One cheap FTSE 100 company that’s caught my attention is Burberry (LSE: BRBY). It’s down 14% this month and 66% over one year.

Could that mean the luxury fashion brand is significantly undervalued? Someone seems to think so as a notable board member at Burberry recently bought shares.

On 16 July, Chairman Gerard Murphy acquired 20,000 shares at £7.25 each for a total value of £145,000. This comes during a tumultuous period for the company, as earlier this month it appointed former Coach boss Joshua Schulman as its new CEO. A search for Murphy’s successor is also reportedly in the works, although an exact timeline is unclear.

With the share price in a downward spiral over the past year, the company’s taking drastic measures to enact a recovery. At 736p a share, it’s near the lowest its been in over 14 years.

Why buy the shares now?

When an employee or board member sells shares it isn’t necessarily that they fear losses. Maybe they just need extra cash to fund an emergency expense. Maybe they’ve taken advice to diversify into different assets.

However, when a company insider buys shares it can only be for one reason — they believe the price is going to rise eventually.

So in these instances, it’s a strong indication that the buyer has confidence in the company’s future. Even more so than when brokers or analysts buy, as the insider has a deeper knowledge of the business.

Looking back, there’s a number of occasions where I should have paid more attention to insider buying activity. I assumed certain undervalued stocks would turn around but failed to notice that no insiders were buying. In some cases, the company was simply headed for failure.

So I’ve learned to always check if executives or board members are buying before I dive in. And in Burberry’s case, Murphy isn’t the only buyer. Two other directors bought over 5,000 shares this month.

A tough period for luxury

In the company’s recent first-quarter results released on 15 July, comparable store sales were down 21% on the same period last year. Subsequently, it suspended its dividend payments and announced cost-saving initiatives, leading to a further 20% share price decline.

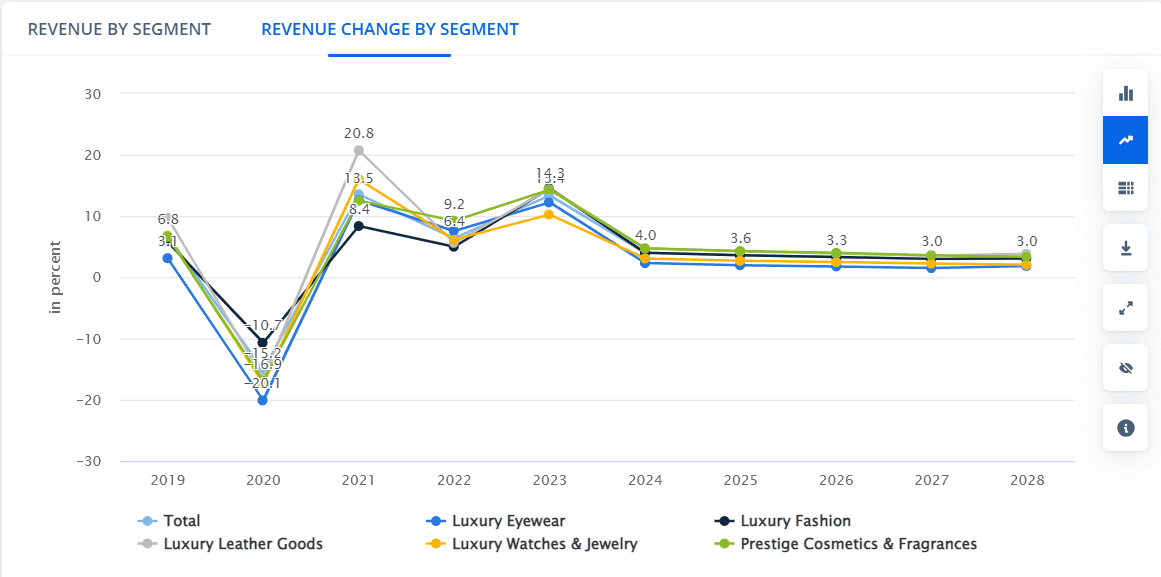

It’s not a lone struggler in the luxury fashion industry. The €328bn Parisian luxury giant LVMH has also reported slower-than-expected sales recently. The luxury market has been turbulent since the pandemic, with sales skyrocketing 20% in 2021 before collapsing again soon after.

Looking ahead, analysts don’t expect a significant recovery soon.

So, does Murphy know something I don’t — or is he just hoping to restore investor confidence?

Using a discounted cash flow model, analysts estimate an undervaluation of 23%. Considering how low the price has fallen, that suggests future cash flows are expected to increase, but not significantly.

The price-to-earnings (P/E) ratio echoes this sentiment. It’s currently 9.9 but is expected to increase to 35.5 as earnings decline. But with a lot of equity and little debt, the company still has a lot of time to turn things around.

I’m not as confident as Murphy about buying Burberry shares right now but I’ll consider revisiting the stock at year-end. I believe the price will recover, but looking at the numbers, it could take some time.