It does not necessarily take a lot of money to start investing in the stock market.

In fact, I think there can be advantages to starting sooner on a smaller scale rather than spending years saving large amounts to invest. It can mean getting into the markets sooner – perhaps years sooner. It also would hopefully mean that any beginner’s mistakes are less financially painful.

So what are the three steps I would take today to begin with a small amount of cash?

1. Learn what drives value

It may sound obvious, but the key to successful long-term investing is paying less (ideally much less) for things than they are worth.

In the stock market, that means not confusing a successful business with a rewarding investment.

What is the difference?

Partly it is about spotting the long-term prospects for success a business may (or may not) seem to have, as opposed to whether it is performing strongly right now. But it is also about valuation.

Take Apple (NASDAQ: AAPL) as an example. Looking at its share price performance over the past five years, the tech giant has been incredibly rewarding for investors.

Yet no less an investor than billionaire Warren Buffet has been selling hundreds of millions of Apple shares in recent months (although, in fairness, he retains a significant stake). Why?

We do not know the answer.

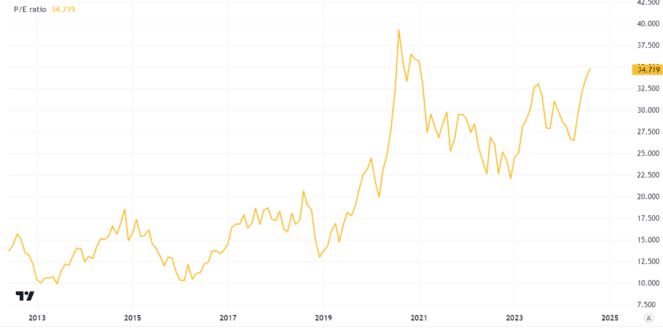

But past performance is not necessarily a guide to what will happen in future. Apple continues to enjoy strengths including a large addressable market, iconic brand and sizeable installed user base. However, at 35 times earnings, the stock looks expensive to me.

Created using TradingView

So, using its price-to-earnings ratio, Apple’s valuation now looks pricy to me – and that is if it can keep earnings per share at their current level.

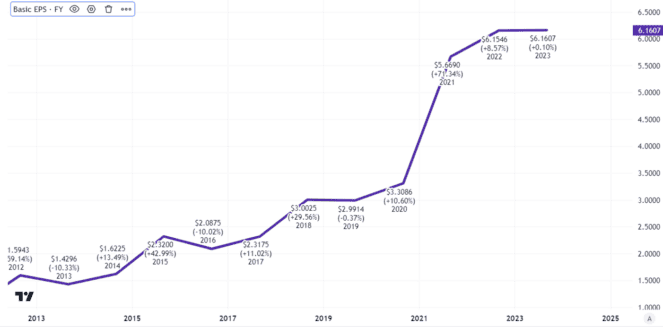

But they have started to stall and I fear an increasingly competitive marketspace combined with tighter consumer budgets could mean they begin to fall.

Created using TradingView

So, although I think Apple is a great business, I would not buy the share at today’s price.

Valuation is a critical tool for any investor – and I would not start investing before learning at least the basics of it.

2. Plan to invest in a strategic way

But how would I know what to value anyway? After all, there are thousands of shares listed just on the London and New York stock exchanges alone.

Like Buffett, I would stick to what I know. I would start my investing efforts conservatively, focusing on lower-risk shares, even if that meant I missed out on some potentially great returns.

To manage that risk, I would diversify. With £360, I could comfortably buy into two or three different companies.

3. Start buying and hold

Once I found shares in great companies I thought had an attractive valuation, I would start investing in them. With a timeframe of years, I would be buying to hold.

To get ready to do that now, I would begin by setting up a share-dealing account or Stocks and Shares ISA.