It’s understandable why investors looking for a high-growth stock to buy might consider Nvidia (NASDAQ: NVDA). The AI chipmaker grew its revenue from $10.9bn in FY20 to $60.9bn in FY24.

The top line could surpass $120bn this year (FY25). That would represent a five-year compound annual growth rate (CAGR) of approximately 61%!

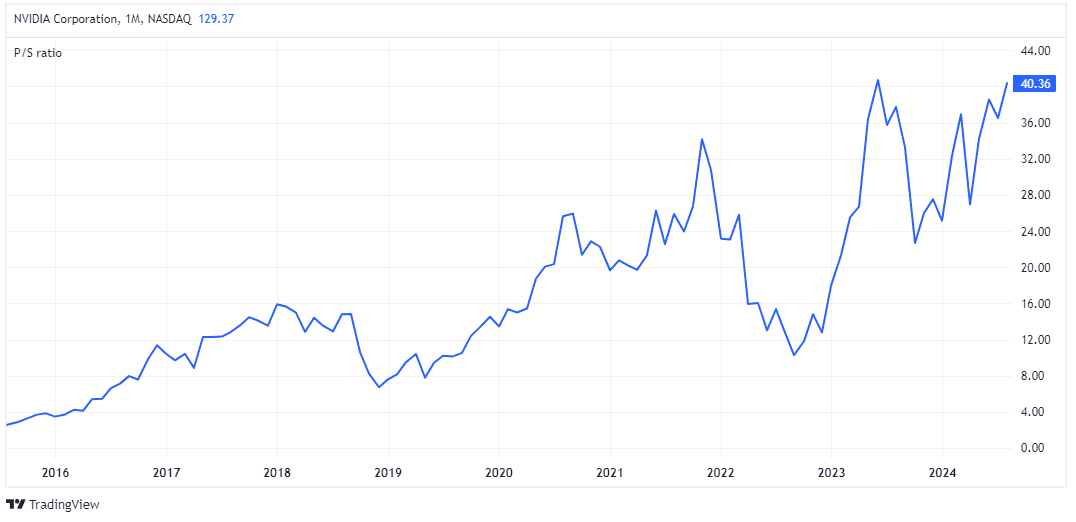

However, Nvidia’s market cap is now in excess of $3.1trn and the price-to-sales (P/S) ratio is very high at 40. In other words, the market has caught up with events.

Moreover, the company’s four largest customers — widely thought to be Microsoft, Meta Platforms, Amazon, and Alphabet — account for around 40% of total revenue, according to Bloomberg.

On the one hand, this crème de la crème of the tech world indicates how world-class Nvidia’s products are. On the other, it reveals a high level of customer concentration, especially when these firms are all developing their own AI chips to reduce reliance on those from Nvidia.

Still growing

In contrast, Uber Technologies (NYSE: UBER) doesn’t have this problem. At the end of June, it had a record 156m monthly platform customers!

Despite this enormous scale, the company continues to expand its reach. This year, it launched in Luxembourg and re-entered Hungary after an eight-year absence.

The company is also expanding into new areas in existing countries. For example, it’s experiencing rapid growth in Brazil, while in the UK it recently launched in Hull, Northampton, York, Teesside, and Aberdeen.

Management estimates that in its top 10 countries, the monthly penetration rate among customers is still less than 20%. So there appears lots of room to grow, even in more mature markets.

Then there’s an huge untapped digital advertising opportunity. Management is looking to Amazon for what’s possible here (the retail firm’s advertising business has grown enormously in recent years).

Expanding into adjacent areas like advertising, subscription services (Uber One), and even train ticket bookings, shows how Uber is enhancing its optionality (a key trait of winning stocks).

