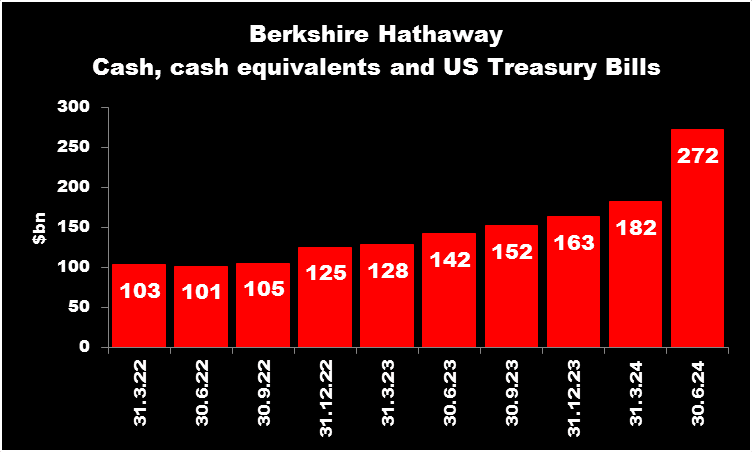

Warren Buffett, as chairman and CEO of Berkshire Hathaway, is presiding over a cash balance of $272bn. As the chart below shows, the company’s cash, cash equivalents, and US Treasury bills — which are a proxy for cash — have been steadily rising since the end of 2022.

Not that it appears to be affecting its market cap. This week (28 August), it became the first non-tech business to record a stock market valuation of $1trn.

From 1965 to 2023, its share price increased by 19.8%. This compares to an average annual return of 10.2% from the S&P 500 (with dividends reinvested).

And although some of this can be attributed to Berkshire’s investment in Apple, much of it has come from stakes in companies outside the technology sector, like American Express and The Coca-Cola Company.

However, when probably the world’s most famous investor starts substituting cash for stocks, I think it’s time to consider the implications.

What could this mean?

Most of the cash generated during the second quarter of 2024 came from the sale of around half of Berkshire’s stake in Apple.

When asked at the annual shareholders’ meeting about the disposal, Buffett implied it was for tax reasons. The billionaire expects the rate on capital gains to increase as the US tries to bring its budget deficit under control.

Maybe this means there’s nothing to worry about?

I’m not so sure.

Buffett once told investors to be fearful when others are greedy. And many believe that US equities are currently overvalued.

Any sign of a crash is likely to affect everyone’s portfolio, including mine, which predominantly holds FTSE 100 stocks. As the saying goes, when America sneezes the rest of the world catches a cold.

