A recent trip to the Cheshire Oaks outlet shopping centre resulted in me unexpectedly taking a position in JD Sports Fashion (LSE:JD.), the FTSE 100 sports/fashion retailer. Buying shares was the last thing on my mind but I was persuaded by what I saw.

Of the 140 stores on-site, three had queues to get inside.

The popularity of Crocs and Birkenstock didn’t surprise me. But the large number of shoppers waiting outside both of them was partly due to the small size of their stores. However, it was the fact that people were prepared to wait to enter Nike (NYSE:NKE) — possibly the largest shop on site — that got me thinking.

God of victory

The apparent popularity of the American sportswear brand appears to buck a wider trend. In recent years, Nike’s decided to concentrate on selling through its own stores directly to the consumer (DTC) rather than via third parties, like JD Sports.

However, on 27 June, the company revealed that during the three months ended 31 May 2024, its DTC sales fell 8%. On the same day it also announced a cut in its 2025 sales forecast.

The news caused a 20% fall in its stock price. It’s now only 16% higher than when the pandemic was wreaking havoc.

Despite the queues in Cheshire, some industry experts claim that Nike has lost its way.

It appears to rely too much on its legacy brands. For example, Michael Jordan last played an NBA basketball game in 2003. Does anybody under the age of 35 really know who he is?

A better idea?

The JD Sports share price has undoubtedly been affected by Nike’s problems. It fell 5% when the American company provided its gloomy update in May. It’s now 30% lower than its 52-week high.

This isn’t surprising given that estimates suggest Nike accounts for 50%-55% of JD Sports’ revenue. But the retailer is more than just one brand.

Nike’s strategy has opened the door for some lesser-known rivals to gain market share. Castore, On Running and Hoka are the new kids on the block. JD Sports sells all three, as well as Crocs and Birkenstock which are also in vogue at the moment.

And despite its problems, my visit to Cheshire confirms that Nike’s products remain popular. By stocking these, along with established favourites like Adidas, Puma and New Balance, I think JD Sports is well positioned to cover all budgets and demographics.

In addition, I’m sure the Olympics will have boosted sales in the short term.

Some concerns

But there are risks. The company operates 3,400 stores in 38 countries which is a logistical nightmare. And these account for 75.7% of sales, so JD remains vulnerable to pure play online retailers who don’t have to pay property taxes.

In addition, its dividend is miserly which means many income investors will look elsewhere.

However, with a forward price-to-earnings ratio of 9.4 — below the FTSE 100 average — I believe now’s a good time for me to buy.

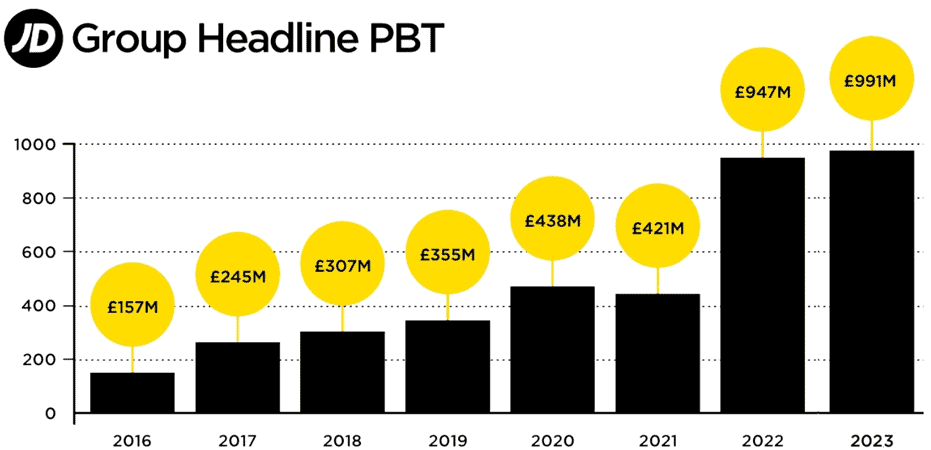

I therefore hope to capitalise on JD Sports’ strong track record in growing its earnings, both organically and through acquisition.

The company’s due to release its first-half results later this month (August). These should give me an early indication as to whether I’ve made the right decision.