tesco share price has surged 35% and, as I write, now rests at 361p. That crushes the 9.4% return of the FTSE 100 over this time.

Indeed, the stock is now at a 10-year high!

This means a five grand investment made just 12 months ago would now be worth about £6,750. Add in the dividends since then, my total return would be just under £7,000. Nice.

Unfortunately, I didn’t invest in Tesco shares a year ago. I was loading up on Legal & General for the dividends while it was yielding 9%. It’s still yielding that today though, with the stock up a measly 3% in one year.

Clearly, I’d have been far better off investing in Tesco for a superior 12-month performance.

Why is Tesco stock going up?

There are a number of reasons why investors have turned bullish on the shares. Firstly, inflation has been cooling in recent months and it seems likely that interest rates are on the way down.

With purse strings loosened, some shoppers feel a bit more confident putting more items in their basket. I know I do compared to when cheese and olive oil prices went through the roof a couple of years ago!

On top of this, Tesco is maintaining its dominant position as the UK’s leading supermarket. In fact, it’s actually taking market share. According to Kantar, it now commands 27.8% of all grocery sales, its highest share since January 2022. This compares to 15.2% from Sainsbury’s in second place.

This is important because some investors were worried that online competitors like Ocado and Amazon would steal market share. They still might one day, as could Aldi and Lidl through their physical stores.

But for now, Tesco remains top dog.

Strong trading

The company has also been reporting solid performance. In the 13 weeks to 25 May, group sales rose 4.5% year on year at constant exchange rates. In the UK, online sales were up 8.9%, while its Ireland business saw its fourth consecutive quarter of volume growth.

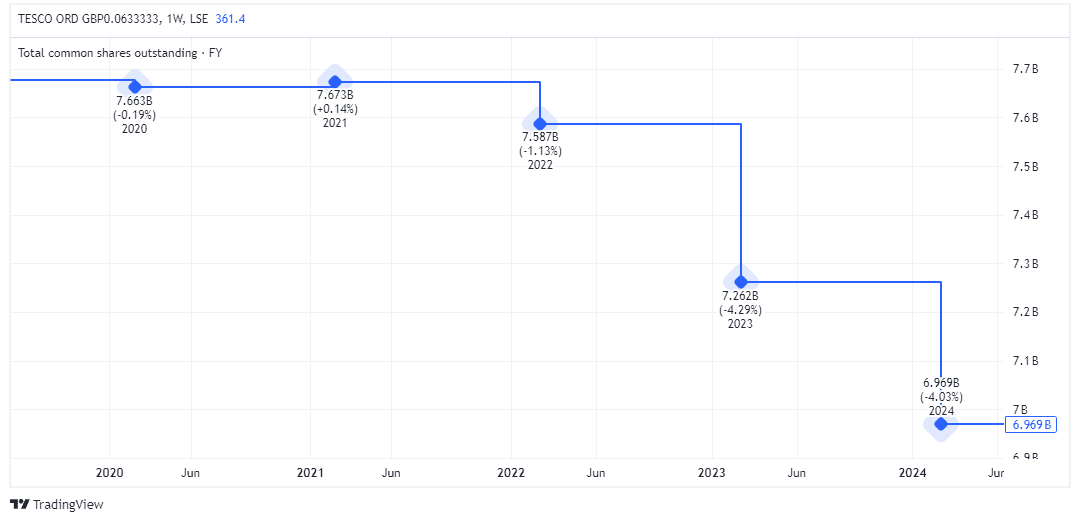

Earlier this year, Tesco committed to buying back an additional £1bn worth of shares by April 2025. At this point, it will have bought back a cumulative £2.8bn worth of shares since October 2021.

Large share buybacks like this tend to increase metrics like earnings per share (EPS). That’s because there are fewer Tesco shares for earnings to be distributed among.

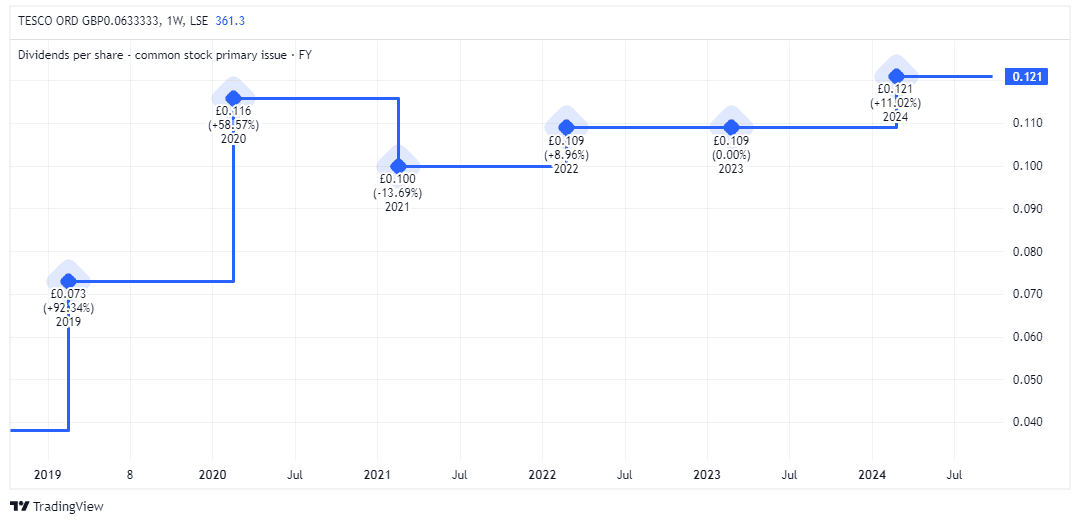

Meanwhile, the dividend was hiked by 11% last year. This means the payout is now higher than it was pre-Covid.

Will I invest?

Despite its rise, Tesco stock still looks reasonably valued to me. The P/E ratio for this year’s forecast earnings is about 14. That’s in line with the wider FTSE 100.

If I were looking for a defensive stock for my portfolio, I’d consider Tesco. But with the yield at 3.3%, I’m still having my head turned by those higher dividends elsewhere. Perhaps I’ll regret that again in a year.