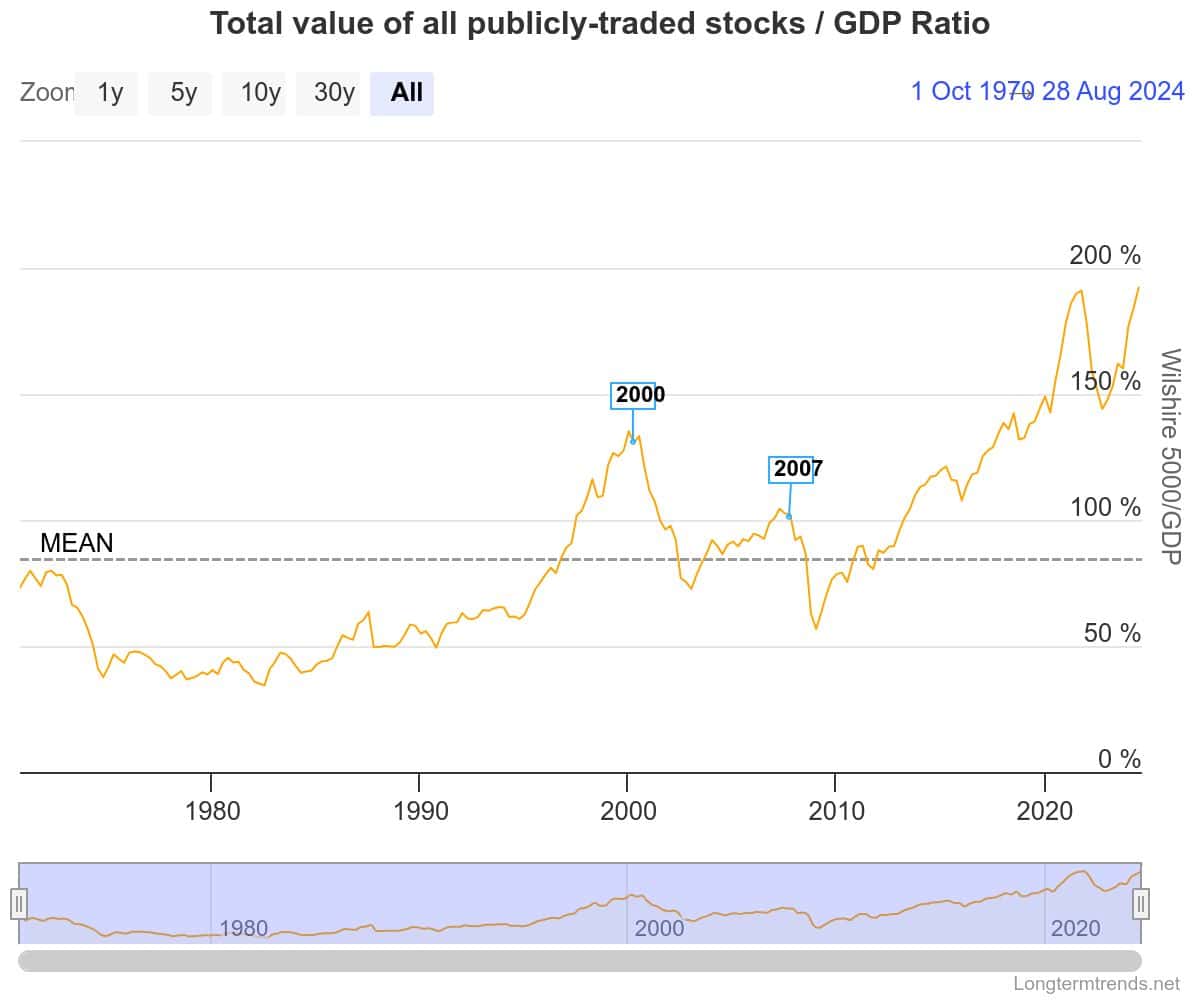

A bit like a market-wide price-to-earnings ratio, the chart below compares the combined value of the country’s 5,000 biggest listed companies with its gross domestic product.

And looking back 54 years, valuations have never been higher. Similar peaks in 2000 and 2007 were followed by significant market corrections.

My own view

But despite this, I’m not going to change my strategy.

I shall keep investing for the long term. I know there will be some bad times ahead. But I can’t predict when these will happen.

Instead, I’m going to continue to invest in quality companies that have the best chance of consistently growing their earnings.

That’s why I recently bought some Barclays (LSE:BARC) shares.

I’m impressed by the bank’s chief executive who recognises that its performance lags behind that of its peers. For example, its statutory return on tangible equity for the six months to 30 June 2024, was 11.1%. This is inferior to that of Lloyds Banking Group (13.5%) and NatWest Group (16.4%).

C.S. Venkatakrishnan has embarked on creating a simpler business model with an emphasis on its higher-margin markets.

Analysts are forecasting earnings per share (EPS) of 30.5p (2024), 39.6p (2025), and 48.4p (2026). If these estimates prove accurate, by 2026, the bank will have increased its EPS by 75%, compared to 2023. These figures imply a forward (2026) price-to-earnings ratio of just 4.7.

However, banking stocks can be volatile. Bad loans are always a risk and margins will be squeezed as interest rates (as expected) start to fall.

Despite this, for its long-term potential, I think Barclays will be a good addition to my portfolio.