Most of my Stocks and Shares ISA portfolio’s made up of quality growth shares and steady dividend-payers. However, I do reserve a small part of it (no more than 5%) for a handful of ‘moonshot’ stocks.

These are pioneering firms that aren’t making money today, but may well do in future. Of course, this approach is inherently risky, which is why it’s a small (but fun) part of my overall strategy.

Here’s why my largest moonshot position today is Joby Aviation (NYSE: JOBY).

The Uber of the skies

Imagine gliding effortlessly in near silence above traffic-congested cityscapes before arriving in Leeds from Manchester Airport. A journey that would usually have taken 90 minutes by road has taken just 15 minutes by air — and it was a zero-emission trip!

Toyota-backed Joby Aviation’s leading the charge to make this a reality. Its electric flying taxi — known formally as electric vertical takeoff and landing (eVTOL) aircraft — can carry four passengers and a pilot.

It hopes to start commercial operations by the end of 2025. For consumers, it would be similar to ordering an Uber, which is why Joby has been dubbed the ‘Uber of the skies’.

Indeed, the ride-hailing giant sold its eVTOL division (Uber Elevate) to the firm in 2020 and became a significant shareholder. There are plans to eventually integrate air taxis into the Uber app.

Deals

Delta Air Lines also has a large stake in Joby, with whom it plans to launch an air taxi service running between Manhattan and JFK Airport. Each flight will reportedly take around seven minutes compared to 50-75 minutes by car.

The aim is for higher-end Uber Black pricing before moving to regular taxi pricing over time.

In February, the company signed a deal to operate air taxis exclusively in Dubai for six years, starting as early as 2026. It will also introduce its aircraft in Saudi Arabia via direct sales.

In the UK, it’s applied to the Civil Aviation Authority, with plans to link cities such as Liverpool, Manchester and Leeds.

Risks

As exciting as all this sounds, eVTOLs first need regulatory approval. And this is the big risk here. The company might not ultimately get regulatory approval or there may be significant delays.

Moreover, there is competition in the space, notably from Archer Aviation (backed by United Airlines and Stellantis).

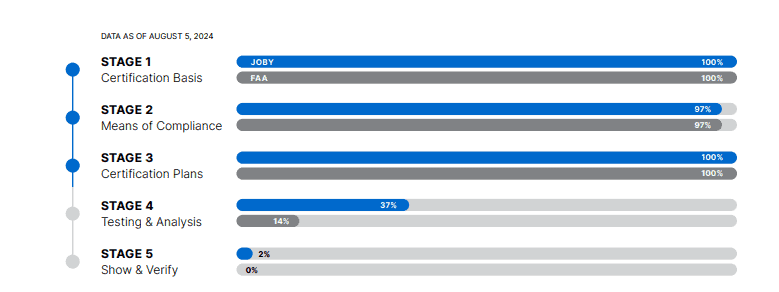

However, Joby was the first company to complete the first, second and third of five stages of the certification process needed for commercial service. As of 5 August, 37% of the fourth stage was completed on the Joby side.

It lost $123m in Q2, but also had no debt and cash of $825m. This should comfortably be enough to fund a commercial launch. But to expand beyond the four aircraft currently in flight testing, the company will almost certainly need additional capital.

A potential $1trn market

Down 52% since listing in late 2020, the stock’s currently $5. This gives a market-cap of $3.6bn.

In future, eVTOLs could become a new form of mass transportation due to being faster and greener. They might replace helicopters and even disrupt train services.

Morgan Stanley estimates that this urban air mobility market could reach $1trn by 2040! That’s why it’s my risky moonshot.