One of my most unsettling investments in recent years has been fashion retailer boohoo (LSE: BOO). When I bought into the company a couple of years ago, it was still profitable and I liked its business model. But the boohoo share price has slumped. It is 85% lower than five years ago and sells for pennies.

Even hitting £1 would mean almost tripling from today’s dismal share price.

I have no plans to buy new shares, but ought I to hold onto the ones I own in the hope of a recovery?

Should you invest £1,000 in J D Wetherspoon Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if J D Wetherspoon Plc made the list?

Bad to worse

Before considering what could happen in future, it is helpful to recap on why the share price has crashed.

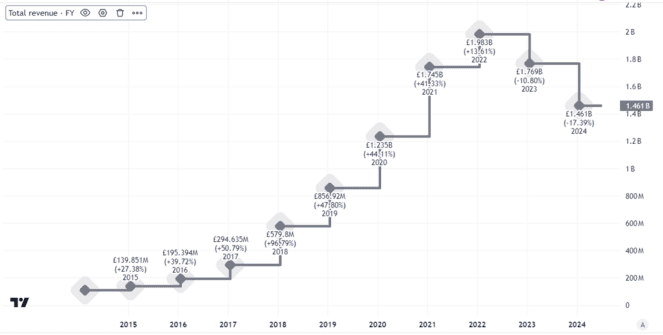

First, sales have been falling. What was once a strong growth story has seen revenues go into reverse.

Created using TradingView

Not only is that concerning in terms of what it suggests about the company’s appeal to its target market, it also raises alarm bells about profitability. After all, fast fashion is basically a ‘pile ‘em high, sell ‘em cheap’ business. Boohoo has been piling sales less high than before, meaning its fixed costs are spread less thinly.

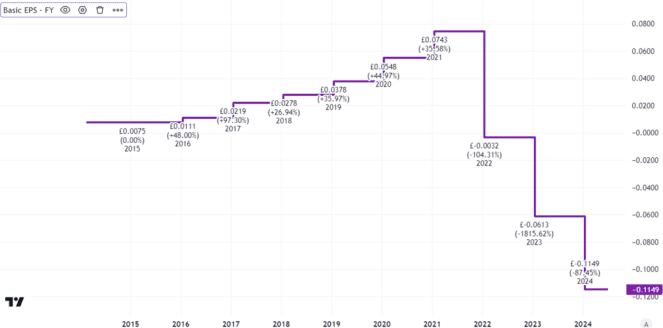

That partly explains declining profitability. In 2021, basic earnings per share were around a fifth of today’s share price. Fast forward to last year, though, and the picture was far worse.

Created using TradingView

The company, once flush with cash, now has almost £100m of net debt. If it continues to lose money, there is a risk it could issue more shares to raise funds, diluting existing shareholders in the process.

Some grounds for optimism

And yet and yet. There are still some things to like here.

While boohoo sales have declined, they remain substantial. It has a large customer base and well-developed supply chain. In an economy where we are seeing growing signs of weakening consumer spending power, I think the cheap and cheerful fashion merchant could benefit.

The business saw gross profit margins increase slightly last year, to 51.8%. Operating costs fell sharply.

A strategic focus on its five big brands could mean boohoo sales continue to decline slightly or stay flat, but the profitability picture improves. It is targeting sales growth and expects to generate free cash flow this year.

A lot still to prove

The share price has fallen so far that the company now has a market capitalisation of under half a billion pounds.

If it can generate free cash flow this year I think that will cheer the City. A return to profitability could drive the share price up significantly. To get back to £1 though, I think would take more than just a return to profitability.

boohoo management’s reputation has been weakened by poor business performance in recent years. While I am upbeat about its prospects, seeing the share price almost triple from here would take strong proof that the new strategy is delivering on a sustained basis.

I think that could yet happen, but see it as a long-term project. I would be surprised to see boohoo shares trading even close to £1 this year, or next year for that matter.