As a long-term investor, it is unsurprising that I see a Stocks and Shares ISA as a long-term investment vehicle.

Buying into great companies at an attractive price then letting them demonstrate their worth over time could hopefully help me improve my own worth too.

Here is how I would do that.

Making the most of my ISA allowance

Even if I did not have any money in my ISA, my first move would be to put some in to invest. In fact, I would try to make the most of my annual allowance.

Doing that depends on one’s personal financial circumstances, but if I could put in £20K I would.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Building long-term wealth

I would then invest that over a diversified group of companies I hoped could deliver strong growth over time. That could come from share price gain, dividends or a combination of both.

If I could compound my ISA’s value at a 5% rate annually, after 15 years it should be worth around £42,000.

Fifteen years may sound like a while to wait, but I can easily imagine being glad 15 years from now for the financial moves I make today.

Choosing the right shares

Is a 5% compound annual growth rate feasible?

I think it is, but would want to put the odds in my favour by ruthlessly focusing on great companies with attractive share prices. As an example of the sort of cheap share I would happily buy this August if I had spare cash to invest, consider Diageo (LSE: DGE).

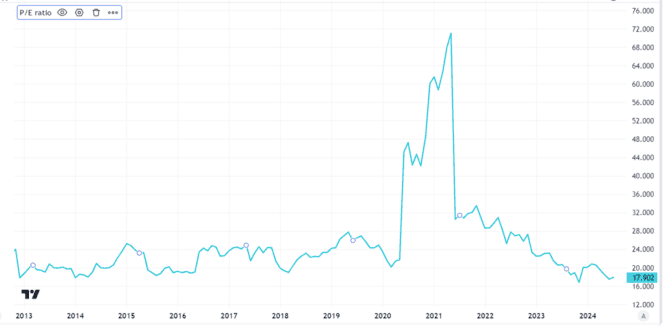

The FTSE 100 drinks giant’s price-to-earnings (P/E) ratio this year has hit a decade low. At a P/E of 17, it still may not seem cheap. But I think that is an attractive price for a company like Diageo.

Created using TradingView

The market for alcoholic drinks is strong and demand will likely remain high. Diageo has what Warren Buffett (a former investor in the company when it was much smaller than today) calls a moat. Its iconic premium brands and unique production facilities mean it can charge a price that allows for a high profit margin.

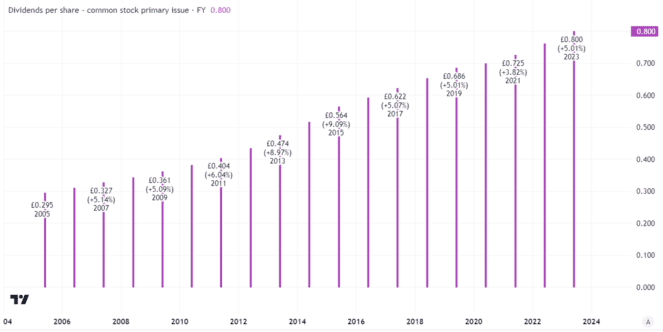

That in turn can fund a dividend. Diageo is a Dividend Aristocrat, having grown its payout per share each year for over three decades.

Created using TradingView

Aiming for long-term wealth creation

The current yield is 3.6%. I expect Diageo to keep growing its well-covered dividend annually, although that is never guaranteed. Spending on premium goods has been falling markedly in large markets. In its preliminary results today (30 July), Diageo reported sales volumes 5% lower than a year ago.

Even if the dividend does keep growing though, could Diageo help me hit a 5% target? After all, its share price has fallen 34% in the past five years.

In fact, that partly explains why I think the share could do very well in coming years – and recently bought some myself.

I believe the current price overemphasises short-term business challenges. But over the long term, I think it looks cheap for a share in such a brilliant business. With large long-term growth opportunities in developing markets and the chance to ride the next economic upturn, I think Diageo’s share price could move closer to its historical P/E ratio, moving upwards.

If I am right, I expect the share price could grow handily over the coming 15 years.