Valuation

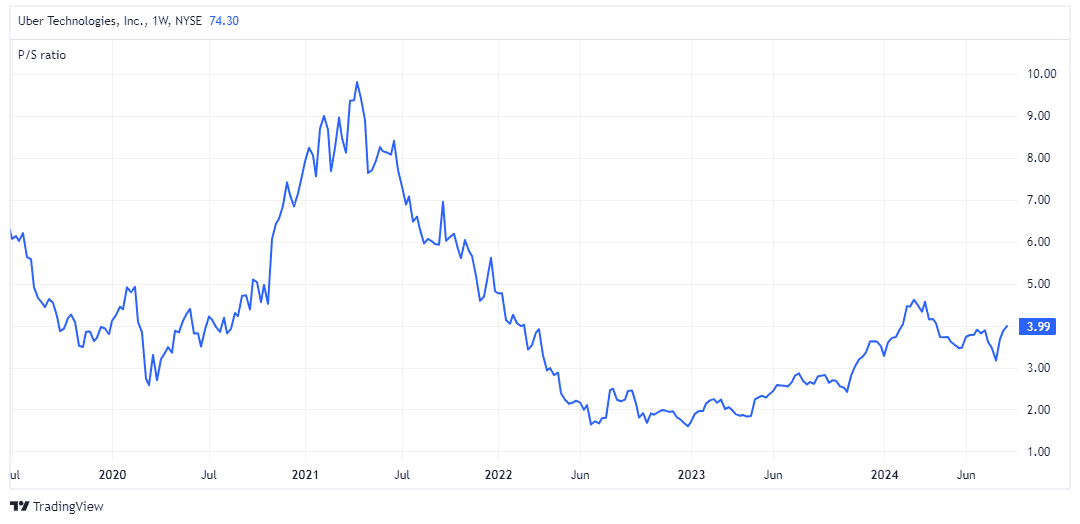

The P/S ratio is 3.9, which is around its historic median (and far cheaper than Nvidia).

Meanwhile, the forward P/E ratio might look pricey at 33, but the firm is projected to increase its earnings per share at a compound annual rate of 52% between 2023 and 2026.

Autonomous vehicles

Now, Uber does faces competition from local taxi firms and DoorDash, as well as feet, buses, bikes, scooters, and skateboards. There are plenty of ways to get about.

Plus, Tesla’s long-overdue robo-taxi network might be a risk. That said, Uber already has autonomous vehicles (AVs) available on its app in some US cities. Last quarter, it recorded a sixfold increase in AV rides.

Meanwhile, it has partnerships with all the leading AV players:

- Waymo

- Cruise

- BYD

- Aurora Innovation

- Joby Aviation (a flying electric taxi firm working on autonomy)

I’m investing

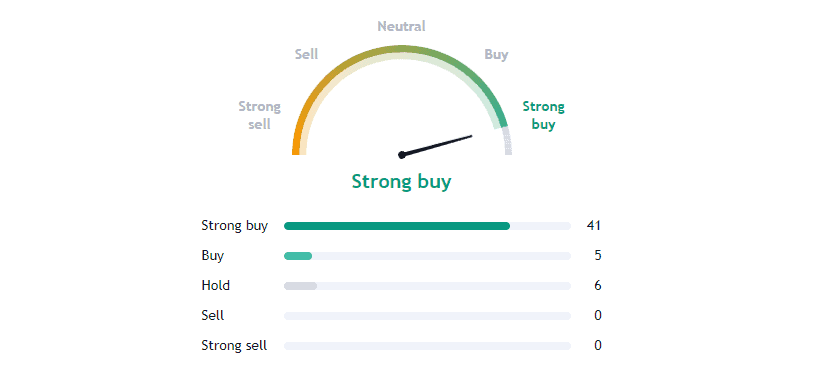

Of the 52 analysts rating the stock in the last three months, an incredible 46 have it down as either a ‘buy’ or ‘strong buy’ (overwhelmingly, the latter).

Uber has built an incredible brand and powerful competitive advantage based on network effects (the platform’s value increases as more users join). And it’s quickly turning into a profit-making machine.

This is an exciting high-growth stock that I plan to buy very soon.