I’m constantly on the lookout for great investment opportunities on the FTSE 100. One thing I’m always hoping to find is top-quality shares that have been heavily sold off.

As a long-term investor, I look to hold any stocks I buy for at least five years. My ideal timeframe is a decade or more.

By buying well-run companies in growing markets at knock-down prices today, I have a chance to enjoy exceptional capital gains as their share prices (hopefully) rebound in the subsequent years.

With this in mind, here are two falling companies I expect to bounce back.

Value star

Footsie retailer B&M European Value Retail (LSE:BME) slumped in June despite announcing full-year profits at the top end of its forecasts. I think the scale of investor selling’s a massive overreaction.

Shareholders were spooked by the company’s failure to issue guidance for the new year. But I for one am not worried. Adjusted operating profit of £614m for the 12 months to March was up 10.9% year on year, driven by like-for-like revenues growth of 3.7% at its core UK business.

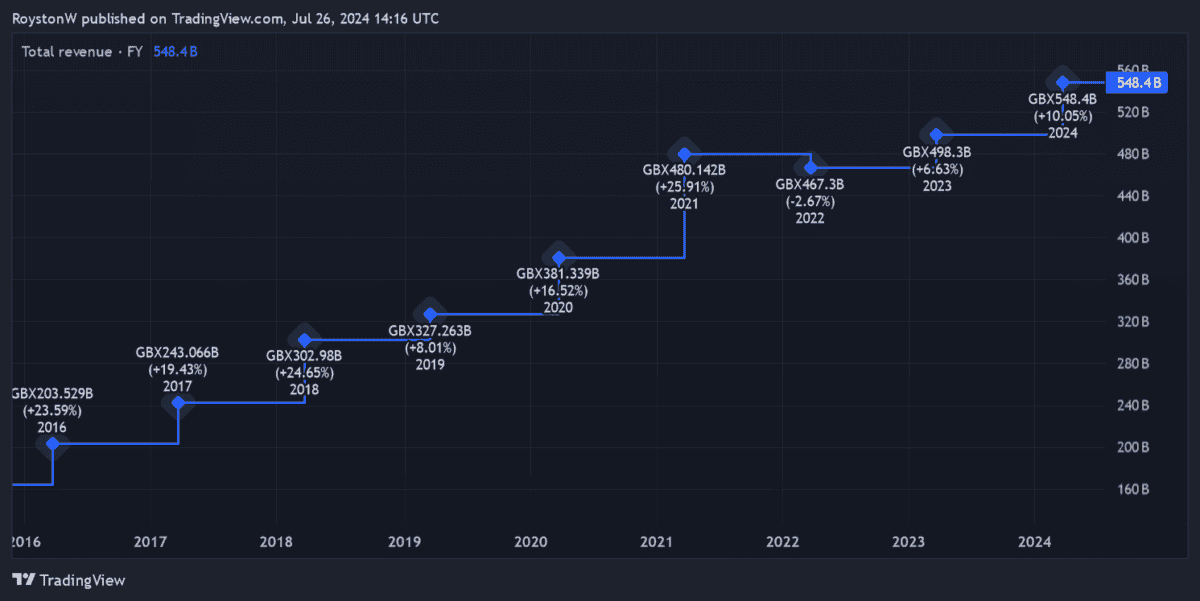

Sales at the company have soared 169% during the past eight years. And given the bright outlook for the value retail segment in both Britain and France, it has a terrific opportunity to keep this growth record going.

The firm’s determined to continue aggressively expanding to make the most of this opportunity too. In the UK alone it’s targeting a B&M store estate that’s 1,200 strong. It operates 755 so far.

Encouragingly, B&M’s a master at identifying the best store locations and getting them firing straight away too. In July’s most recent trading statement, the FTSE 100 company said that “all stores opened since last year are performing ahead of expectations“.

Competition from other low-cost retailers is a growing threat. But I think B&M’s share price may surge from current levels.

Dividend hero

I also believe Legal & General Group (LSE:LGEN) shares have been oversold of late. This follows its announcement in June that annual dividends will rise 2% from 2025 to 2027. This is down from increases of 5% more recently.

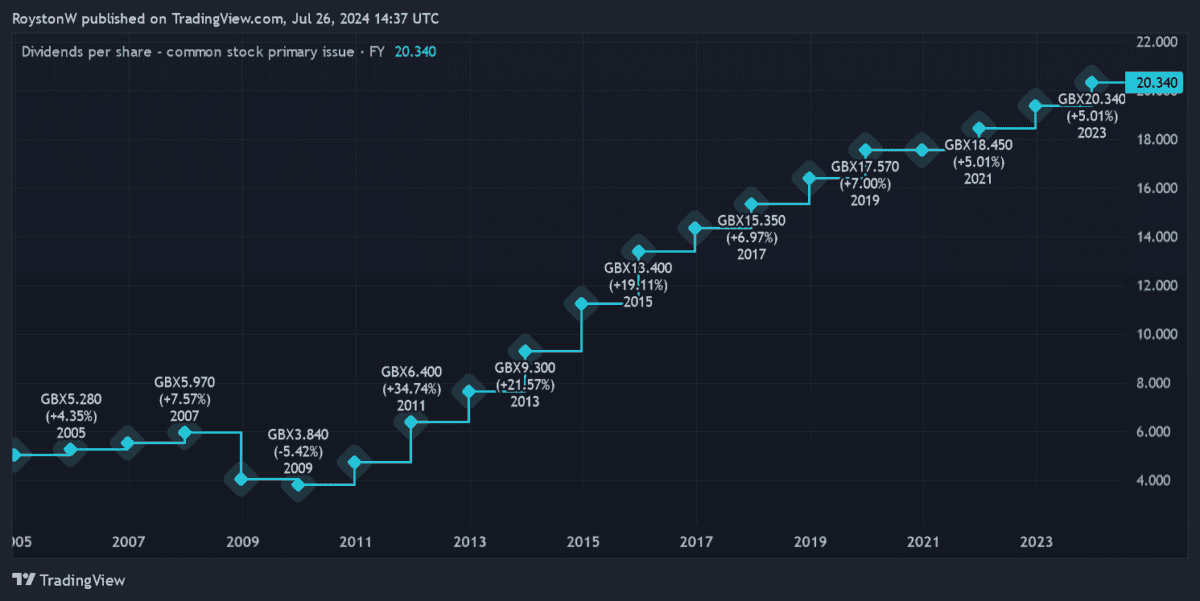

Dividends form a huge part of the firm’s investment case. The business has raised shareholder payouts almost every year since the 2008/2009 financial crisis. So it’s easy to see why investors might be spooked.

The thing is, I believe Legal & General is still an excellent pick for passive income. Its dividend yield now stands at an impressive 9.3%, one of the highest in the FTSE 100.

It’s tipped to meet its objective of raising dividends by City analysts for the next three years at least too. And so for 2026, the yield on Legal & General shares moves to a staggering 9.8%.

It’s also worth remembering that reducing dividend growth now could help the business raise shareholder payouts over the long term. Reallocating capital today to invest in its operations gives it a better chance to capitalise on its rapidly growing markets, and thus to remain one of the UK’s best-paying income shares.

Legal & General’s upcoming restructuring drive carries some execution risk. Yet I still expect it to be a standout dividend provider and for its share price to rebound.