If I’d been brave enough to buy £10,000 of Rolls-Royce (LSE:RR.) shares on 12 November 2020, I’d be sitting on a paper profit of £45,333. That was the day when the shares issued as part of the company’s October rights issue were admitted to trading.

Extinction was a possibility

Looking back, it’s hard to overstate the devastating impact that the pandemic had on the engineering giant. I think it’s fair to say that it nearly went bust.

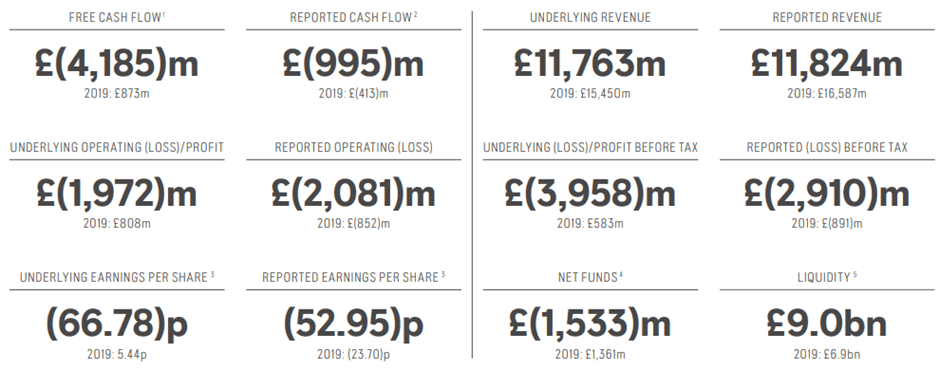

The graphic below compares the company’s 2020 financial performance with that of a year earlier. Incredibly, there was £4.5bn reduction in underlying earnings and a £5.1bn swing in free cash flow. These contributed to the group moving from a net funds position to a net deficit.

To survive, it had to raise £5.3bn of debt, dispose of some non-core assets, rapidly cut costs, and, finally, raise £2bn through the issue of new shares.

Fortune favours the brave

But I didn’t buy.

I remember thinking at the time that it was way too risky for me.

Perhaps I should have reflected more on the words of Warren Buffett, who famously advised: “to be fearful when others are greedy and to be greedy when others are fearful”.

Those who heeded this advice — and bought Rolls-Royce shares nearly four years ago — have been handsomely rewarded.

However, with the benefit of hindsight, Buffett’s quote will always hold true. I can find literally thousands of examples of how — in theory — I could have made loads of money from buying shares at a relative low point and then selling them when their price was much higher.

But in reality, it’s much more difficult than that.

When confronted with a stock that appears to be going in the wrong direction, it’s easy to think that it will continue to fall. Likewise, with one that’s been on a strong bull run, many will wonder whether it’s at — or close to — its peak.

And this brings me back to Rolls-Royce.

Having failed to buy when it was at rock bottom, I’m now telling myself that it’s too expensive!

Brokers are forecasting earnings per share of 15.76p in 2024. This implies a forward price-to-earnings ratio of 31.6 — not far off the multiple of the Magnificent Seven (35).

Time to reflect

As I get older I find myself becoming more cautious. But that’s as it should be.

There’s no point spending a lifetime building up a stocks and shares portfolio, to then go and blow it a few years before retirement by making some speculative ill-fated investments.

Don’t get me wrong, I’m not putting Rolls-Royce in this category. I remain a big fan of the company, which has a reputation for engineering excellence.

It’s proven me wrong many times over the past four years and could do so again.

It (again) upgraded its 2024 earnings forecast on 1 August and now expects to report an underlying operating profit of £2.1bn-£2.3bn. And it plans to reinstate its dividend.

But I think there are currently much better opportunities elsewhere for my portfolio.