I’m primarily a value investor, focused on slow-growth stocks paying reliable dividends. That’s because I’m in it for the long run — aiming for a steady stream of passive retirement income.

However, diversification is paramount to any successful investment strategy. And I’d be a fool to shy away from stocks that have excellent growth potential.

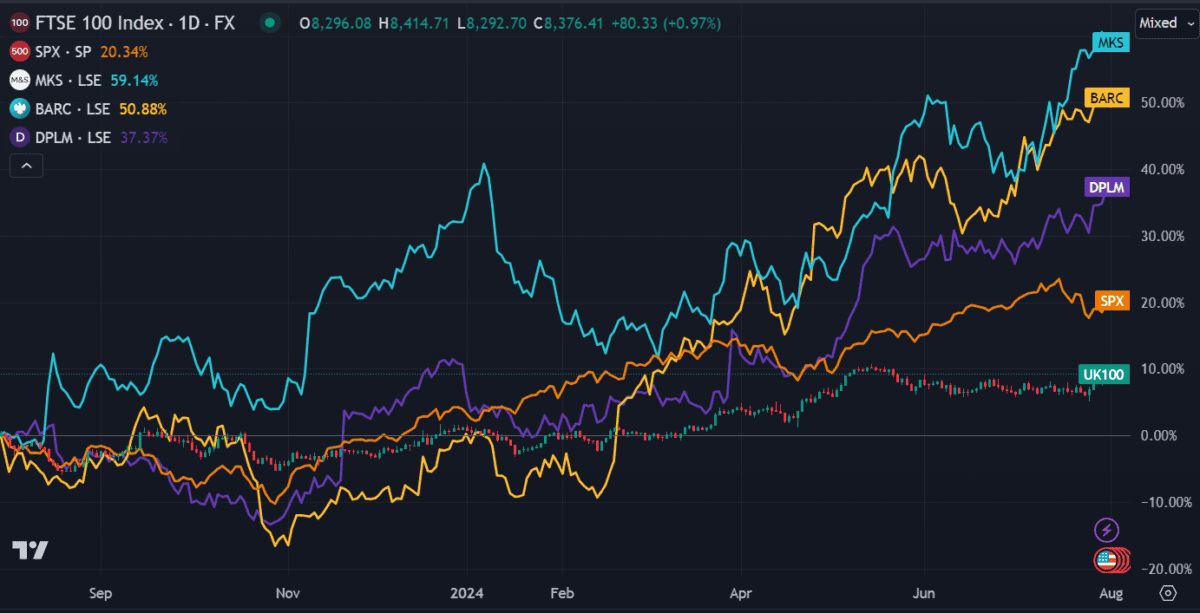

So I hold a few promising growth stocks that I believe any investor would be smart to consider for their portfolio. Several of them have outpaced the FTSE 100 and S&P 500 over the past year — and could continue to do so.

Here are three of my favourites.

Diploma

Diploma (LSE: DPLM) is the second highest-performing stock on the FTSE 100 over the past five years. Up a massive 200%, that’s on par with US tech giant Microsoft.

The life sciences, seals and connections specialist has made a series of high-profile global acquisitions lately to boost revenues. It now has operations in Europe, Asia, America and Australia. In total, it’s added six new businesses to the group this year alone.

However, with the price outpacing earnings lately, its price-to-earnings (P/E) ratio is up to 50. Moreover, it’s overvalued by around 39% based on future cash flow estimates. After such an exceptional period of growth, it wouldn’t be surprising if a mild price correction happened.

But if so, that could be a good buying opportunity – because long term, I think it’s got great potential.

Marks and Spencer

At 140 years old, Marks and Spencer (LSE: MKS) has long been a high-street institution in the UK, once described as “one of the last bastions of middle-class Britishness“.

Before Covid, it struggled through several years of decline. Competition from high street rivals Next and John Lewis cost it dearly, and it was relegated to the FTSE 250 between 2019 and 2023.

But lately, things are improving after a restructuring of the business. Now up by 60% in the past year, it’s far outpaced both the FTSE 100 and the S&P 500. Once thought of as an expensive supermarket, a change in pricing structures has made it more competitive.

In its FY 2024 earnings released in June, revenue was up 9.3% and earnings up 19%.

Barclays

I bank with Barclays (LSE: BARC) so maybe I’m biased in this respect but it’s my favourite bank stock. And no surprise why — the shares are up 51% in the past year, beating both Lloyds and HSBC.

Another area where it beats them is its P/E ratio. At 8.5, it’s higher than most major UK high street banks. That could stifle growth. However, positive earnings forecasts mean the 12-month forward P/E is 7.3 – more in line with the industry average.

Much of the recent growth could be attributed to high interest rates. If more cuts come after this week’s initial cut, the growth could taper off soon. And in 2022 and 2023, growth was also subdued by a stifled economy. Should the economy take another dive, banks could be among the hardest hit.

Still, I think it’s one of the most solid and reliable gainers among the big banks. Plus, it’s a fairly solid dividend payer to boot. The 3.4% yield is nothing to write home about but it’s that extra bit of value when times get tough.