Becoming a stock market millionaire is the stuff of dreams. Or is it? I reckon it’s possible to turn this dream into reality by investing in UK stocks with high growth potential.

Pursuing this objective requires risk tolerance and financial dedication. However, there are plenty of shares listed on the London Stock Exchange that can deliver the returns necessary to reach a coveted seven-figure portfolio.

Here’s how I’d aim for a million with £464 a month to invest.

An ambitious goal

Reaching a £1m portfolio won’t happen overnight. In fact, it’ll likely take many years. But it doesn’t need to take a lifetime. Simply relying on cash savings accounts won’t cut the mustard however. I’ll need to buy shares.

Over the past two decades, the FTSE 100 has delivered an annualised return of nearly 6.9%. With some smart individual stock picks, this is beatable. But I don’t want to be too bullish when forecasting what my portfolio of UK stocks could deliver.

So for my calculations, I’ll plump for an 8% annualised return. I feel this strikes the right balance between ambition and realism. Of course, it’s not guaranteed that I’d achieve this. There’s a risk my portfolio could underperform. In this case, I’d need to invest more, or expand my time horizon.

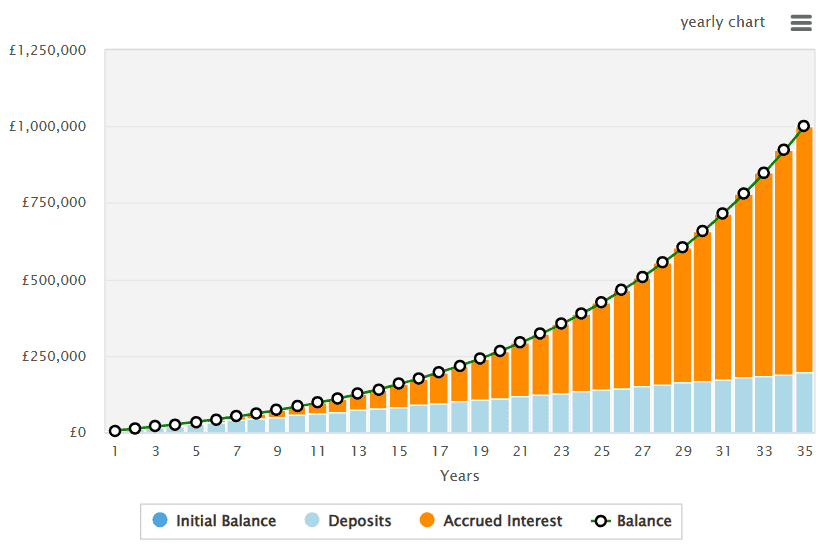

But let’s assume my assumption’s valid. If I secured this growth rate by investing £464 a month I’d hit my target in 35 years. That means if I started investing at 30, I’d be a millionaire in time to enjoy a happy retirement at 65.

Compound returns

With these caveats and considerations in mind, here’s what my journey to millionaire status might look like.

Okay, perhaps not. Only in a perfect world would my returns be this linear. In reality, there’ll be good and bad years. That’s par for the course with stock market volatility.

However, the graph makes an important point. The orange sections of the bars reflect just how important compounding (interest on the interest I’ve already earned) will be to achieving my goals. In the later years, it’ll do much of the heavy lifting, even in our imperfect, volatile world.

Finding growth shares

Now for the really exciting stuff. What UK stocks should investors consider buying?

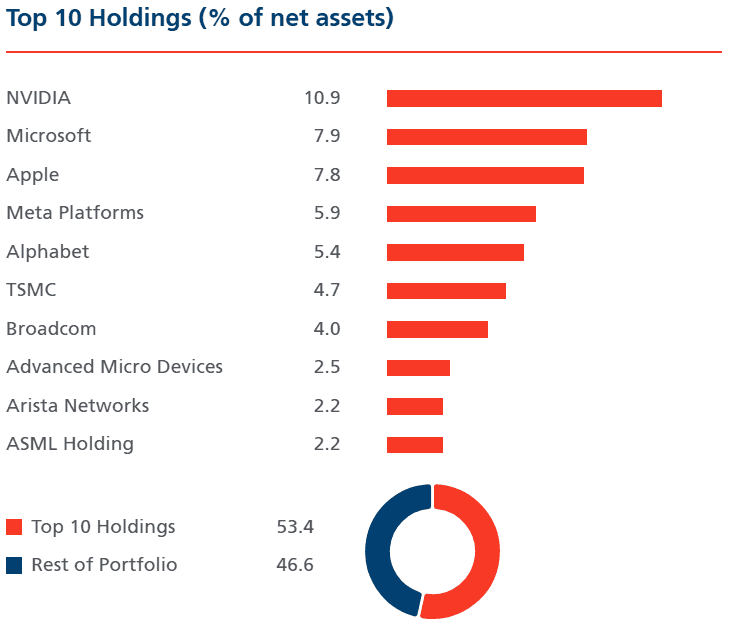

Well, one growth stock I’d consider for a diversified portfolio is Polar Capital Technology Trust (LSE:PCT).

This investment trust focuses on tech stocks around the world. It’s delivered exceptional returns and the share price has advanced 110% over five years.

The portfolio contains plenty of familiar names, some of which I already own.

Artificial intelligence (AI) is likely to be a key source of future economic growth and I think this trust’s well-positioned to benefit given the nature of its holdings. Many stocks it invests in are heavily involved in producing the infrastructure powering the AI revolution.

Moreover, investors considering the shares could get them at an 11% discount to the net asset value currently. That gap might not last.

Granted, the tech sector’s no stranger to market hype. Speculative valuations are commonplace, especially in the AI space, and investors should brace for big share price falls along the way. But risk often goes hand-in-hand with reward.