Consumer goods giant Unilever (LSE: ULVR) has moved up by 20% over the past year on the London stock market. But that simply takes the Unilever share price back to… where it was five years ago!

The share currently stands within 1% of its price back then.

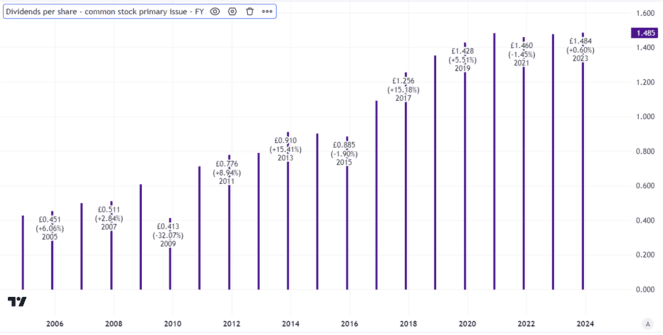

Meanwhile, the business pays quarterly dividends, with a fair track record of growth. But with its yield of 3%, I would describe Unilever as decent rather than especially exciting when it comes to passive income.

Created using TradingView

So, after a 20% rise, has the tide turned? Might the maker of Magnums and Marmite keep marching up in price?

A lost five years

From an investing perspective, the past five years can be seen as a lost period for the business. The Unilever share price has gone precisely nowhere and the dividend yield is below the FTSE 100 average.

But as long-term investors, sometimes we have to take the rough with the smooth.

Unilever has faced multiple challenges over that period, from rampant inflation at times to stuttering consumer demand due to a weakening economy.

Why the next five years could be different

The investment case for Unilever is much the same as it has been for a long time. Selling products that are regularly used in households around the world, from shampoo to laundry detergent, it can tap into resilient long-term demand.

A portfolio of premium brands gives the business pricing power and helps build customer loyalty. However, a downside is that when the economy is weak as it currently is, some shoppers will trade down to cheaper supermarket own label products.

The company has launched a cost-cutting plan that is expected to see thousands of job roles eliminated. It also plans to hive off its ice cream business. As that is a lower margin business than personal care products, for example, that could make the business more financially attractive over the long run.

The price does not look like a bargain

I fear that unloading the ice cream business could distract management attention, though.

I also think the cost-cutting programme could be disruptive. Maybe it will help improve profits over time. But such programmes are usually costly to implement at first and can damage staff morale.

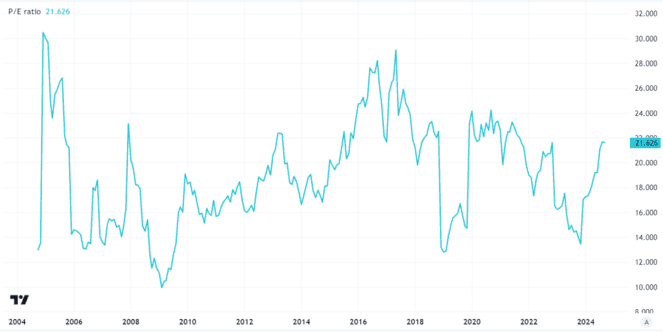

After the 20% rise in the past year, the Unilever share price now trades on a price-to-earnings ratio of 22.

That is lower than it has been historically, but markedly higher than it was just a few months ago.

Created using TradingView

It is higher than I would consider as good value for the company, especially given that it remains to be seen how well it is able to move forward with its strategic plans and what that ends up meaning in practice for the company’s financial performance.

So, for now, my only plans to try and clean up with Unilever involve using Domestos or Cif, not buying the share.