Many FTSE 100 stocks have sunk in value at the start of August. And so there are around 40 shares that offer dividend yields above the index’s 3.6% forward average.

But income investors need to tread carefully and resist diving in. There’s plenty on this list I think might fail to pay the dividends brokers are expecting this year. A lot may also be poor picks for those seeking a sustainable and growing dividend over a long time horizon.

If I had £10k burning a hole in my pocket, here are a couple of excellent dividend shares I’d buy today.

Dividends are never guaranteed, but if broker forecasts are right, my £10,000 lump sum would throw off £880 in dividends this year alone. That’s assuming I invested an equal sum across each company.

I believe the dividends on these Footsie shares will increase steadily over time too. Here’s why.

Iron giant

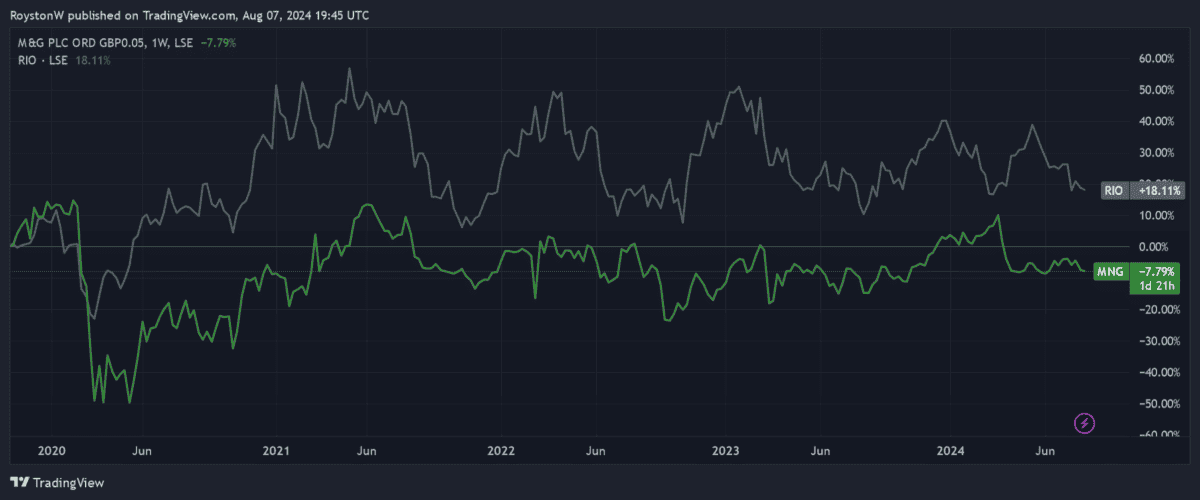

Dividends at industrial metal suppliers can unfortunately reverse when commodity prices struggle. This was the case at Rio Tinto last year, and in 2022. And City analysts expect this to happen again in 2024.

However, it’s far from all bad at the diversified miner. It still carries that near-7% dividend yield. And a strong balance sheet means it looks in great shape to meet payout forecasts.

Rio Tinto’s net-debt-to-EBITDA ratio was just 0.6 in June.

Shareholder payouts could be volatile here from time to time. Yet I still believe they’ll rise over a long time horizon. This will be driven by factors such as growing renewable energy investment, the rise of artificial intelligence (AI) and ongoing urbanisation that drives demand for metals including copper and iron ore.

And thanks to its deep pockets, it can invest heavily to develop new and existing projects and make earnings-boosting acquisitions to capitalise on this opportunity.

Dividend grower

As with Rio Tinto, financial services firm M&G’s highly sensitive to broader economic conditions. But just like the miner, it can also put its strong balance sheet into action to help it pay a large and sustainable dividend.

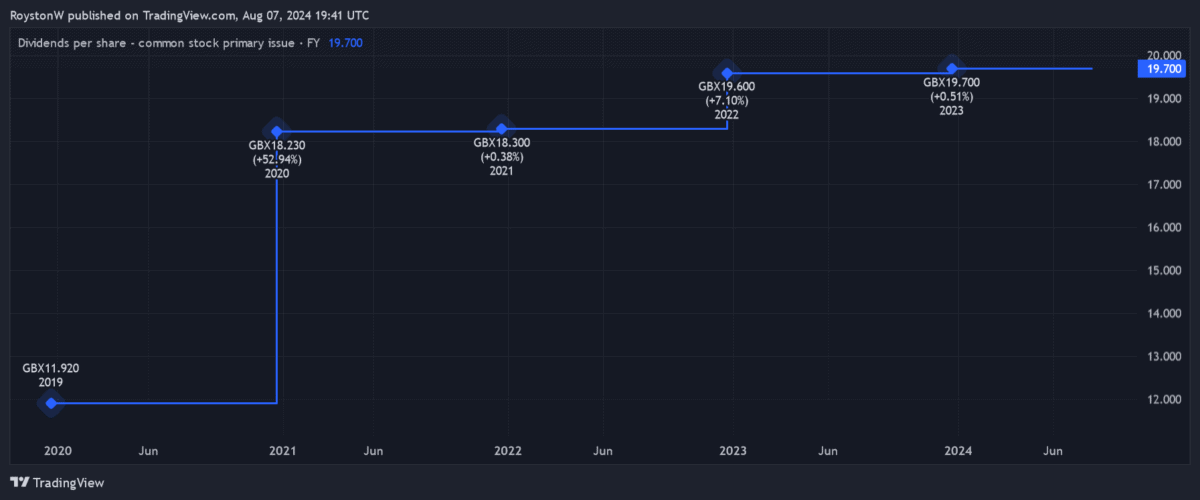

Indeed, the company’s raised the annual dividend each year since it was spun off from Prudential in 2019, even during the Covid-19 crisis.

M&G’s Solvency II capital ratio also improved over the course of 2023, to 203%, as operating capital generation sailed past forecasts. The firm’s targeting impressive operating capital generation of £2.5bn by the close of this year.

I feel it can continue to grow shareholder payouts beyond this year too. Its £200m cost-cutting drive will help reduce debt and create a much leaner organisation beyond 2025.

It should also witness a strong uplift in revenues and cash flows as the UK’s population rapidly ages. This demographic change is tipped to supercharge demand for savings and retirement products.